Call Me Crazy (Part 8)

Posted by Mark on July 8, 2021 at 07:36 | Last modified: May 27, 2021 10:50Last time, I discussed the risks of a multi-year down or flattish market on the long call (LC) strategy. Today I want to start wrapping up some loose ends in preparation to move on.

Many variants can be made to what is just one of many LC backtest permutations:

- Vary DTE from two years

- Vary DIT from one year

- Apply price-based (i.e. market up/down X%) rather than time-based roll

- Vary strike from ATM (i.e. ITM, OTM)

In Part 7, I discussed how the LC can realize serial losses by rolling down to the current ATM strike in a multi-period down/flattish market. Holding the strike avoids replenishment of juicy extrinsic value that dissipates quickly on a continued move lower. Some people would say the stock market’s long-term upward bias makes this a lower-probability trade. My gut reminds me this upward bias is not written in stone or guaranteed by law. The Nikkei has gone over 30 years since hitting all-time highs. Can you imagine this happening to US stocks? I feel the need to consider it in order to be prepared.

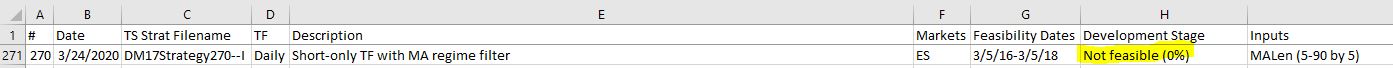

A trend-following (TF) technique could take advantage of a sustained move lower. Maybe I hold the strike and do not roll down when price is below the 200-MA. Although this seems logical, keep in mind we have no data to suggest it actually works. In fact, I have data to the contrary from testing a variant of this as a short entry for /ES:

As much as it twists my innards, sticking with the long bias and is probably best until and unless I have reason to someday think otherwise (and if this happens, then hopefully I’ll have capital left when I finally make the decision to switch). Did someone say hope is not a strategy?

Thinking about the damage from a long-term bear market is to say the LC strategy has no built-in TF downside component. Oh well. One of two resilient [expectancy, not necessarily risk-adjusted] edges I have found is the upside for equities.

A volatility filter to add or substitute more downside protection sounds logical to monetize a down market. In this case, maybe something OTM would work better because despite the built-in insurance, the LC cost can really hurt. Maybe even selling the stock and going put-only would help—or some sort of put spread to offset the higher volatility and time decay.

Similar to the TF filter explored above, the problem with this idea is that going long on VIX spikes historically performs well. While a volatility filter might keep me alive should equities not bounce back, I think (versus my gut) I’d rather play the percentages than bet on something never-before experienced. Much of investing seems to come down to this.

I will continue next time.