Envestnet Case Study (Part 3)

Posted by Mark on March 23, 2020 at 11:51 | Last modified: May 11, 2020 12:03Continuing on with my year-long organization project, this is an unfinished draft from August 2018 on performance.

I was confused about many things from this draft, which is now a completed post. I have figured it out; it was in reference to this Envestnet study. Part 1 was in May, Part 2 was three months later, and part three is seen below.

—————————

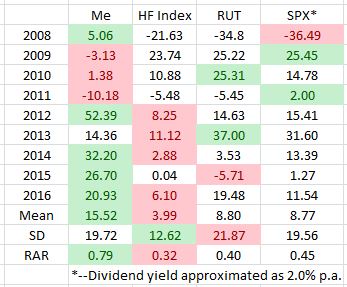

Kudos to Envestnet for outperforming the index (table from second link above). Furthermore, I only edged out Envestnet by 79 basis points when normalized for standard deviation (SD). As discussed in the first link above, however, because upside SD doesn’t hurt anyone I actually outperformed them by over 9% per year. This is a different perspective that leads to completely different conclusions.

My belief (based on a sample size of zero) has been that hedge fund (HF) managers and those who develop trading strategies for these funds are people like myself. I would think these are people who have studied and read everything they could find in the process of learning how to trade. I would think they are well-versed in system development and statistical fundamentals. I would also think they are well-schooled in quantitative analysis and the art of coding.

With that said, the HF performance is extremely interesting to me because hedge funds seem to significantly underperform:

The name suggests HFs aim to limit losses by hedging, which suggests a lower SD. They do, in fact, win the SD category. Because hedges generally cost money, I would not expect them to generate the highest absolute returns. Also in their defense, perhaps, is the fact that from 2008 – 2016 the market has been mostly up, which may not be where they excel since hedges are not needed.

I still find it hard to accept significant HF underperformance, though. From 2008 – 2016 HFs got trounced in mean return. Even on a risk-adjusted basis, the worst-performing index (RUT) beat them by over 20% and my 0.79 beat them by 146% over those nine years! For a 2/20 (or even 1/10) fee structure, I just don’t see how the value proposition exists.

Or maybe this is substantiation that I am just that good? Perhaps I am, indeed, professional trader (TPAM) material.