Calendar Calculations

Posted by Mark on June 9, 2015 at 07:03 | Last modified: June 10, 2015 10:01Trading can be challenging especially when trying to manage the heat of a moment. In reading lots of material and hearing even more discussion, I find people rarely discuss actual trading details. As opposed to “optional activities,” trading activities include: reading and manipulating charts, running stock/option screens, recording trades, modeling positions, entering orders, and keeping abreast of what needs to be executed when. Perhaps the most important trading activity is the application of simple arithmetic.

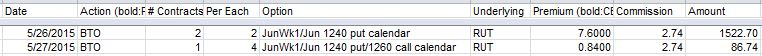

Here is my spreadsheet from my last calendar trade:

The “Premium” column shows prices. First, I bought two 1240 put calendars for $7.60 each. I then rolled one to the 1260 call strike for $0.84 resulting in a double calendar. If I want to exit for a 10% profit, what price do I require to close?

At first I thought this was simple: ($7.60 + $0.84) * 1.1 = $9.29 [1]

Wrong. As a combination of two calendars, the double calendar price should be much higher.

Perhaps the answer is ($7.60 + $0.84) * 1.1 * 2 = $18.57 [2]

Wrong again.

Let’s look at the “Amount” column to see if we can figure it that way.

$1,522.70 + $86.44 = $1,609.44 [3]

$1,609.44 * 1.1 = $1,771 [4]

$1,771 / 100 = $17.71

Check:

Profit = $1,771 – $1,609.44 = $161.56

$161.56 / ($1,522.70 + $86.44) = 0.10, or 10%.

Yay!

What was so hard about this? Didn’t I do the same thing with [3] / [4] as I did with [2]?

If I overlay [2] and [3]:

($7.60 + $0.84) * 1.1 * 2 = $18.57 [2]

$1,522.70 + $86.44 = $1,609.44 [3]

How are these different?

The two calendars [2] are $7.60 * 100 * 2 = $1,520, which is about $1,522.70 [3] without transaction fees.

Rolling one for $0.84 [2] should be $0.84 * 100 * 2 = $168, which is not $86.44 [3]. Why?

This is the mistake. The initial cost of $7.60 must be multiplied by two to account for both calendars. The subsequent cost of $0.84 is the entire roll of four contracts traded: no need to multiply by two.

In fact, if I take half of the roll debit and calculate:

($7.60 + ($0.84 / 2)) * 1.1 * 2 = $17.64

If I multiply that by $100/contract then I get $1,764, which is about equal to $1,771 [4] minus transaction fees.

Trading platforms usually do not track running profit/loss of positions. As traders, we must have a reliable means to do this simple arithmetic if we want to make money rather than lose it.

No experienced trader ever said this was easy; here is another House advantage the markets use to take our money.

Categories: Option Trading | Comments (0) | Permalink