RUT Weekly Calendar Trade #6

Posted by Mark on May 26, 2015 at 07:30 | Last modified: June 5, 2015 08:54I opened my sixth weekly calendar trade Tuesday, May 19, at the 1255 strike. The market was right around 1255 upon fill. I placed the order at the mid and caved $0.10 over 10 minutes to get filled.

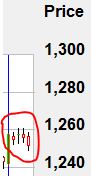

Here was the price action during this pre-Memorial Day week:

With the market trading sideways, this position was like manna from heaven. I closed the trade Friday morning. The market only gained two points in three days and the trade profited 8.5%.

I believe the long holiday weekend gave this trade an advantage. With the market to be closed the following Monday, I anticipated Friday to see nearly four days of time decay rather than three. I consider this difference to be significant since the trade is only placed with 10 DTE.

Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #5 (Part 3)

Posted by Mark on May 23, 2015 at 08:42 | Last modified: May 28, 2015 14:25Today I will finish analyzing my fifth weekly calendar trade.

Is there any reason not to hold this trade into expiration Thursday if necessary? My bias had been to close the trade by the close of expiration Wednesday. In theory, a big gap on the last day could land this trade heavily in the loss column. Is there a significant difference between a big gap on expiration Thursday and a big gap on expiration Wednesday, though?

I have no direct experience telling me to close the trade on expiration Wednesday. Until/if this happens, perhaps I should be willing to hold the position into the last trading day as long as I don’t violate max loss or any other rules. I am controlling total risk by keeping contract size small. Do I really have much to worry about?

Alternatively, I could choose to exit by the close of expiration Wednesday and just take whatever I can get at that time.

I certainly don’t believe I had any good reason to exit the trade when I did. My max loss was not threatened. The breakout turned me into an emotional trader.

I doubt I can understand this trade in the proper context until I’ve traded many more of them. This is the first time I had to make the third adjustment on expiration Monday. Perhaps I will find this to be an extremely rare event. If that is the case then closing for breakeven is not a big deal.

However, if I find that such a Monday adjustment happens more regularly then I believe it will pay to hold the trade longer. I closed for breakeven when I was just a few trading hours away from a 5-10% profit. When a trade goes bad, I expect the losers to hit in full force (max loss) every time. If I screw up winners by taking less than the profit target then I could be turning a perfectly viable trading plan into one that loses money.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #5 (Part 2)

Posted by Mark on May 22, 2015 at 06:25 | Last modified: May 28, 2015 13:49Today I will analyze the weekly trade presented in my last post.

The market did get a bit crazy on the final day of the trade. I got out of the trade here:

At the time, I felt lucky to get out of the trade with a profit of any sort.

One thing I’ve learned for my own trading is that the market is very good at sucking me in when it breaks up or down like this. I usually regret chasing the market at these times rather than waiting for it to settle down and pull back.

I can’t even remember how many times I have retrospectively thought, “if only I would have gotten up instead of trading, gotten a cup of coffee, and come back 30 minutes later…”

What happened in this instance? Look at the next 50 minutes:

I definitely could have gotten out for a 5% profit by close or, had I held until Thursday, gotten out for the full 10%.

What’s the take-home message here?

The large negative gamma on this trade is something to beware so close to expiration.

On the other hand though, if I’m not willing to lose 15% on this trade then I can’t expect to make 10%. The trade was still 7-10 points from expiration breakeven when I closed it. I never saw the trade go down significantly on that Wednesday: it was profitable all day long up until the point I closed it…

…and wouldn’t you know it: the point I closed it ended up being the market high for the entire day!

This is typical of the way markets work and I am certain that I was not the only one screwed over by that breakout.

What’s the saying: “markets act to cause the maximum possible harm to the maximum number of traders?”

Yes indeed.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #5 (Part 1)

Posted by Mark on May 21, 2015 at 07:51 | Last modified: May 28, 2015 13:21I opened my fifth weekly calendar trade Tuesday, May 12, at the 1230 strike. The market was at 1231 upon fill. I placed the order 0.05 off the midprice and caved 0.05 over several minutes.

After moving down, the market proceeded to rally over the next few trading days. On the morning of Monday, May 18, I rolled one 1230 calendar up to the 1255 strike with the market around 1247. This left breakevens at 1223 and 1260 with net position delta about zero.

The market moved sharply higher on this day and that afternoon with the market around 1256, I made a second adjustment by rolling the other 1230 calendar up to 1255. I did this as two trades and got seemingly poor execution on the 1255: placed the order at the midprice and caved 0.35 nine minutes later (filled 0.12 off the then mark). The 1230 calendar seemed to execute well (placed 0.025 off the midprice and filled immediately). The trade was now down over 10%.

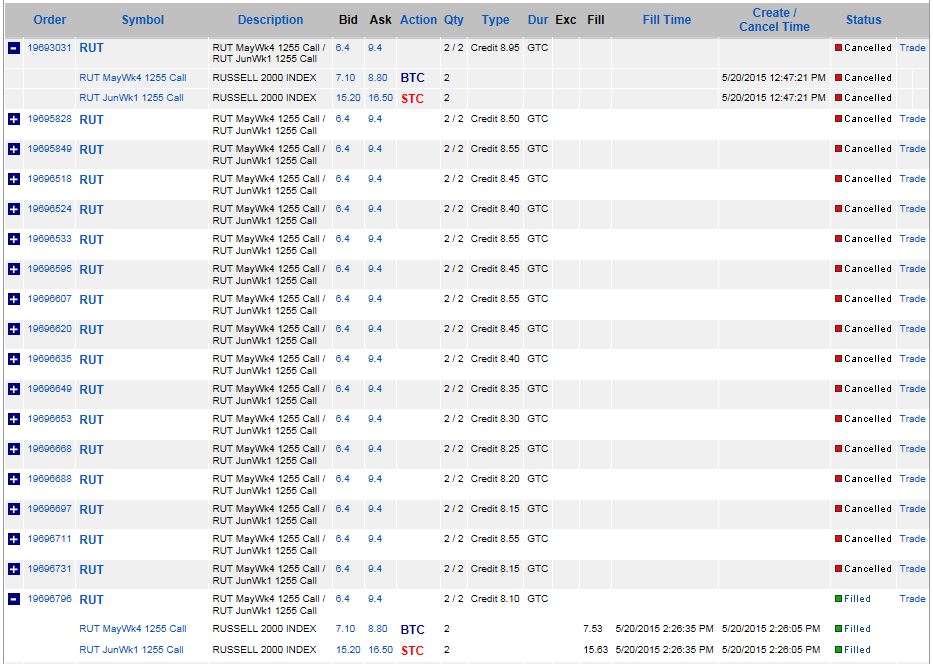

The market traded sideways into Wednesday afternoon. Being the second-to-last trading day, I watched closely for a sharp move that could really cause losses to build in a hurry. I had a GTC order working to close the trade for a 10% profit. Around noon, I lowered the GTC to the 5% profit level (if filled). You can see my working of the trade during the day here:

The bid/ask spread was 2.60-3.00 for most of the afternoon until I saw this at 2:05 PM:

All hell was breaking loose right about then. The calendar spread got to be as wide as 6.00 (7.00 / 13.00)! At times, My working order was up to 0.45 off the mark and still not filled.

I finally did get filled for 8.10, which was 0.25 off the then mark. This gave me a profit of $10 on the trade.

I will analyze this trade in the next post.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #4 (Part 2)

Posted by Mark on May 11, 2015 at 06:53 | Last modified: May 14, 2015 10:28As discussed in the last post, my weekly calendar trade was still down after Day 2 (5/6/15) but farther away from the downside adjustment point.

The market was up on Day 3 and the trade was profitable by noon. At the close, the market was at 1225 and somewhat comfortably within the adjustment points.

Friday was the big day with the jobs report to be announced at 8:30 AM. The market liked the report and opened around 1235. My contingent order to close was triggered and I got out with a profit of 8.5%.

I will say that I wasn’t entirely happy with this result because I’ve been aiming to close with a profit of 10% or better. In this case, I opened the trade for $6.70 and closed for $7.30.

Here’s how it should have gone:

Bought 2 @ $6.70 = $1,340

Add $8 for commissions on eight contracts: $1,348

Add 10% profit target: $1,348 * 1.1 = $1,483

Price per calendar = $1,483 / 200 = $7.415

I should have entered a contingent order to close for $7.42 or $7.45 (if I wanted to round up to the nearest nickel) rather than $7.30. Oh well… any win is much better than a loss!

I could look to get 8% on the trade if out by Friday. That would mean accepting a slightly lower profit to avoid the weekend risk. I don’t want to be taking losses much larger than 8% when it doesn’t go my way, however. My max loss has been 15% and my two losers closed for several percentage points worse than that simply due to slippage and fast market movement. This might or might not be viable depending on how much this trade wins.

In four weeks, I have thus far won on two of them. I’m down money overall, though.

We’ll see what next week brings.

Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #4 (Part 1)

Posted by Mark on May 9, 2015 at 07:51 | Last modified: May 14, 2015 10:28I opened my fourth weekly calendar trade Tuesday morning (5/5/15) at the 1230 strike. This was a big down day for the market. I placed my original order around 9:45 AM for a 1235 put calendar. The market was quickly down to 1230 and I lowered the strike. I got filled about 10 minutes later with the market down to 1226 and I had caved a nickel to get that done (it filled 0.05 better than the then mark).

Before the day was out, the market had bottomed out near 1211! My downside breakeven was around 1205 and I had an alert in at 1208 to adjust. This time, I figured if an adjustment point was hit on the very first day then I would just exit the trade for a loss rather than trying adjusting and quite possibly being at max loss after the adjustment.

Psychologically, I was in no shape to adjust this trade anyway. My expectations are to average about +2% per week on this trade. In three weeks, I’ve lost 21%, made 10%, and lost 19%. I therefore expect to be “due” [it must be bad karma to even think that much less write it or say it] for a preponderance of winning trades to improve that average. We have possibly been through a very volatile time in the market recently: something that does happen every now and then.

With the market closing Tuesday at 1215, I survived Day 1.

Day 2 was mostly higher, which made for an easier day to hold the trade and watch paint dry. The market bottomed at 1211 on this day and it closed near 1220. The trade was down about $58 at the close, which was frustrating, but I felt comfortable being 10 points from the downside breakeven and still having 10 points of upside until I hit the short strike. The upside adjustment point was still over 20 points away.

I will conclude this trade summary in the next post.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #3

Posted by Mark on May 1, 2015 at 06:44 | Last modified: May 14, 2015 10:27I opened my third weekly calendar trade Tuesday morning (4/28/15) at the 1255 strike. I paid 6.45, which I thought was an excellent price! I later realized this was lower than usual because it was a call calendar instead of put calendar. That shouldn’t make too much difference but if I’m getting used to prices in one (puts) then seeing prices in the other (calls) could throw me off.

The market really tanked yesterday. This trade had been up as much as 6% on Wednesday although I’m not sure I could have gotten executed there. Yesterday morning, the downside adjustment point was hit. I rolled one of the 1255 call calendars to a 1225 put calendar. Unlike my first weekly calendar trade where I was able to do this roll for just 0.06, this one cost 2.25. Again though, much of that was probably due to the difference in implied volatility between calls and puts.

The market continued lower yesterday and I eventually closed this trade for [more than] max loss: -19%. This was not as bad as my first loser, which was 21%. Still doesn’t make me feel any good, though.

The question remains: how often does this happen? No doubt the market is shaky this week. Certainly the market does seem much calmer when it’s doing the slow grind upward but it just so happens that in the three weeks I have been doing this trade, it’s looked ugly and more ugly. RUT fell 31 points during the course of this trade. In trade #1, the market fell only eight points from open to close but did a sharp reversal.

I’ll lick my wounds and get ready for next week.

Categories: Accountability | Comments (0) | Permalink