Time Spread Backtesting 2022 Q1 (Part 4)

Posted by Mark on July 1, 2022 at 07:22 | Last modified: April 15, 2022 15:22Today I continue manual backtesting of 2022 Q1 time spreads by entering a new trade every Mon (or Tues in case of holiday).

With SPX at 4403, trade #5 begins on 1/24/22 at the 4425 strike for $7,598: TD 29, IV 25.7%, horizontal skew 0.2%, NPV 334, and theta 43.

Profit target is hit 32 days later with trade up 15.82% and TD 20. Nothing to see here.

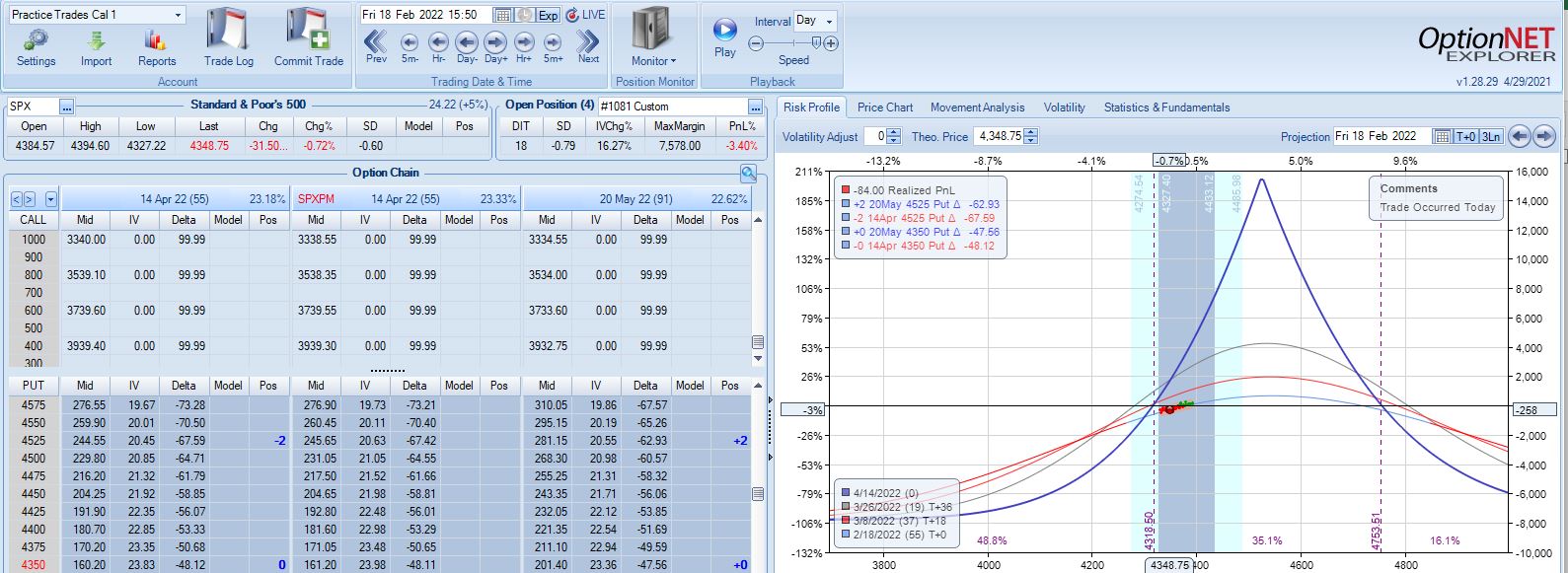

With SPX at 4515, trade #6 begins on 1/31/22 at the 4525 strike for $7,578: TD 32, IV 20.8%, horizontal skew -0.1%, NPV 356, and theta 41.

According to the base strategy, this is not an adjustment point with SPX down 0.79 SD over 18 days:

Trade is only down 3% and TD (not mentioned in base strategy guidelines) = 4. Graphically, expiration breakeven looks close such that another substantial SPX move lower could mean big trouble.

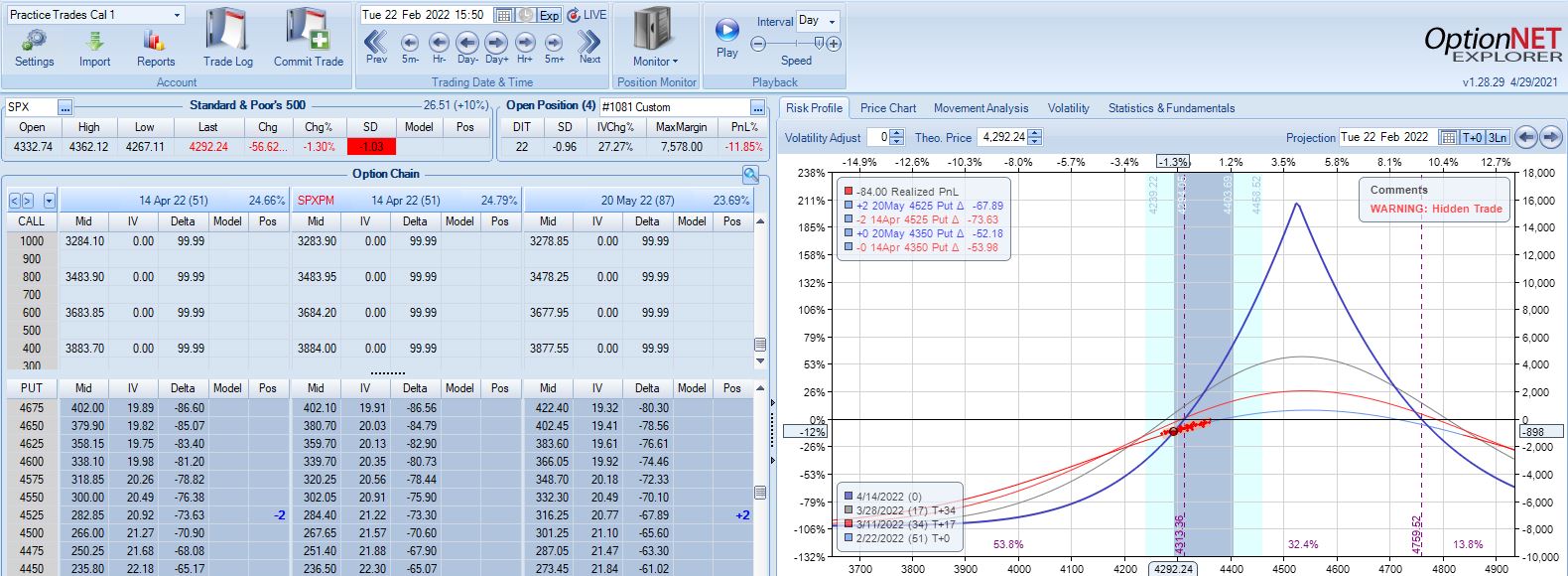

This is exactly what happens the very next trading day with a 1.03 SD selloff. The pre-emptive adjustment just mentioned would have the trade down less than 9% and just under 14% the day after: an even worse selloff at 1.42 SD. The trade would then go on to reach PT with a gain of 14.1% after 30 DIT.

Sticking with the base strategy would put me at an adjustment point the next trading day (22 DIT):

Trade is now down 12% after a 1.03 SD selloff in SPX, which is not as bad as I might have expected. What is somewhat frustrating about adjusting for the first time down 12% is the next adjustment point lingering a mere 2% away.

The lesson here may be to mind the numbers (TD 4 is much better than 1-2) rather than a graph that may not be properly scaled for best interpretation. A holiday separates the two graphs above, too; the extra day of time decay can help PnL.

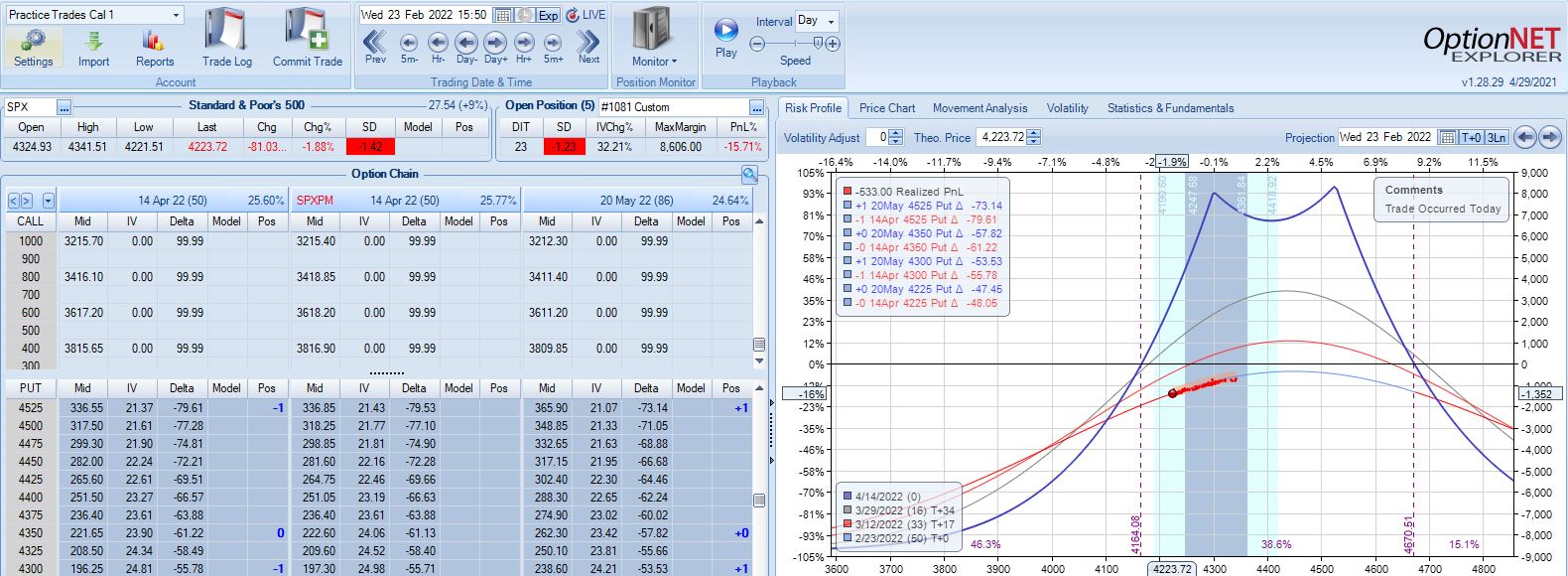

The very next day (23 DIT), that 1.42 SD selloff puts the trade down 16%:

The base strategy does not address days between adjustments, which means I should adjust on back-to-back days as needed. My gut wants to minimize adjustments because of slippage loss,* and skipping this second adjustment gets me to PT with a gain of 13% after 32 DIT. The risk of skipping the second adjustment is that a big move catapults me well beyond -16% to max loss before a second adjustment can be made.

Adhering to trade guidelines and making adjustments on back-to-back days results in a 10% profit after 37 DIT. For this particular trade, the specifics of management really do not matter.

You can get a sense of why I find time spreads so challenging, though. “The devil’s in the details,” and there are lots of details in which to get lost.

I will continue next time.

* — I need to trade more time spreads to get a feel for how significant this is.