Time Spread Backtesting 2022 Q1 (Part 1)

Posted by Mark on June 20, 2022 at 06:41 | Last modified: April 11, 2022 13:09Ironically, while developing a Python backtester over the last few months (e.g. here, here, and here), I have completely gotten away from time spread backtesting. Today, I will revisit the manual backtesting realm by looking at time spreads in the first three months of 2022.

As seen in previous posts on the subject (e.g. here, here, and here), time spreads may be approached in a variety of ways. In the current mini-series, I will address a number of different details and tweaks. Rather than get confused, distracted, and drawn off course by manually backtesting one at a time, my ultimate hope for the Python backtester is to be able to algorithmically run through a large sample size of each variant and compare pros versus cons.

For now, my base strategy is as follows:

- Trade the nearest 25-point put strike ITM with 10% profit target and 20% max loss.

- Place short leg at least 60 DTE with the long leg one month farther out.

- Adjust if down over 7% on max margin by rolling half to the nearest 25-point ITM put strike.

- If trade is down over 14% on max margin, roll most distant spread to nearest 25-point ITM put strike.

- If PnL recovers and heads lower again, watch for -7% and -14% as subsequent adjustment points.

- To account for slippage and commissions, a $21/contract fee will be assessed.

- Exit no later than 21 DTE.

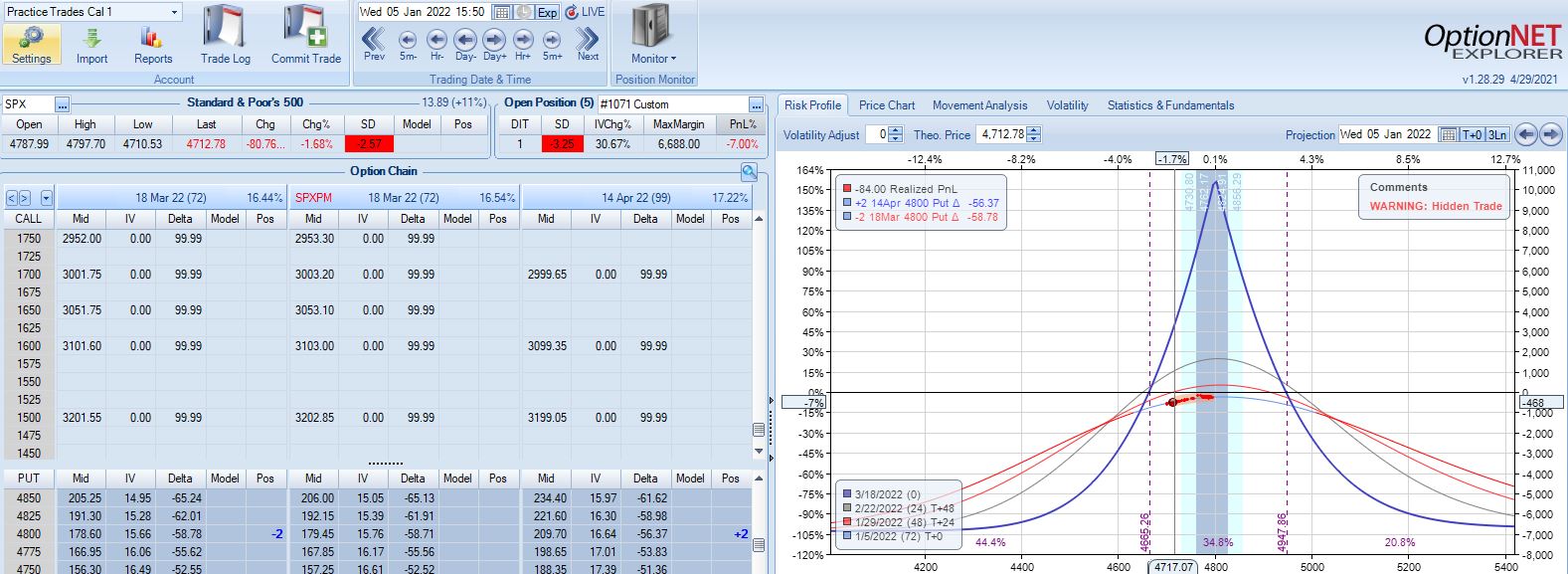

With SPX at 4799, the first trade begins on 1/4/22 at the 4800 strike for $6,688: TD 20, IV 10.6%, horizontal skew -1.1%, NPV 291, and theta 15.6.

The very next trading day, a 2.57 SD move down brings us to the first adjustment point with PnL -7%:

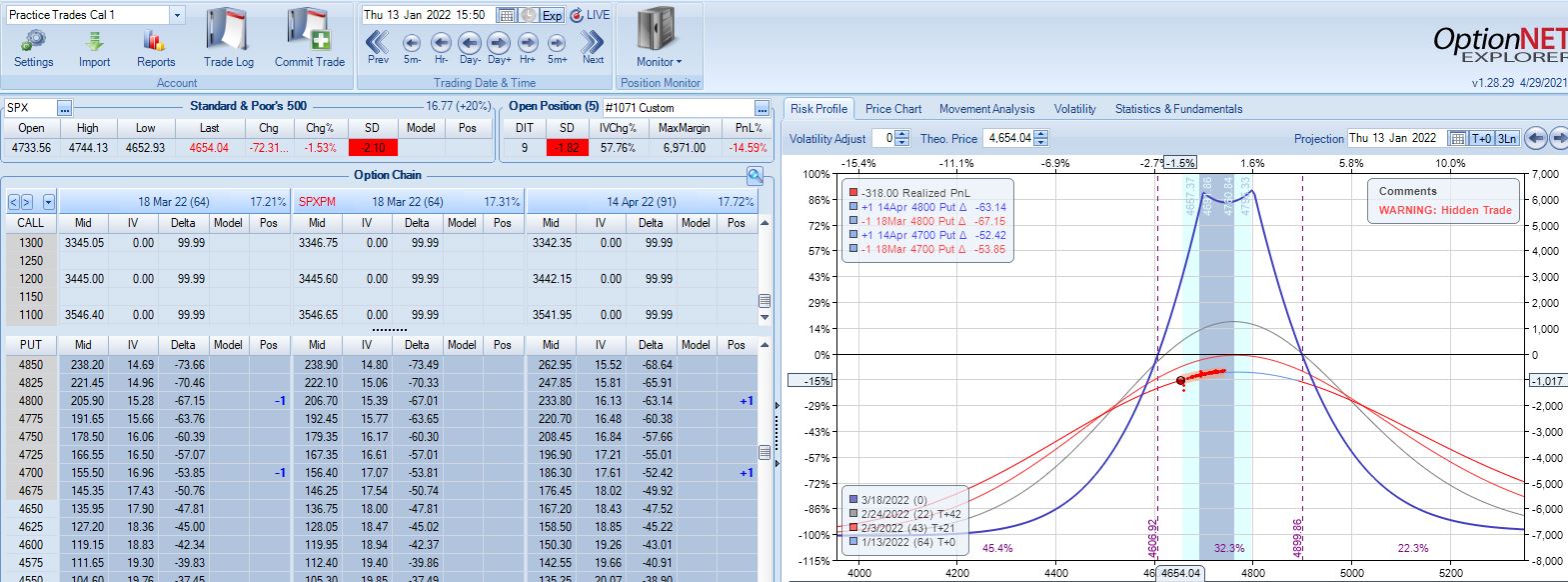

A 2.10 SD move down eight days later brings us to the second adjustment point with PnL -15%:

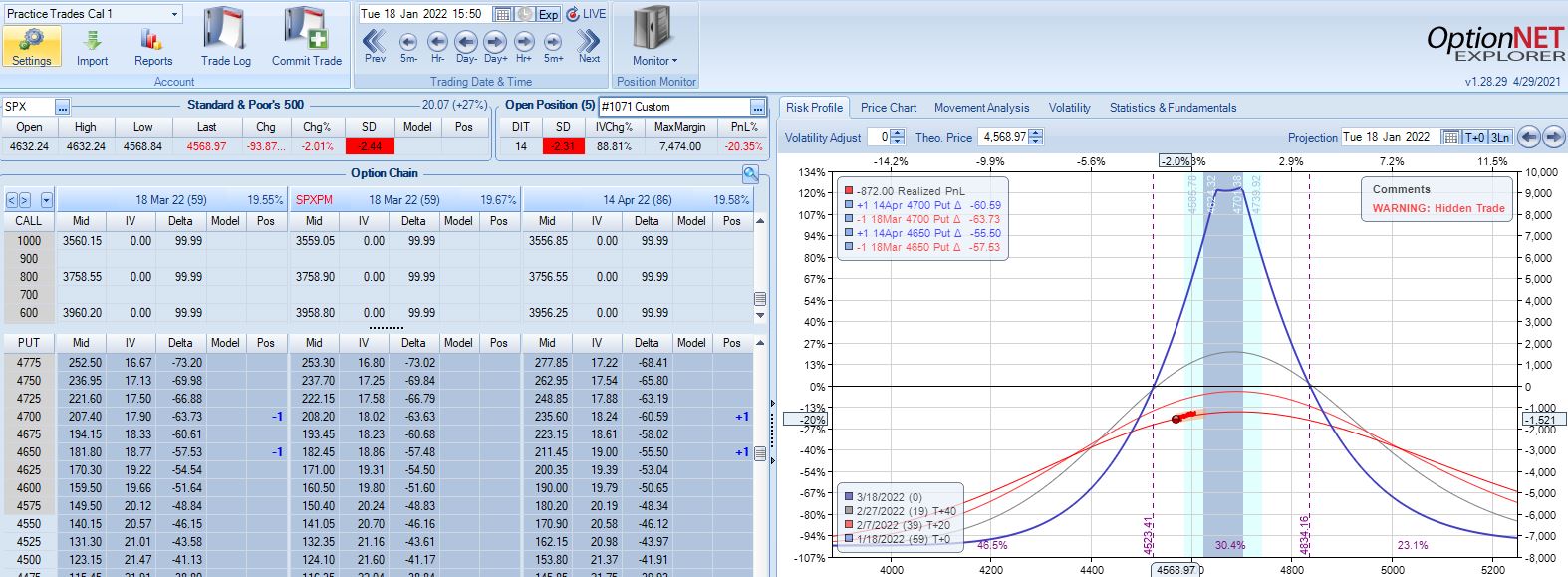

Max loss is hit five days later on a 2.44 SD move lower:

SPX cratering 2.31 SD in 14 days has resulted in a loss of 20.4%. Tough to overcome that! Although horizontal skew increases, it still remains negative while IV spikes ~90%. This suggests IV increase as a partial hedge in this trade.

I will continue next time.

Categories: Backtesting | Comments (0) | Permalink