Covered Calls and Cash Secured Puts (Part 31)

Posted by Mark on February 21, 2014 at 04:44 | Last modified: February 12, 2014 06:57In the last post I described how to evaluate the value of potential adjustments. Today I begin discussion on another trade management technique called the Combo Buy Back and Roll Out and Up (Combo BB & RO & Up).

I previously made the points that trade adjustment is not risk-free and that we will encounter cases where a rolling adjustment cannot be found. In his book Systematic Covered Writing, Rich MacDuff describes this situation:

> Unfortunately, with an Interim Trade position there will be times

> when the SysCW Buy Back & RO & Up strategy will not work

> mathematically… the cash received for the Roll Out option would

> not be greater than the cash needed to close the existing option…

> there is a solution… the SysCW Combo BB&RO&Up strategy.

The steps for this adjustment are as follows:

1. Buy to close the existing short call.

2. Buy 100 additional shares of the underlying stock (this is dollar cost averaging or $CA).

3. Sell one more contract than was purchased in step 1 at a higher call strike than previous.

This adjustment should raise cash and increase the strike price.

MacDuff takes a shot at the Characteristics and Risks of Standardized Options, which is a booklet published by the CBOE that all new brokerage clients must be provided. The booklet states:

> The writer of a covered call forgoes the opportunity to benefit

> from an increase in the value of the underlying… above the

> option [strike] price, but continues to bear the risk of a decline

> in the value of the underlyling…

MacDuff argues this to be false. The Combo BB & RO & Up adjustment allows us to benefit from stock appreciation. We only surrender this opportunity if we do nothing.

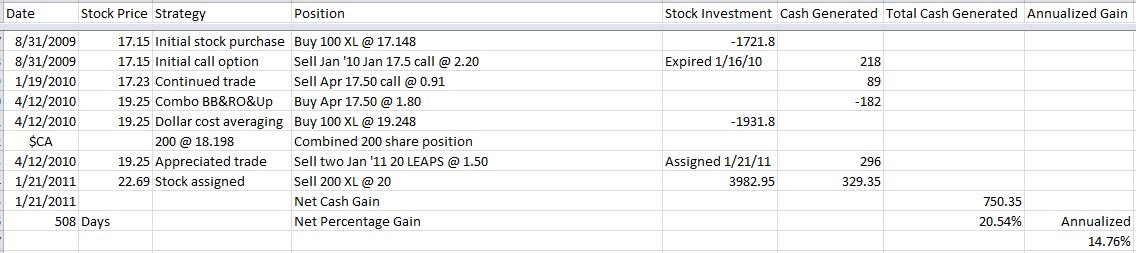

Here is an abbreviated example of this adjustment from the MacDuff archives:

I will discuss this further in the next post.

Comments (1)

[…] Today I will analyze a Rich MacDuff example of the Combo BB & RO & Up position management strategy. […]