Incremental Value (Part 2)

Posted by Mark on January 16, 2018 at 07:54 | Last modified: October 13, 2017 11:42The time has arrived to break out the spreadsheets and start dissecting exactly how much I might earn as an investment adviser (IA) representative trading AUM.

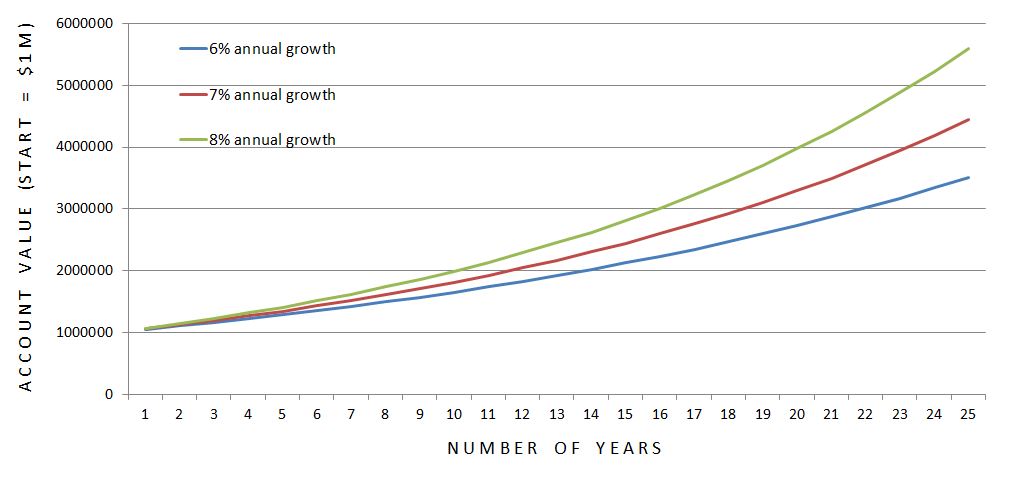

I need to begin with some assumptions. Suppose the IA charges an annual management fee of 0.8%, which is assessed at the beginning of every year. As a conservative projection, let’s also assume the IA generates annual investment returns of 6%. A $1M account would therefore grow to $3.51M in 25 years.

Upon joining the IA, what if I were able to generate 7% or 8% per year?

Instead of $3.51M in 25 years, the account would now grow to $4.44M or $5.60M, respectively. That’s a significant boon for the client! This also brings incremental value to the IA in terms of management fees: an additional $58K or $126K, respectively, over 25 years. If I were to split that incremental value with the IA then I would make $29K or $63K with disproportionately more being earned as the years go by.

Keeping in mind that this trading gig must also be worthwhile to me, from a monetary standpoint I see some things not to like. First, my cut of the management fee ranges from 0.01% to 0.08% (or 0.14%). This seems minuscule. Second, that “incremental” detail is a killer. While I could make $29K or $63K over 25 years, if the client leaves the firm earlier then I will be effectively starting over with someone new. This feels like a mortgage where significant equity doesn’t start to build until later in the term. Although the incremental approach would keep me motivated to do well, I would rather be paid the average annual fee of 0.04% (or 0.07%). Besides, I don’t believe my history suggests a need for any additional motivation.

I could make a case for keeping all the incremental fees from my trading outperformance. The IA would benefit by earning more in fees as a result of my employment. My potential reward needs to be large enough for me to take on the challenge, though. If all the incremental fees went to me then it might represent a more acceptable wage (still small at an average of 0.08% or 0.14% over the 25 years) and a much happier client. That could lead to a larger book of business for the IA.

For now, in the spirit of keeping positive I think the bottom line is that I would make some money as a representative without having to do many of the back-office tasks required to launch my own IA. I wouldn’t have to file all the paperwork, come up with Form ADV, have legal work done, establish a new entity, hire a compliance team, deal with E/O insurance, cover all the overhead, or be forced to raise assets—the latter, especially, being no small feat.

Categories: Money Management | Comments (0) | Permalink