Naked Puts (Part 7)

Posted by Mark on December 7, 2015 at 05:16 | Last modified: November 5, 2015 06:51Comparing long shares and naked puts with equal capital risk ended up being far superior for the latter in terms of drawdown (DD).

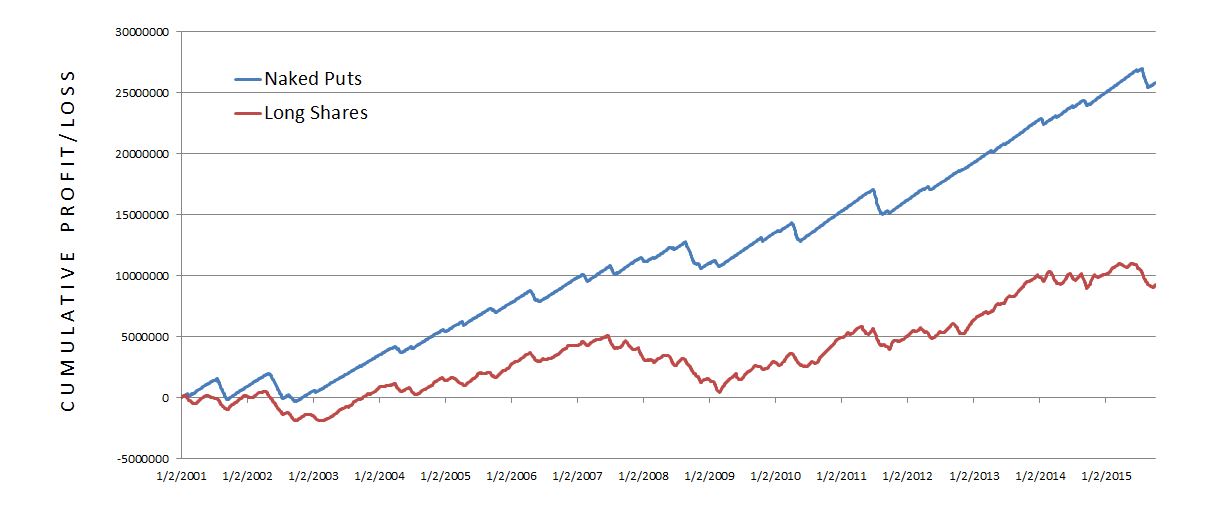

If I cut the long shares position size by a factor of eight, here is how the two compare:

This is a huge difference. The long shares now gain $9.31M (down from $74.5M) compared to the (same) $25.8M for the naked put trade. In other words, observation 1 has been reversed. The naked put trade still has a lower max DD (-$2.27M vs. -$4.65M). The naked put trade still has better consistency with an average (mean) daily DD of -$378K (vs. -$924K). The naked put trade is still in DD only ~49% of the time (vs. ~82%).

The naked put trade appears to make more money with greater consistency than long shares.

For me, putting context around this trade means playing devil’s advocate over and over again. This trade certainly looks pretty good. What am I missing?

Particularly impressive to me is the fact that even with 8x as much capital risk, the option trade has less DD risk.

But it does now have eight times as much capital risk. Were the market to take a huge hit, the option trade could lose much more than the long shares.

In deciding whether to do this trade, I think one’s level of pessimism must be assessed. The “huge hit” that would cause the naked put trade to lose more than long shares would have to be worse than what we’ve seen since 2001. So if you are truly the prophet of doom, you worry about a catastrophe worse than the Flash Crash (2010), than the August 2015 correction, than September 11 (2001)… you worry about a decline worse than the 2008 financial crisis.

Depending on your exact level of paranoia, at some point I would wonder why you are even in the market at all. Keeping your money safe under the mattress might be a better choice.

Alternatively, maybe you simply follow the same traditional recommendation given for long shares: allocate a limited percentage of the portfolio to naked puts.

Categories: Backtesting | Comments (0) | Permalink