Weekly Iron Butterfly Backtest (Part 17)

Posted by Mark on July 26, 2013 at 07:05 | Last modified: August 8, 2013 07:30In this blog series, I’m backtesting the weekly option trade described here.

For Week 16, OptionVue did not have weekly data for the Thursday before expiration week. I therefore started this trade on Friday:

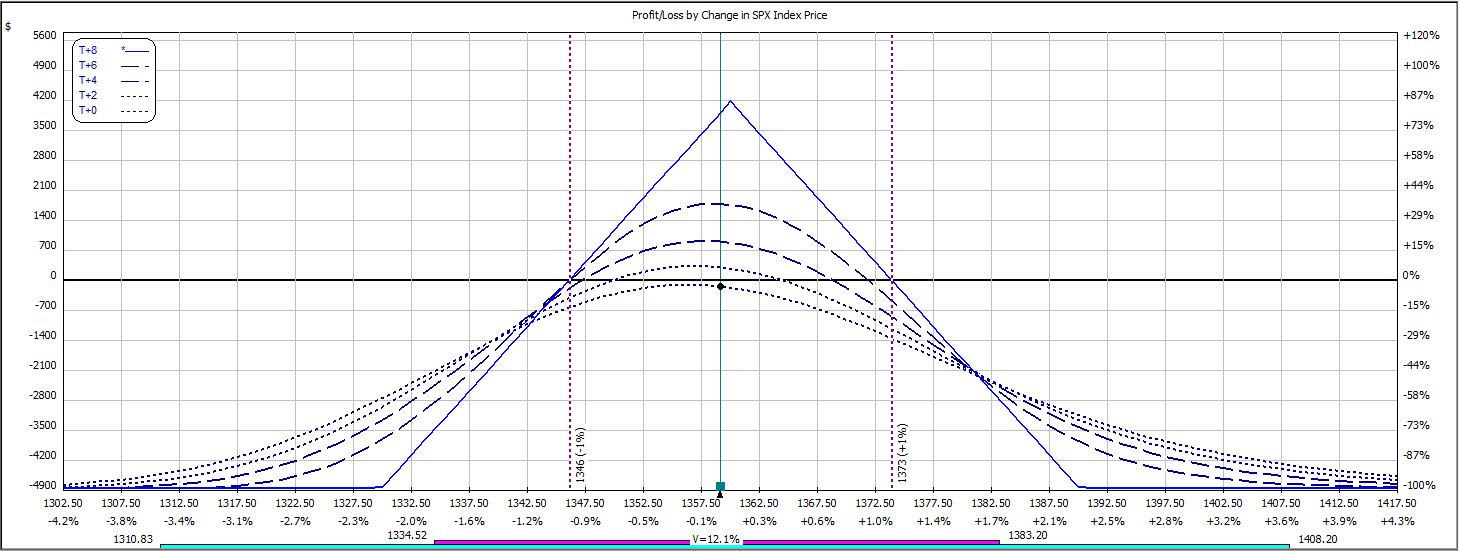

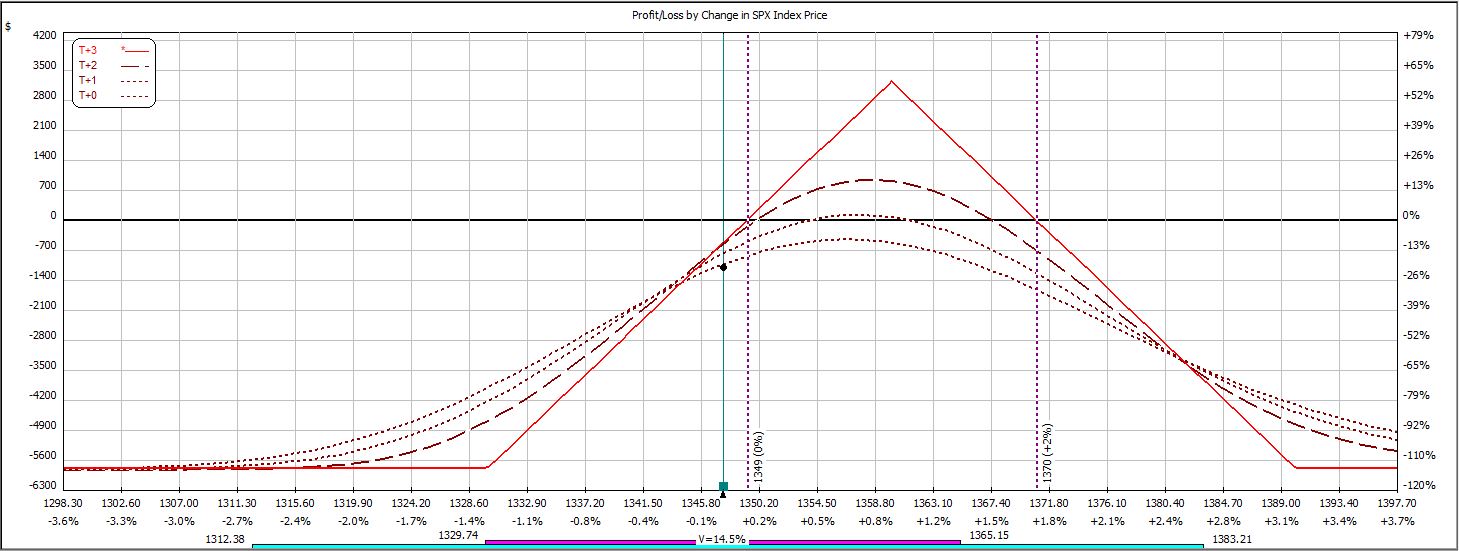

The market rallied into Monday to force an adjustment:

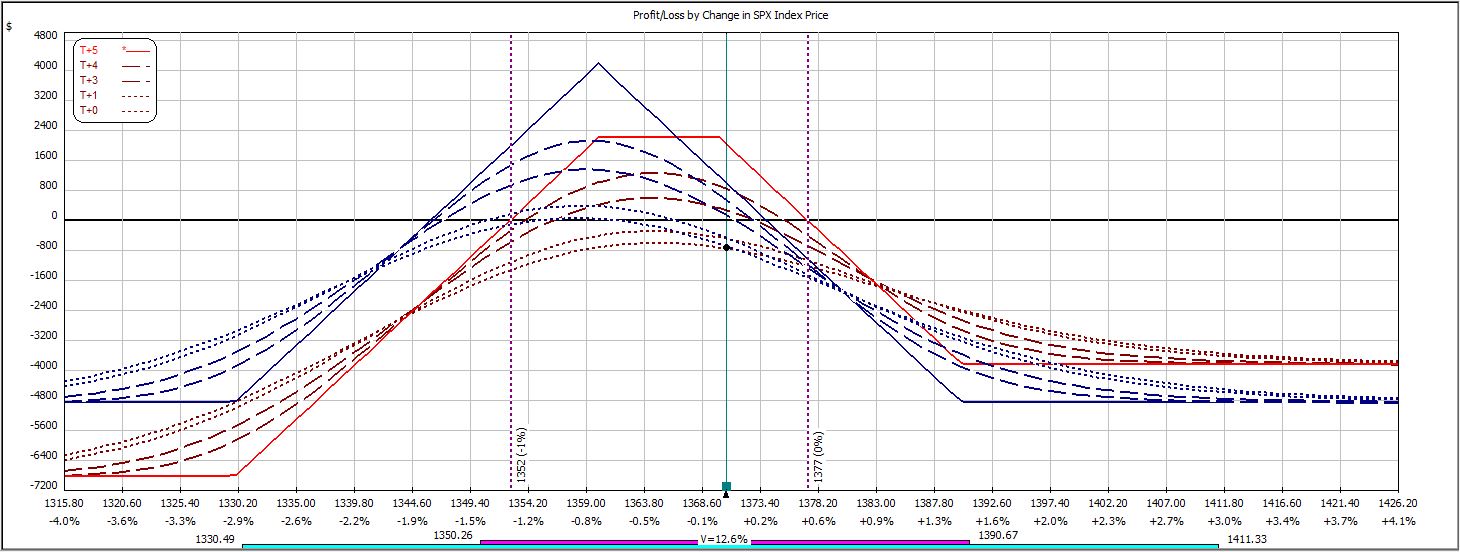

Of all the rotten luck–this was the top! By the next day, the market had fallen 10 points back to its starting point. I adjusted back to the original trade:

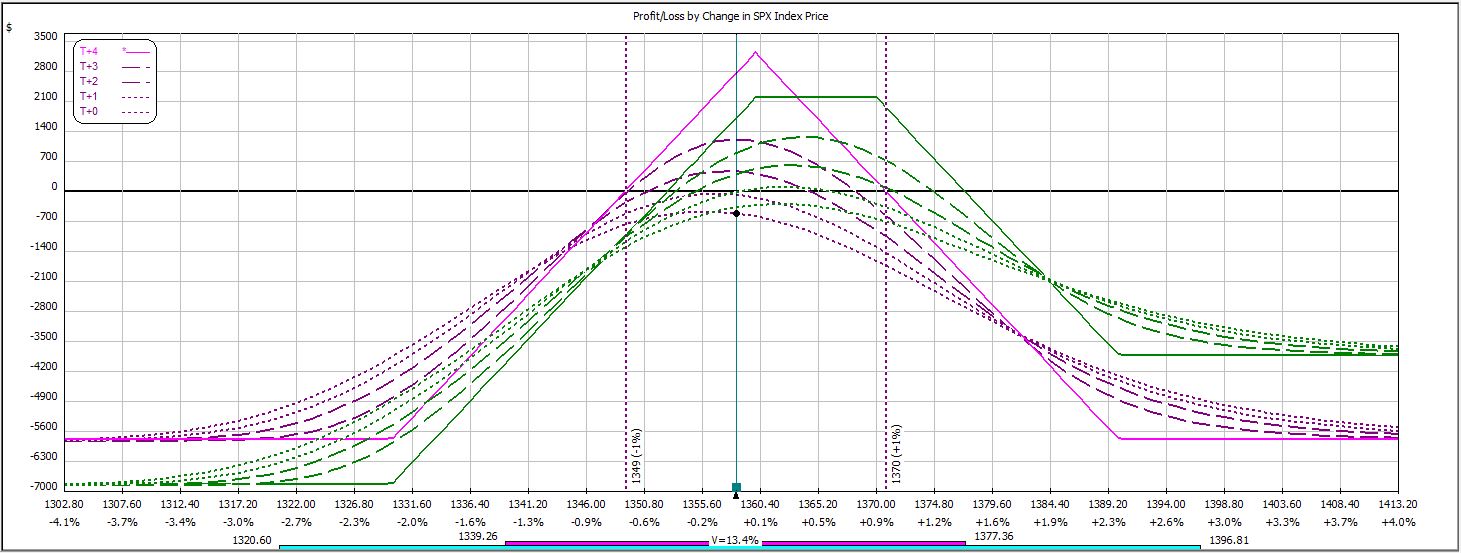

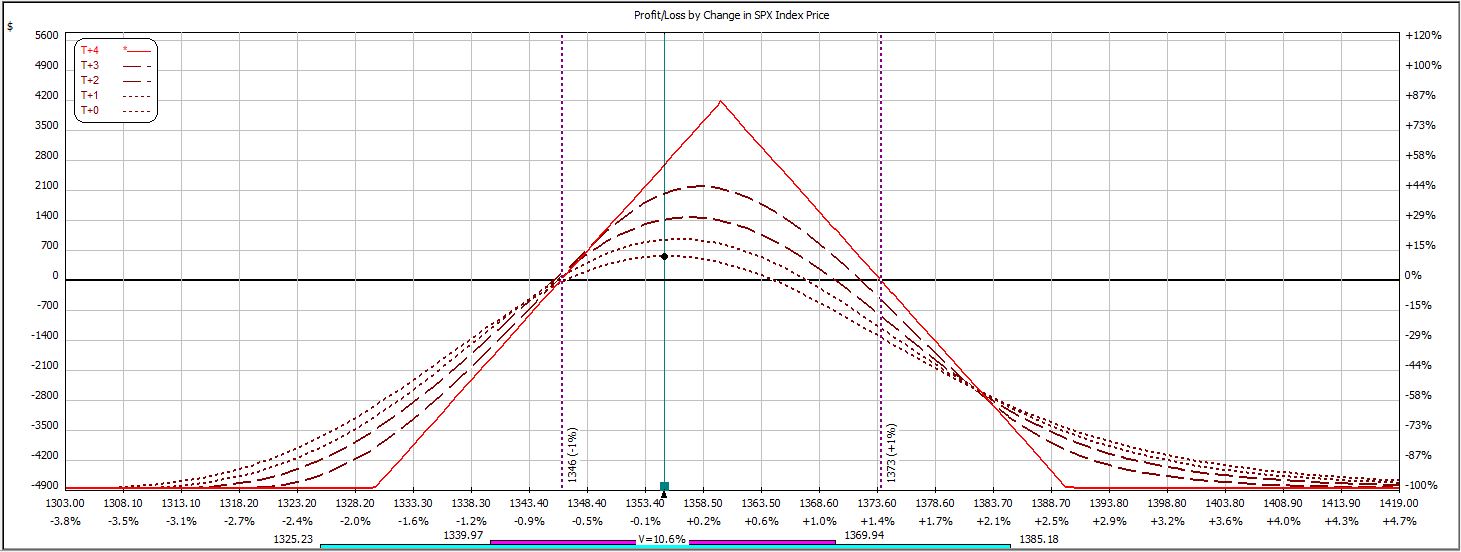

Unfortunately, the market continued to fall. At Wednesday’s open, the trade looked like this:

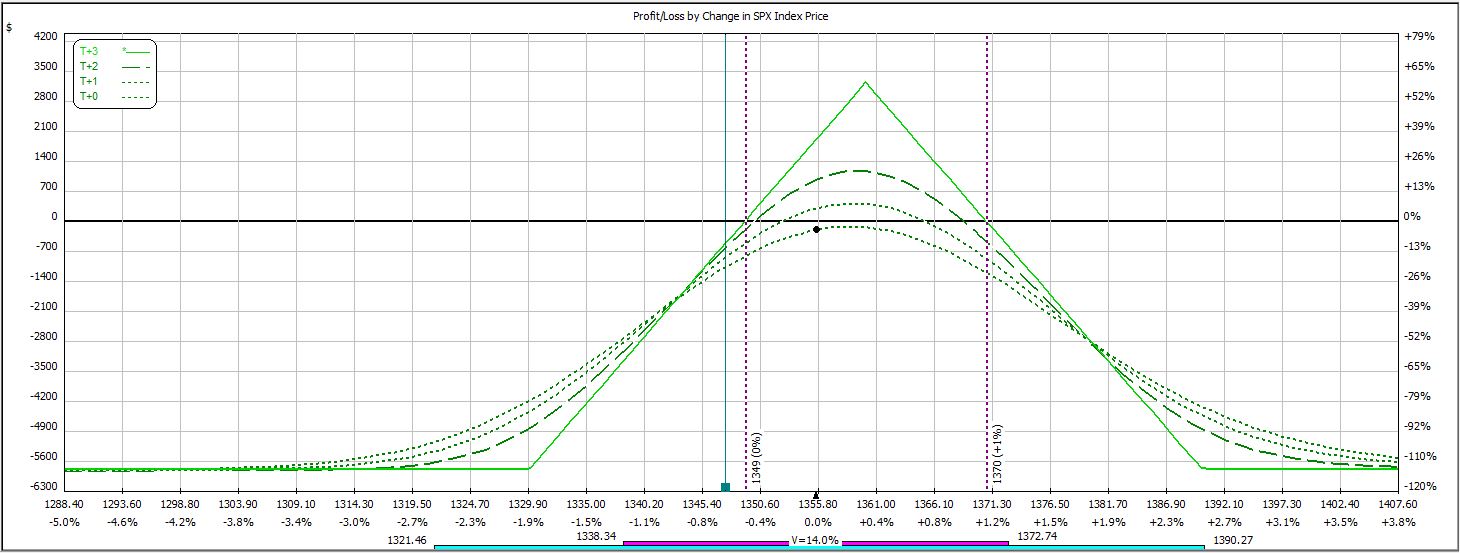

This does not look bad. Look at the wand (turquoise vertical line) sitting far below the current price (black dot). That is how far the market fell just a short time later putting this trade at max loss:

P/L on Day 1 ranged from -$114 to -$366 on $4,854 margin.

P/L on Day 4 (nothing happened over the weekend) ranged from -$498 to -$765 on an adjusted margin requirement of $6,831.

P/L on Day 5 ranged from -$303 to -$777.

After opening Day 6 down only $180, this trade was closed for a loss of $1,101, which was -16.1% on max margin.

This is the classic case of being whipsawed. Had I never made the upside adjustment and then the second adjustment to undo the first, this trade would have hit its profit target on Day 5:

If only trading were that simple?

This trade has now lost seven out of 16 times.