Weekly Iron Butterfly Backtest (Part 12)

Posted by Mark on July 15, 2013 at 07:54 | Last modified: August 5, 2013 13:59In this blog series, I’m backtesting the weekly option trade described here.

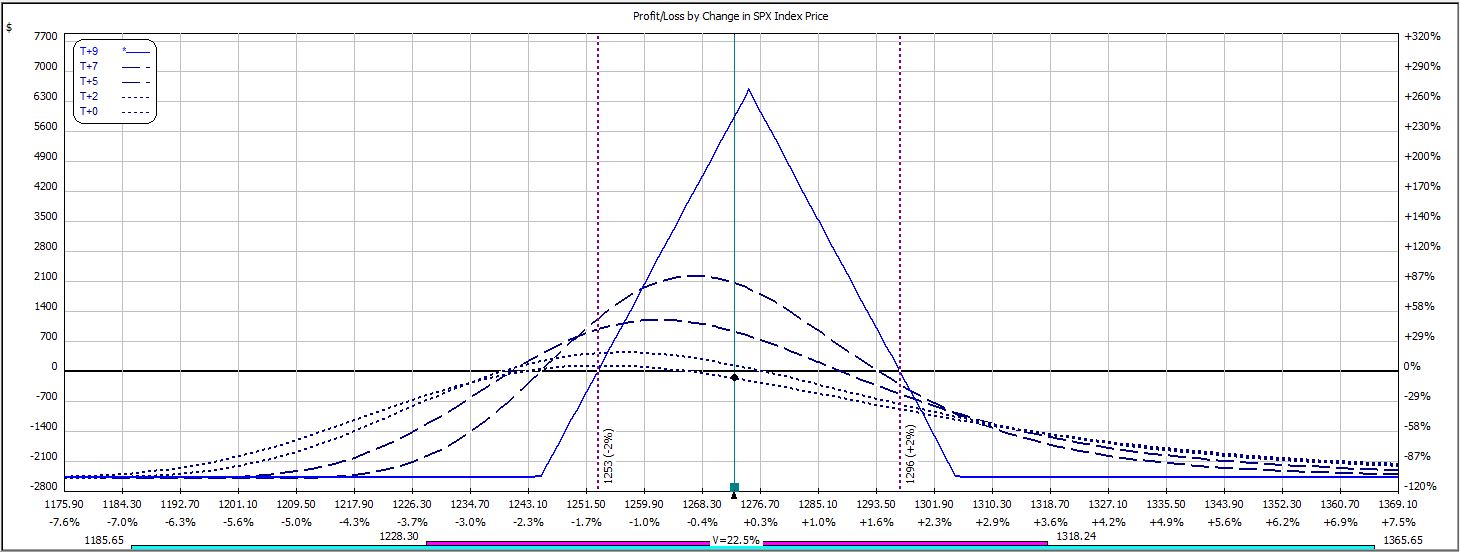

Week 11′s trade begins like this:

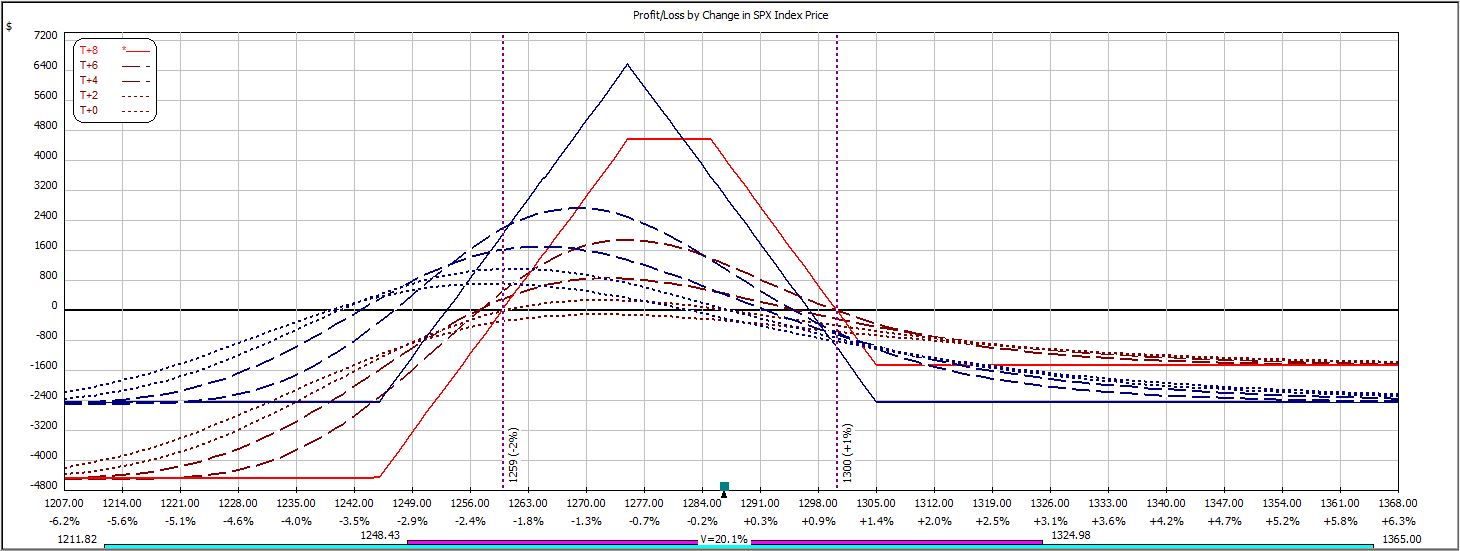

The market rallied and the next day, I rolled the short calls 10 points higher:

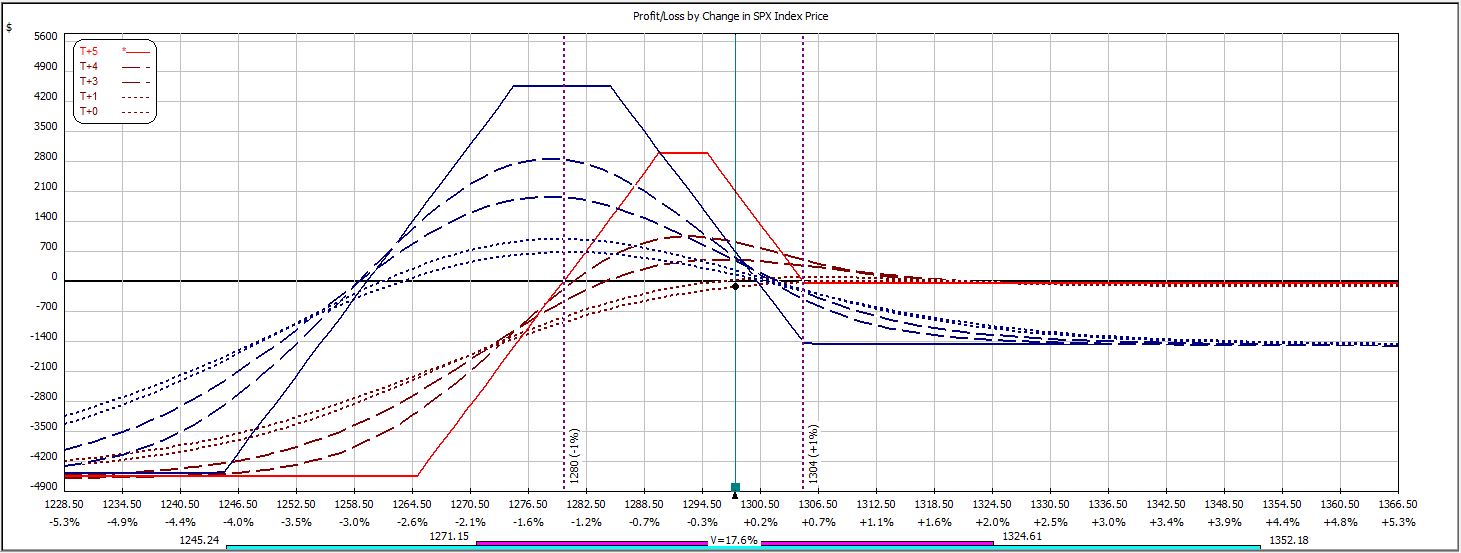

As the market continued to rally, I rolled the short calls 10 points higher on Day 5. To maintain profit potential in the trade and manage risk, I also rolled the short puts up 15 points and the long puts up 20 points:

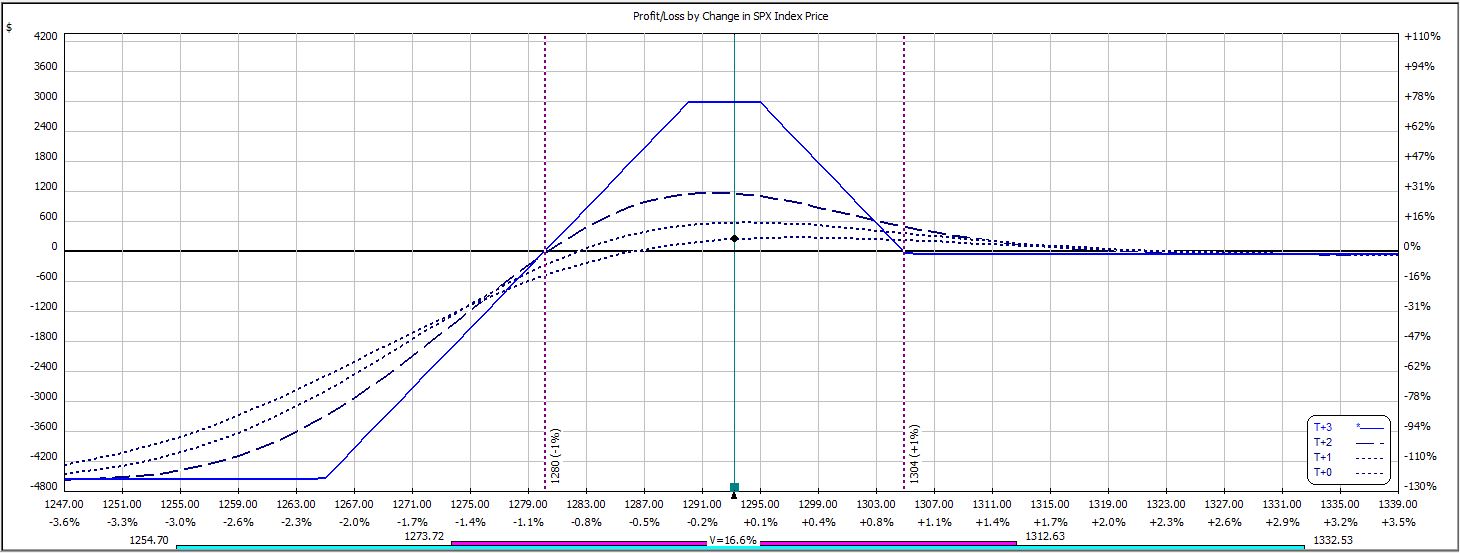

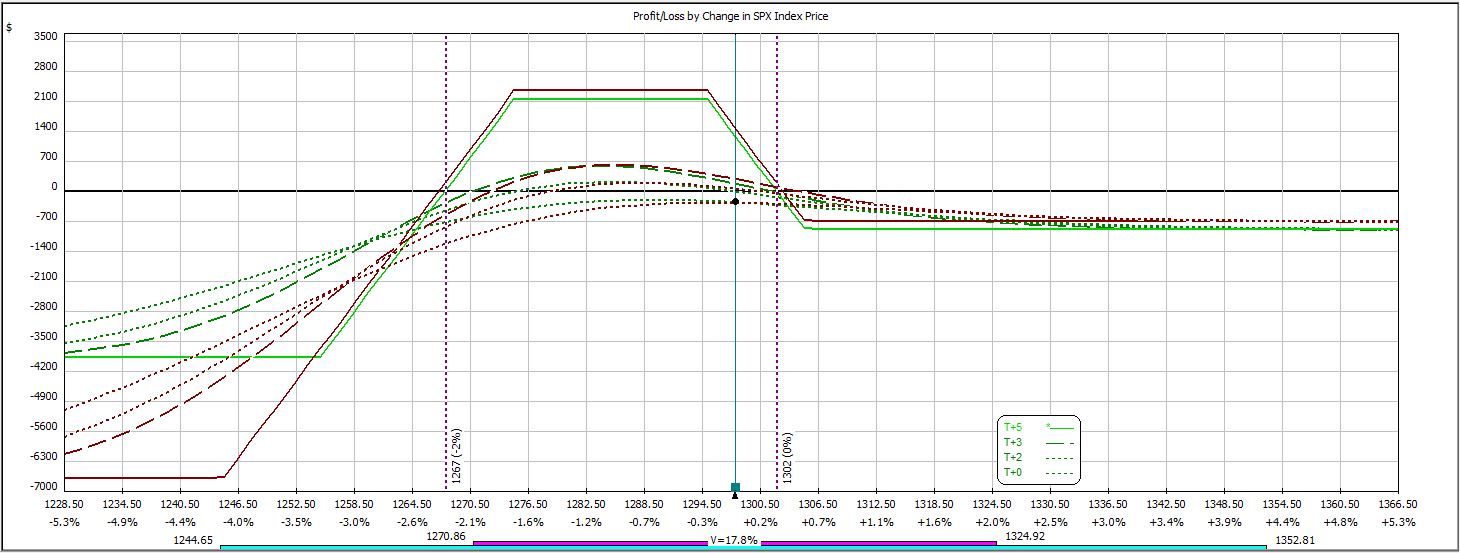

The profit target was hit two days later:

P/L ranged from -$312 to -$72 on Day 1.

P/L ranged from -$270 to -$156 on Day 2 with an adjusted margin requirement of $4,476.

On Day 5 (nothing happened over the weekend), P/L ranged from -$231 to -$129 with an adjusted margin requirement of $4,557.

P/L ranged from -$96 to -$6 on Day 6.

P/L fell as low as -$165 on Day 7 with a final return of +5.9%.

I’m a bit leery of rolling the short puts higher when the market rallies. Rolling the long puts higher clearly lowers margin requirement for minimal cost:

While rolling the short puts higher does bolster profit potential, the profit target is so much less than the max potential profit at expiration that little benefit may be realized. The disadvantage to rolling up the short puts is a faster losing trade if the market reverses and lower.

The weekly iron butterfly is 7-4 thus far.