Crude Oil Strategy Mining Study (Part 3)

Posted by Mark on August 25, 2020 at 07:27 | Last modified: July 15, 2020 10:41Today I will start to analyze results of my latest study on crude oil.

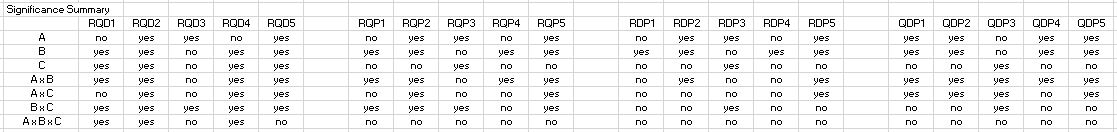

I ended up running four 3-way ANOVA tests. Recall the factors I am testing:

- R(ules: two or four)

- Q(uality: best or worst)

- D(irection: long or short)

- P(eriod OOS: 2007-2011 or 2011-2015)

I am running these analyses on five dependent variables:

- Net PNL

- PNL / max DD

- Avg Trade

- Profit Factor (PF)

- Number of trades

The first four are performance-related while the last is for curiosity.

Along the lines of “conventional wisdom,” here are some hypotheses:

- Four-rule strategies should outperform two.

- Best strategies should outperform worst.

- Long (short) strategies should outperform if the market climbs (falls) during the incubation period.

- Order of IS and OOS periods should not make a difference since strategies are selected on performance over both.

- Number of trades should be fewer for 4-rule than for 2-rule strategies (fifth-to-last paragraph here).

- The software is capable of building profitable strategies.

Here are the results:

Let’s begin with somewhat of an eye-opener: 2-rule strategies averaged PNLDD 0.15 and PF 0.99 vs. 4-rule strategies with PNLDD –0.02 and PF 0.95. I think this is surprising for two reasons. First, the simpler strategies did better (see hypothesis [1]). Second, the signs are misaligned for the 2-rule group. I checked for sign agreement on every strategy; how can overall PNLDD reflect profit when overall PF reflects loss? The answer is because strategy drawdowns along with the relative magnitude of gains/losses all differ. When averaged together, sign agreement may no longer follow.

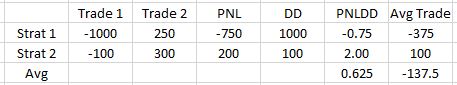

Consider this example of two strategies with two trades each:

Signs align between PNLDD and Avg Trade for each strategy, but when averaged together the signs do not align. PNLDD may be a decent measure of risk-adjusted return, but it cannot be studied alone: sign must be compared with Avg Trade (or PNL). Forgetting this is like adding numerators of fractions with unequal denominators (i.e. wrong).

If I do nothing else today, then this discovery alone makes it an insightful one.

Getting back to the first factor, R does not significantly affect PNL or Avg Trade. PNL is almost identical over 816 strategies (-$4,014 vs. -$4,015). This is a good argument for risk-adjusted return (like PNLDD) as a more useful metric than straight PNL even given constant contracts (one, in this study). With regard to Avg Trade, 2-rule strategies outperform $33 vs. -$41. This difference is not significant.

Here’s something else to monitor: all results so far are negative (see hypothesis [6]).

I will continue next time.

Categories: System Development | Comments (0) | Permalink