Weekly Iron Butterfly Backtest (Part 9)

Posted by Mark on July 9, 2013 at 05:48 | Last modified: August 5, 2013 09:03In this blog series, I’m backtesting the weekly option trade described here.

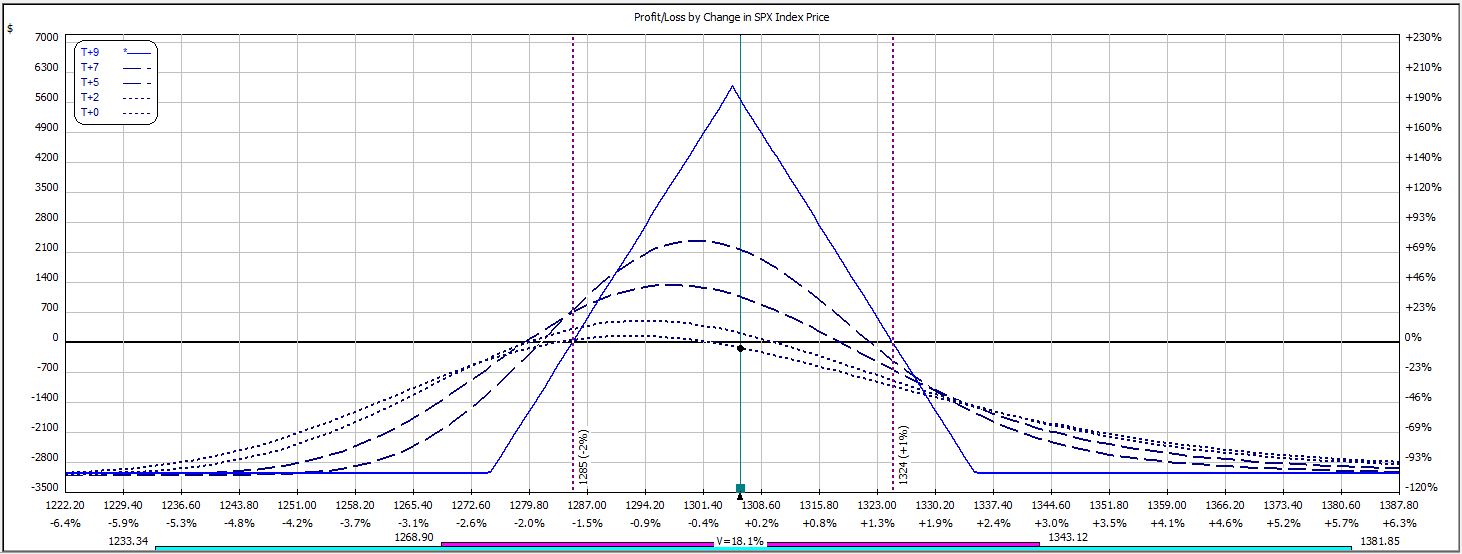

Week 8′s trade begins like this:

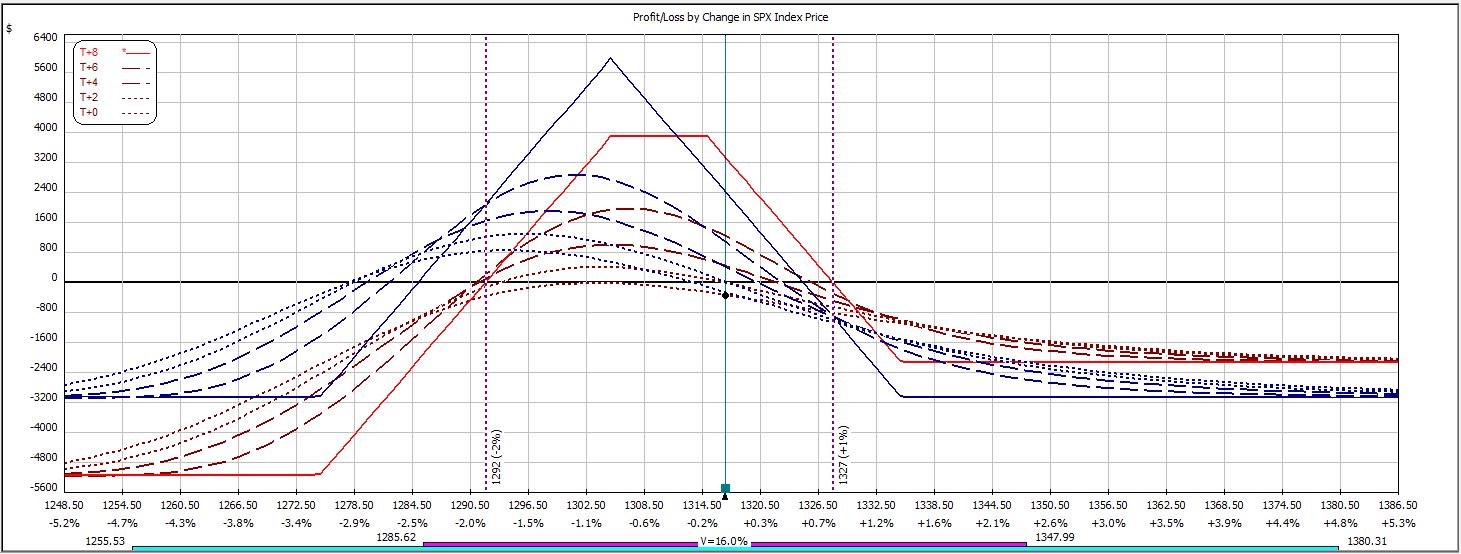

The market rallied to the first adjustment point on the next day:

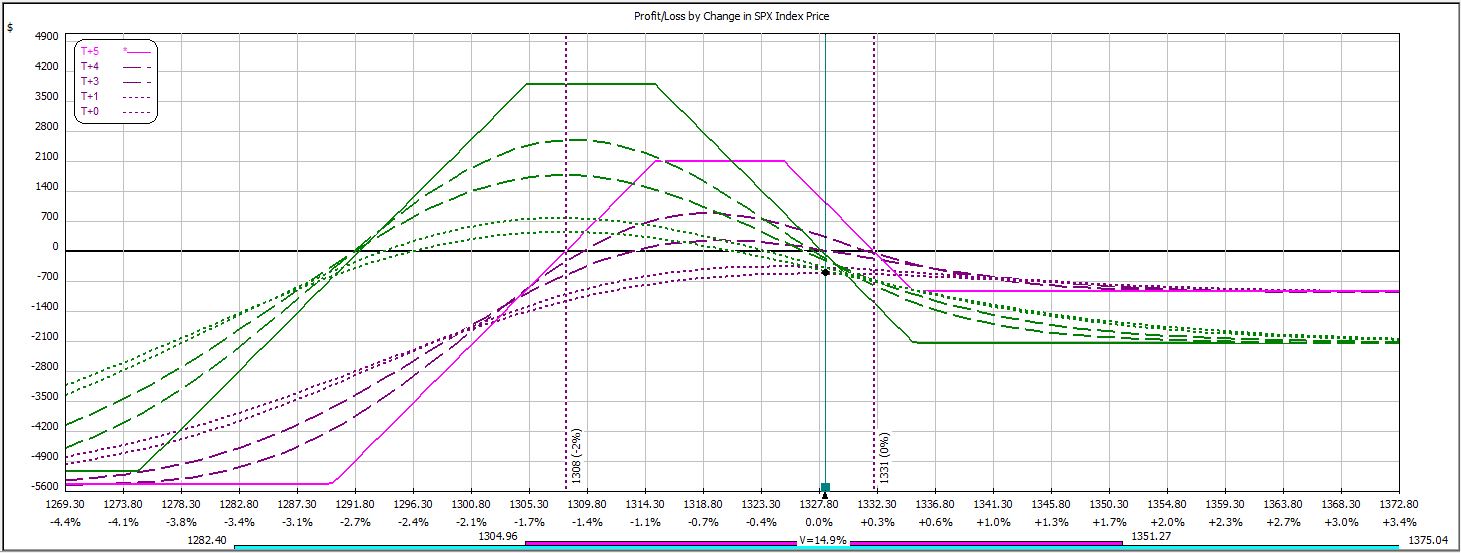

The rally continued into Monday when the second adjustment point was hit. Not only did I roll up the short calls 10 points, I also rolled the short and long put up 25 and 30 points, respectively. This adjustment, shown in pink, preserved profit potential for the trade as well as managing downside margin:

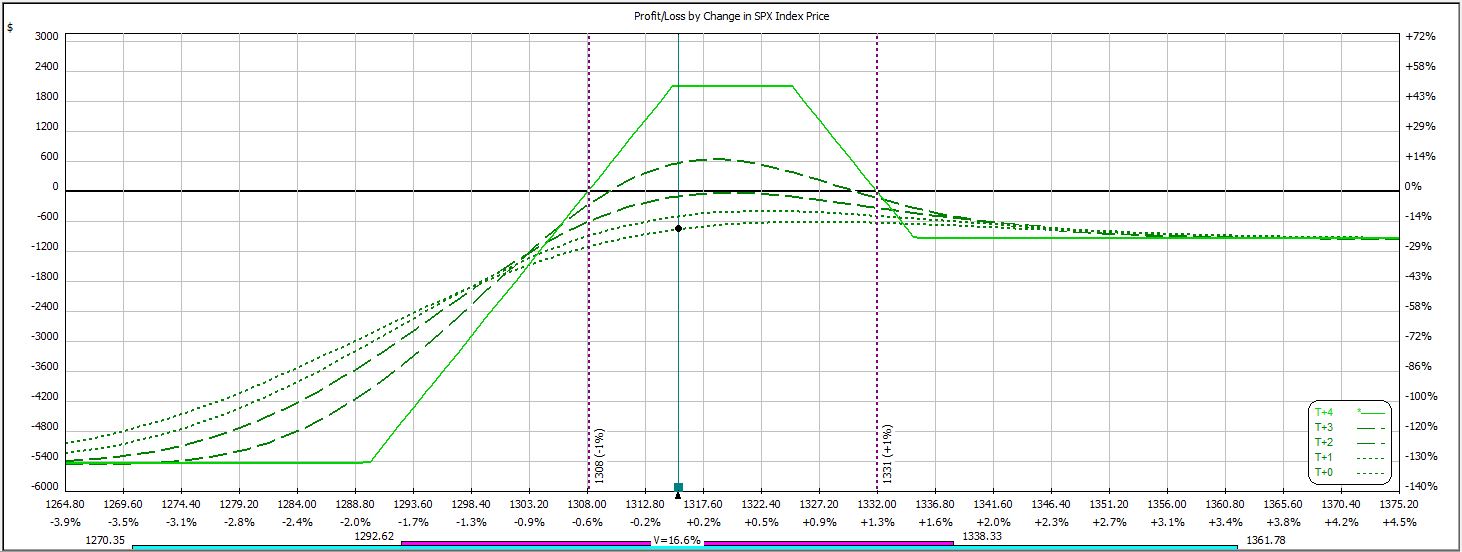

When the market pulled back on the next trading day, max loss was hit:

P/L on Day 1 ranged from -$285 to +$24.

P/L on Day 2 ranged from -$519 to -$345 on an adjusted margin requirement of $5,136.

P/L on Day 5 (nothing happened over the weekend) ranged from -$606 to -$537 on an adjusted margin requirement of $5,433.

Trade was closed on Day 6 for a loss of $738, which is 13.6%.

This backtested trade has now won and lost four times each.

Categories: Backtesting | Comments (0) | Permalink