Naked Put Study 2 (Part 5)

Posted by Mark on November 18, 2016 at 06:06 | Last modified: August 31, 2016 06:38Today I continue by extending the equity moving average (MA) to 100 trading days and studying the results.

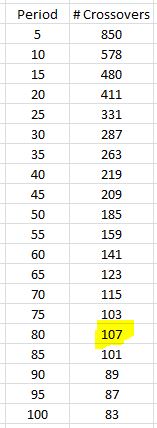

Here is a tabulation of equity MA crossovers by period:

As expected, the number of crossovers continues to decrease as period increases. The 80-day period is an exception.

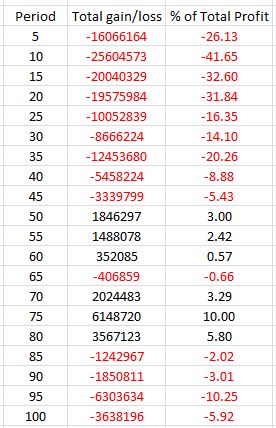

How did the filter compare? As above, I simply extended the analysis presented in Part 4:

Periods 50-80 show net profits* with the exception of 65. I probably would not make a big deal of this because the performance at 60-65 is in the same neighborhood.

I realized these tabulations do not make for a consistent comparison because longer MA periods mean increased lag time before the indicator becomes active. Performance of the shorter-MA filters therefore includes triggers on which the longer-MA filters cannot participate.

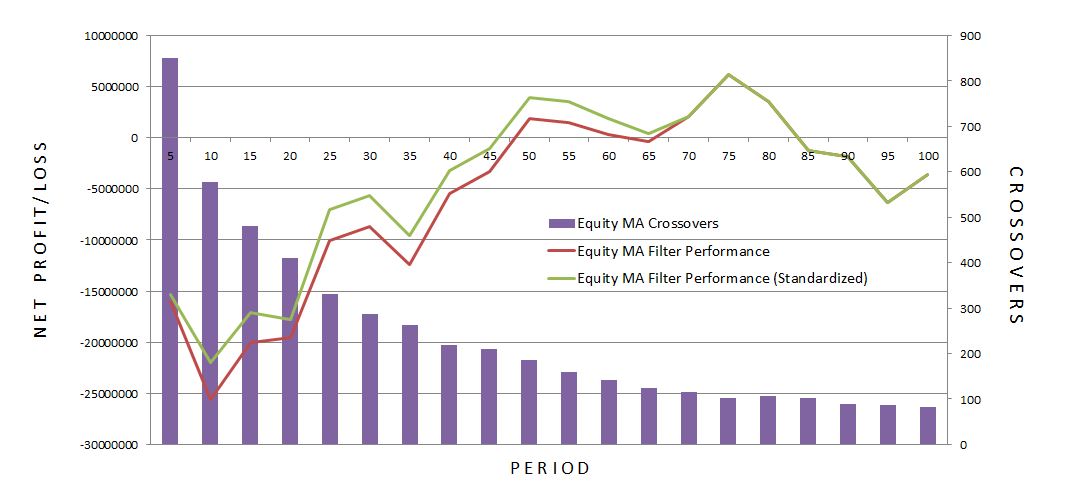

To standardize (i.e. apples-to-apples) the comparison, I recalculated the net profit/loss numbers using triggers after 5/25/01. This is the first day the 100-MA was able to be calculated. The following graph wraps all the data together and brings more clarity:

Standardization had minor impact for the shorter-period MA filters as seen on the left side of the graph. The inverse relationship between crossovers and period is clear.

Determining what period offers the best hope for future performance is somewhat arbitrary and speculative. I definitely want to be above 45 and below 85 because the other values are negative. While 50, 55, 75, and 80 all posted net profit > 5%, I would avoid 50 and 80 since they are negative to one side. 55 and 75 have a total of 9.47% and 9.09% profit surrounding them, respectively. Given that and the fact that 75 is the best overall performer, I would probably choose 75.

Slippage, which will undermine filter performance, must be considered for live trading. The calculations above imply that I can turn the trade off without consequence when the filter triggers. This is not true! Closing all open positions will incur maximum slippage. This would also be multiplied by the number of crossovers to calculate total performance impact. Alternatively, I could buy long puts and attempt to neutralize the open positions. This seems preferable and further backtesting would be indicated.

* — Thanks to XOR LX for some very time-saving spreadsheet assistance!

Categories: Backtesting | Comments (1) | Permalink