RUT Weekly Calendar Trade #5 (Part 1)

Posted by Mark on May 21, 2015 at 07:51 | Last modified: May 28, 2015 13:21I opened my fifth weekly calendar trade Tuesday, May 12, at the 1230 strike. The market was at 1231 upon fill. I placed the order 0.05 off the midprice and caved 0.05 over several minutes.

After moving down, the market proceeded to rally over the next few trading days. On the morning of Monday, May 18, I rolled one 1230 calendar up to the 1255 strike with the market around 1247. This left breakevens at 1223 and 1260 with net position delta about zero.

The market moved sharply higher on this day and that afternoon with the market around 1256, I made a second adjustment by rolling the other 1230 calendar up to 1255. I did this as two trades and got seemingly poor execution on the 1255: placed the order at the midprice and caved 0.35 nine minutes later (filled 0.12 off the then mark). The 1230 calendar seemed to execute well (placed 0.025 off the midprice and filled immediately). The trade was now down over 10%.

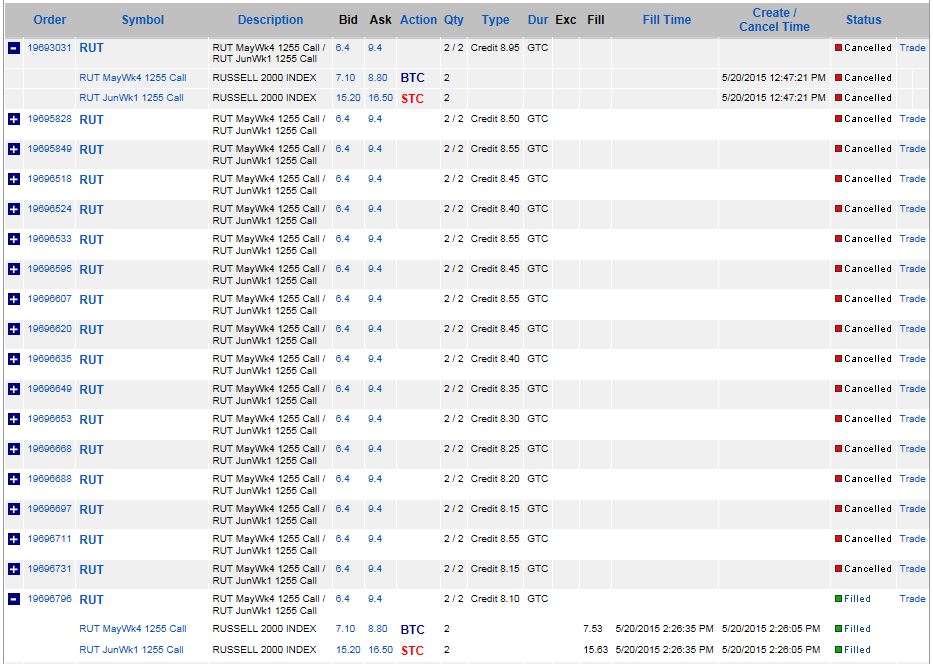

The market traded sideways into Wednesday afternoon. Being the second-to-last trading day, I watched closely for a sharp move that could really cause losses to build in a hurry. I had a GTC order working to close the trade for a 10% profit. Around noon, I lowered the GTC to the 5% profit level (if filled). You can see my working of the trade during the day here:

The bid/ask spread was 2.60-3.00 for most of the afternoon until I saw this at 2:05 PM:

All hell was breaking loose right about then. The calendar spread got to be as wide as 6.00 (7.00 / 13.00)! At times, My working order was up to 0.45 off the mark and still not filled.

I finally did get filled for 8.10, which was 0.25 off the then mark. This gave me a profit of $10 on the trade.

I will analyze this trade in the next post.

Categories: Accountability | Comments (1) | Permalink