Mining for Trading Strategies (Part 7)

Posted by Mark on July 17, 2020 at 07:20 | Last modified: June 27, 2020 14:35Although my next study aimed to correct the mistake I made with the previous [long] study, I accidentally mined for short strategies. This was illuminating—as described in these final three paragraphs—but did not address the comparison I really wanted to make (see Part 6, sixth paragraph).

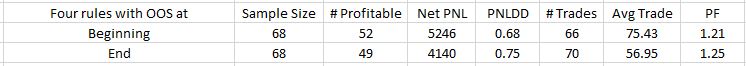

Given the fortuitous discovery I made from that short study, though, I proceeded to repeat the long study by switching around IS and OOS periods. I trained strategies on 2007-2011 and incubated from 2015-2019. I tested only 4-rule strategies expecting to find worse performance due to an inability to effectively filter on regime [which may have taken place in the previous study]:

Results are mixed. Beginning outperforms on Net PNL and Avg. Trade. End outperforms on PNLDD and PF. None of these differences are statistically significant.

This does not seem to be consistent with my theory about mutually exclusive regimes. That would be one regime controlling 2007-2011, a different regime controlling 2011-2015, and just one ruling 2015-2019.

In the face of a persistent long bias, such regimes would not exist: long strategies would be profitable whereas short strategies would not. As a general statement, this is true. Looking more closely, however, it certainly is not. 2007-2009 included a huge bear (benefiting shorts) while 2009 to (pick any subsequent year) benefits long strategies.

And if it’s tough to figure out equity regimes, then good luck finding anything of a related sort when it comes to CL or GC where words like “trend” and “mean reversion” don’t even begin to matter (based on my testing thus far).

Where to go from here?

- I should repeat the last study with 2-rule strategies to make sure I don’t get any significant differences there either.

- I could require a regime filter for the 4-rule strategies just in case none/few have been implemented.

- I need to better understand the short strategies. It’s one thing to find strategies that pass IS and OOS. It seems to be quite another to find strategies that do well on a subsequent OOS2. Performing well in OOS2 is what ultimately matters.

I have one other troubling observation to mention. Although the long strategies in all three studies (including that from Part 5) incubated profitably on average, performance does not begin to approach what we might require from OOS in any viable trading strategy. I did see flashes of brilliance among the 4-rule strategies (6, 9, and 10 strategies for each of three long studies posted PNLDD over 2.0 with a few excursions to 6 and one over 14!). On average, though, 203 top long strategies over eight years averaged a PF ~1.21 and PNLDD ~0.8 over four years to follow of a consensus bull market.

And don’t forget that we don’t have context around the 1.21/0.8 without comparable numbers for long entries matched for trade duration (Part 6, sixth paragraph).

Forget all the pretty pictures (see second paragraph here); if this is an accurate representation of algorithmic trading then those who say you’re not going to get rich trading equities certainly weren’t kidding!

Categories: System Development | Comments (0) | Permalink