Naked Puts (Part 5)

Posted by Mark on November 30, 2015 at 06:21 | Last modified: November 5, 2015 06:57I left off with a graphical performance comparison between the long shares and naked put trades.

Aside from being a yardstick for starting equity required to do a trade, drawdown (DD) may also be understood in terms of risk tolerance. If I run a backtest and find a max DD of -$200,000 then I need to ask myself whether I would feel comfortable continuing to trade a strategy that had lost $200,000. Human nature is actually to overestimate risk tolerance since it’s easy to imagine how I might handle a particular loss but much more difficult to tough it out when I’m in the middle of it. Combine this with that trader’s adage “your worst DD is always ahead of you” and the number used to evaluate risk tolerance should be higher than the max DD.

To summarize, I have now discussed two ways of evaluating max DD: as a measure for starting equity and as a measure for risk tolerance. The biggest concern with insufficient starting equity is that I may go bust. In my opinion, though, the biggest risk for a trading strategy is not necessarily that it will bankrupt me. Rather, it is that I will lose enough money to get scared, to lose sleep, to be constantly worried, and other related feelings that will eventually force me to cash out at the absolute worst time possible to alleviate the psychic pain.

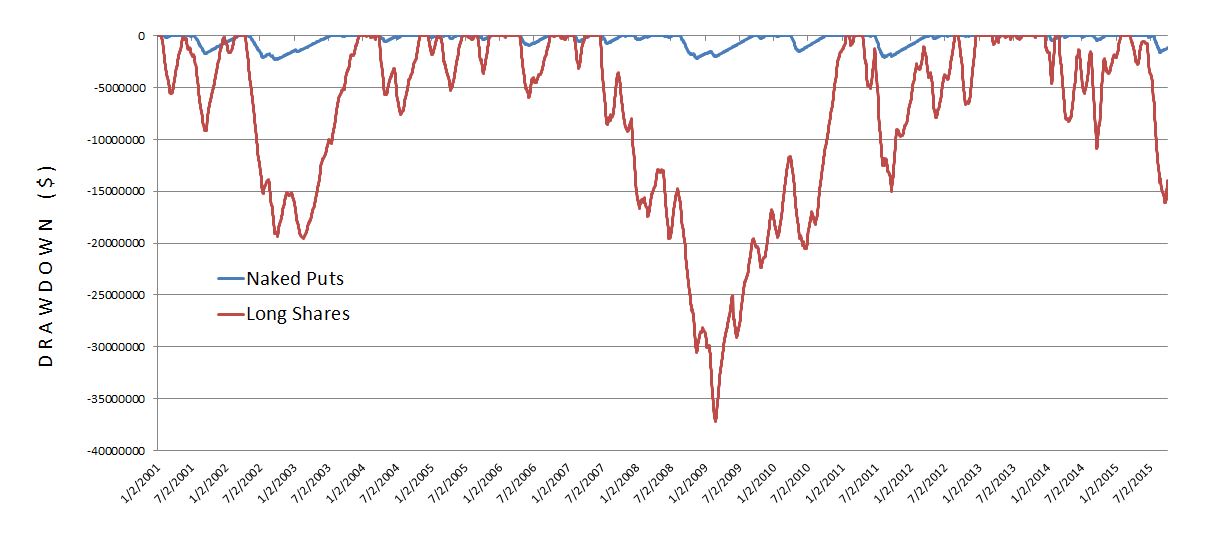

Here is a graph of DD for the naked put and long shares trade:

Clearly the long shares trade is far more risky than the naked put trade. The max DD is $37.2M for the long shares and $2.27M for the naked puts. On any given day, the long shares can be expected (arithmetic mean) to be in a $7.4M DD compared to $378K for the naked puts: a 19-fold difference! As a result, I would want to trade the long shares in much smaller size than I would the naked put trade and that would decrease the estimated profit I could expect from it.

Comments (1)

[…] crash. Studying the last 15 years has given me great perspective in terms of drawdowns (DD). I must always expect a worse DD in the future, though, and it does seem like we’re seeing historic “worsts” on a semi-regular […]