Weekly Iron Butterfly Backtest (Part 9)

Posted by Mark on July 9, 2013 at 05:48 | Last modified: August 5, 2013 09:03In this blog series, I’m backtesting the weekly option trade described here.

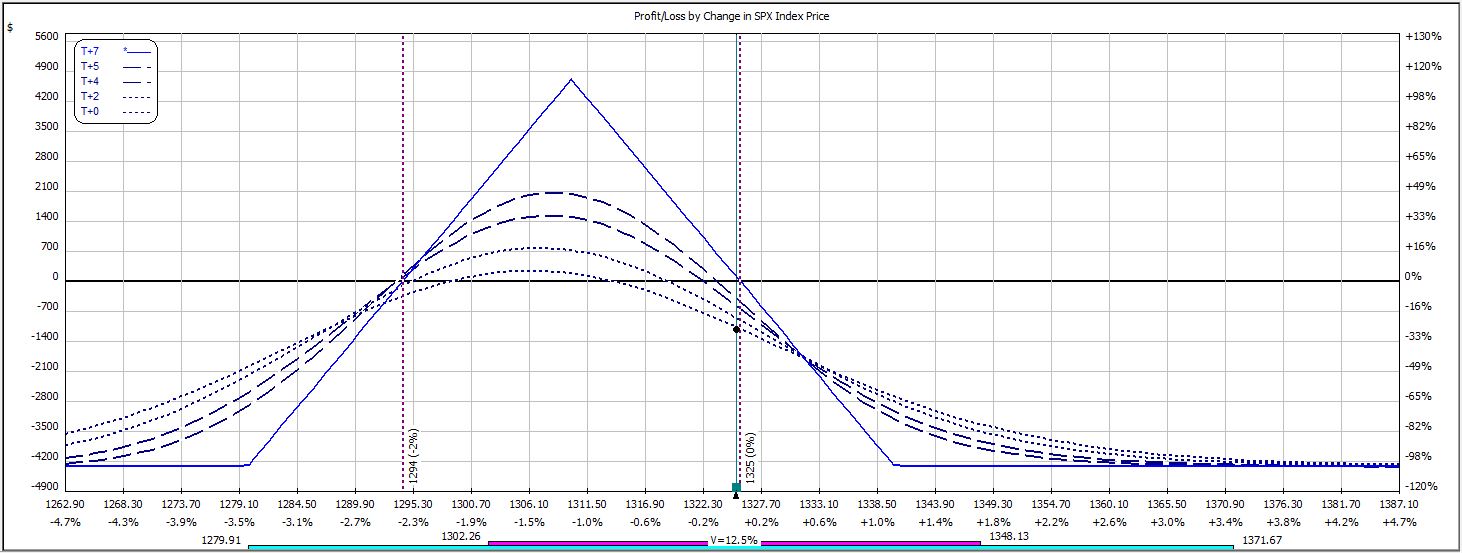

Week 8′s trade begins like this:

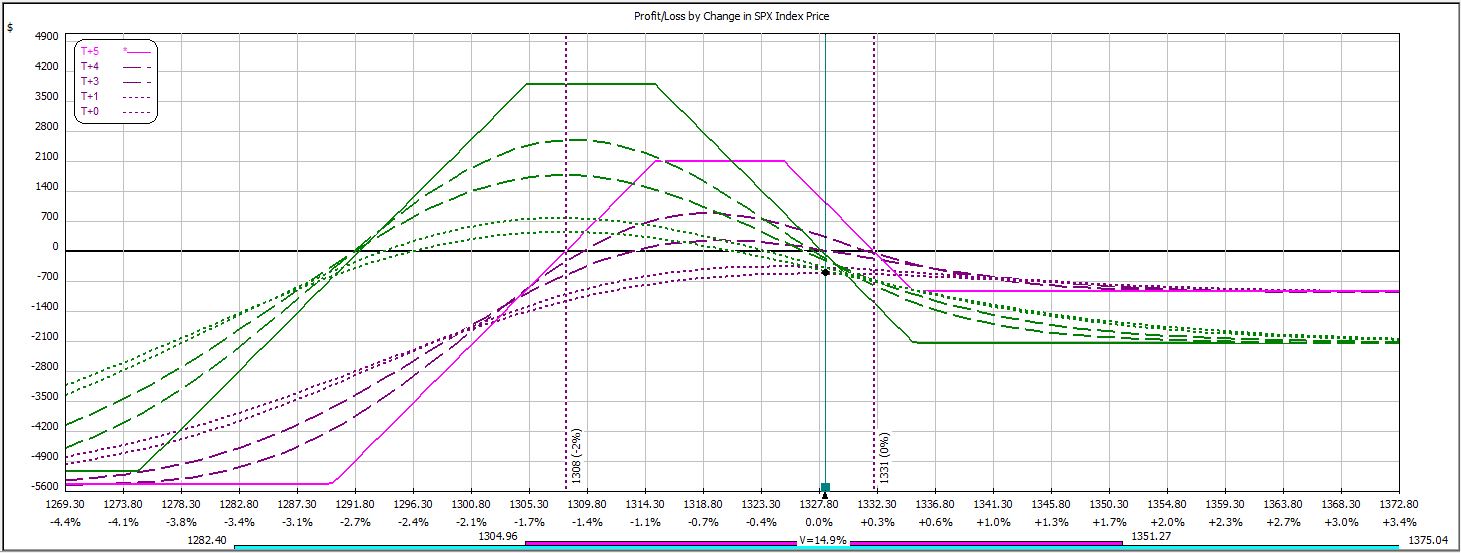

The market rallied to the first adjustment point on the next day:

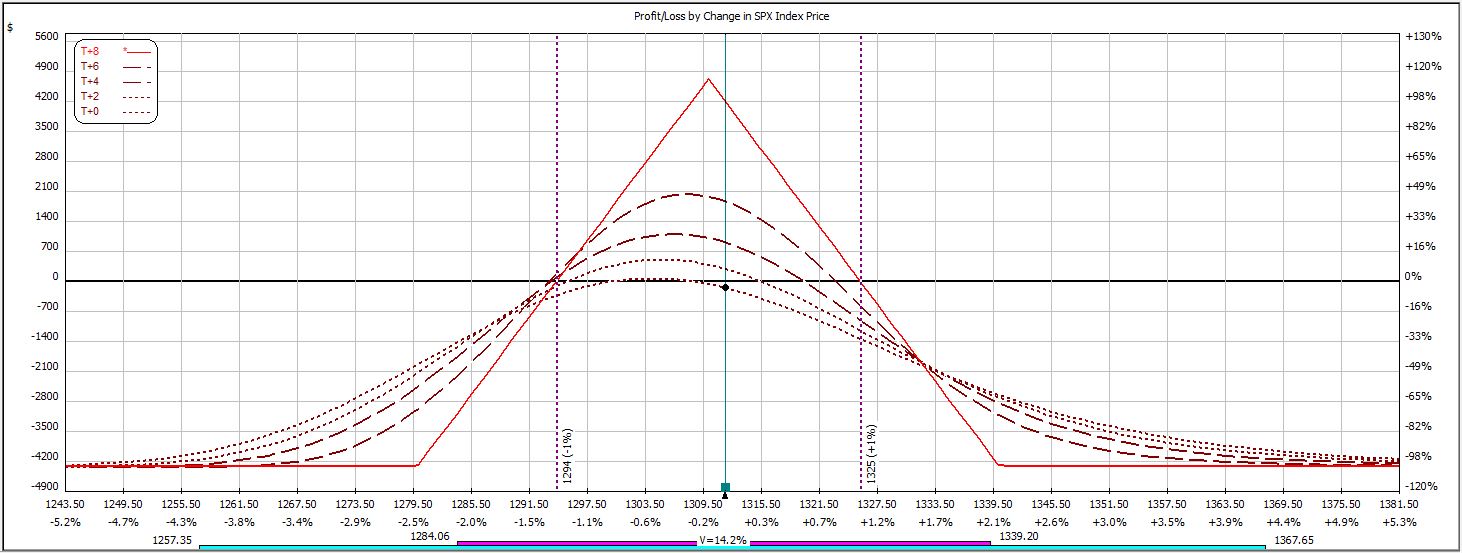

The rally continued into Monday when the second adjustment point was hit. Not only did I roll up the short calls 10 points, I also rolled the short and long put up 25 and 30 points, respectively. This adjustment, shown in pink, preserved profit potential for the trade as well as managing downside margin:

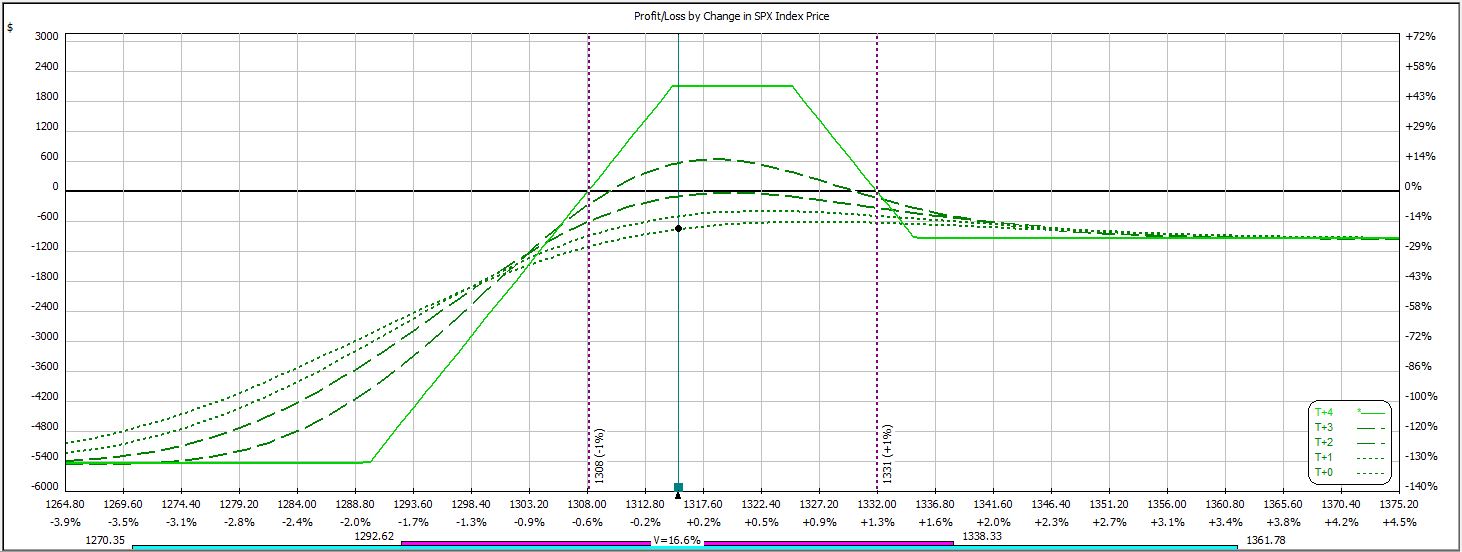

When the market pulled back on the next trading day, max loss was hit:

P/L on Day 1 ranged from -$285 to +$24.

P/L on Day 2 ranged from -$519 to -$345 on an adjusted margin requirement of $5,136.

P/L on Day 5 (nothing happened over the weekend) ranged from -$606 to -$537 on an adjusted margin requirement of $5,433.

Trade was closed on Day 6 for a loss of $738, which is 13.6%.

This backtested trade has now won and lost four times each.

Categories: Backtesting | Comments (0) | PermalinkWeekly Iron Butterfly Backtest (Part 8)

Posted by Mark on July 3, 2013 at 04:14 | Last modified: August 2, 2013 14:20In this blog series, I’m backtesting the weekly option trade described here.

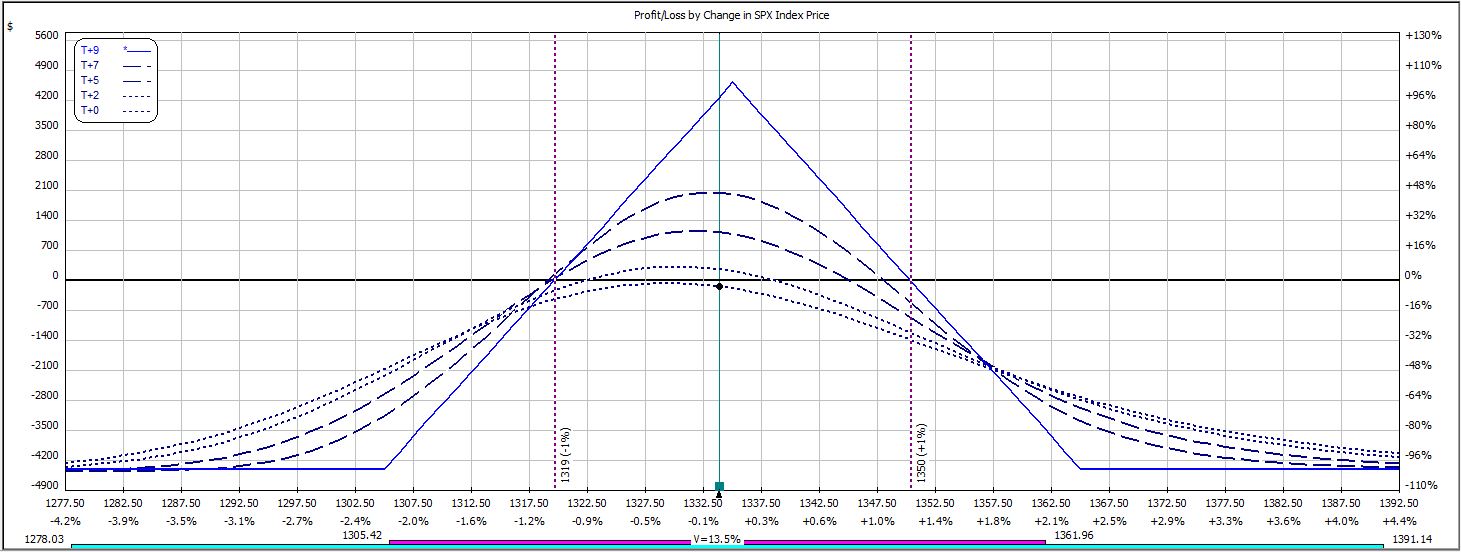

Week 7’s trade begins like this:

The trade closed just before the market sold off markedly:

P/L on Day 1 ranged from -$399 to -$114.

P/L on Day 2 ranged from -$75 to +$318.

Trade closed on Day 5 (nothing happened over the weekend) for a profit of $444, which is 10.1% on $4,419 initial margin.

In backtesting, this trade has now won four times in seven weeks.

Categories: Backtesting | Comments (0) | PermalinkWeekly Iron Butterfly Backtest (Part 7)

Posted by Mark on July 1, 2013 at 10:40 | Last modified: August 2, 2013 10:52In this blog series, I’m backtesting the weekly option trade described here.

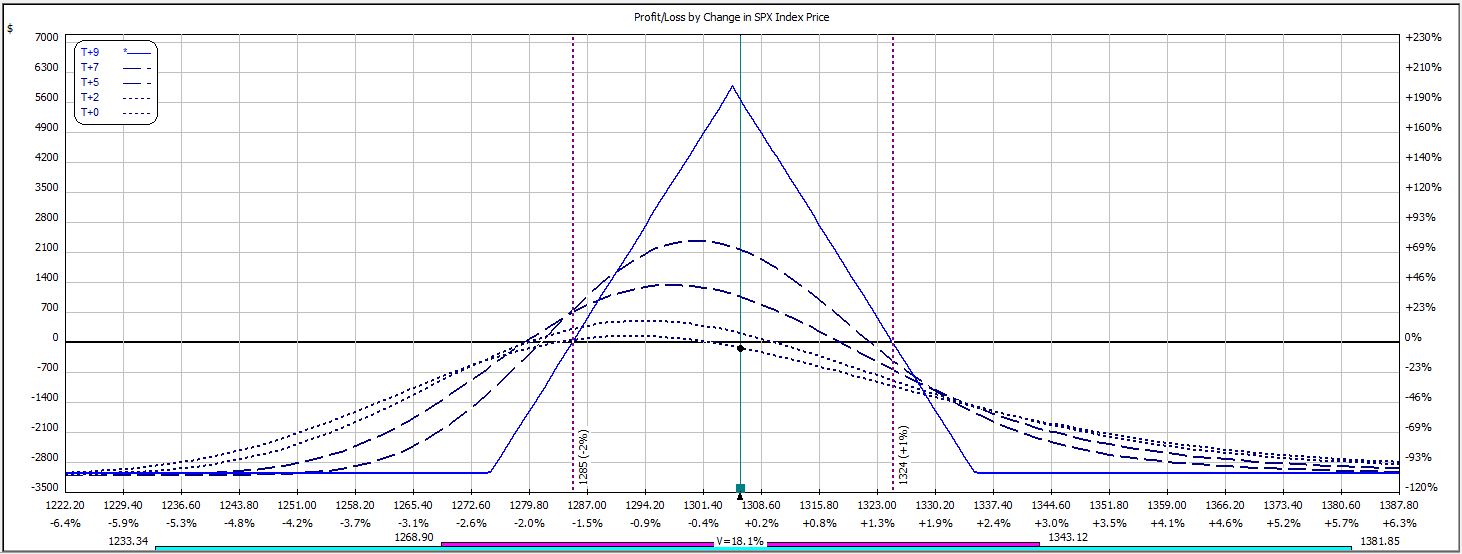

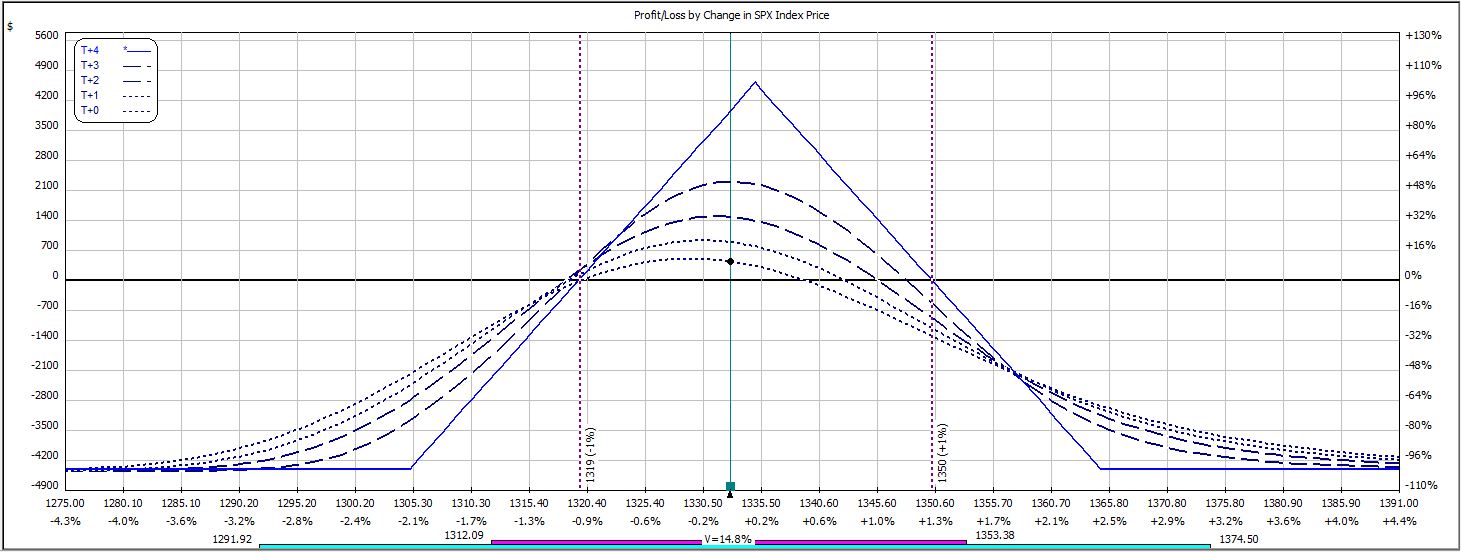

At inception on Week #6, the trade looked like this:

The P/L ranged from -$144 to -$837 on this day.

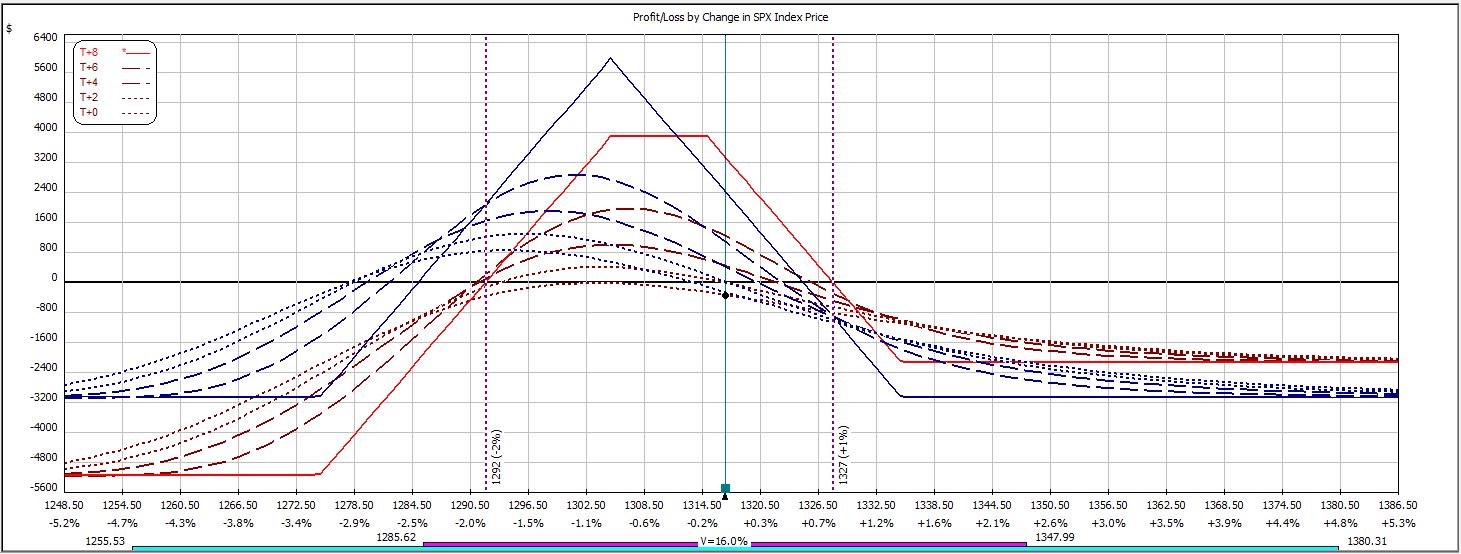

On Day #2, max loss was hit:

The market only had to rally 14 points to force a 26% loss on the initial margin of $4,311.

In the first six weeks of this backtest, we have seen three wins and three losses. That only tells half the story, however. The average win has been $515 versus an average loss of $1,032. That, my friends, is a recipe for disaster!

Time will tell whether these early tendencies persist.

Categories: Backtesting | Comments (0) | Permalink