2012 Performance Evaluation (Part 10)

Posted by Mark on February 25, 2013 at 06:01 | Last modified: February 13, 2013 05:19In http://www.optionfanatic.com/2013/02/21/2012-performance-evaluation-part-9/, I disclosed a third flaw in my preceding analysis showing potential utility for a LF.

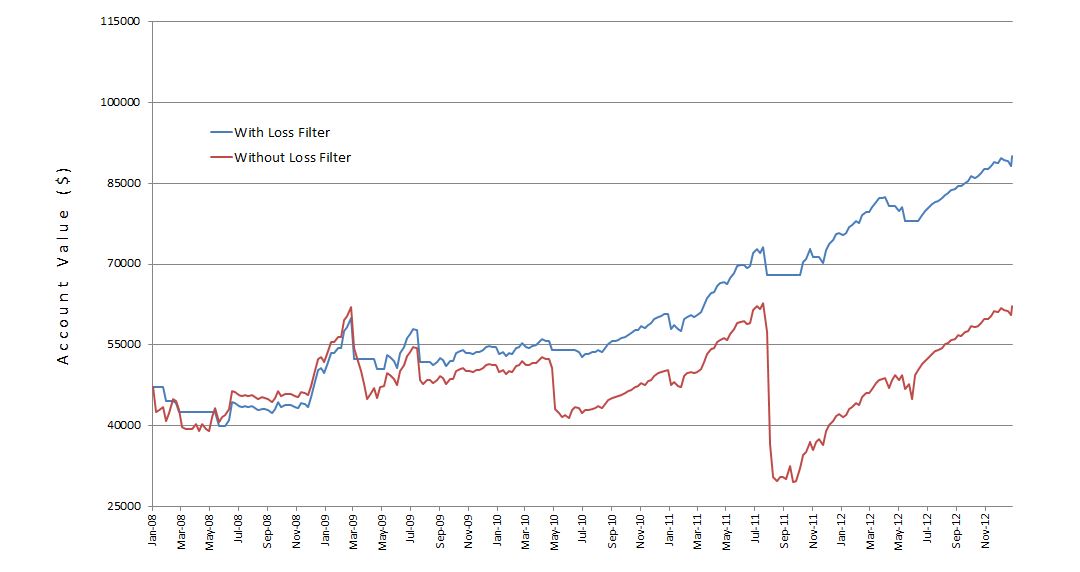

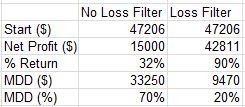

The corrected equity curves and performance results are shown below:

The methodology is still worth researching but a 90% profit is nowhere close to 143%.

I am categorizing this post as optionScam.com (http://www.optionfanatic.com/2012/04/21/optionscam-com/) because I have found deception to be commonplace among newsletter and trader education/mentorship offerings. You should understand the theory behind a proposed system and review the results to see if they are consistent with general tenets of the theory. Furthermore, you should not fall for the “one good example” that might be cherry picked from a population of losers. You should always be thinking about other possible combinations, market environments, and trade situations to evaluate whether an exemplar successful in one situation is likely to be successful in others.

I outperformed with this analysis by going beyond human nature to detect an honest mistake and I believe this is exactly what we need to do as traders to be successful. I really cannot emphasize that enough. Human nature is falling prey to the confirmation bias, as written here:

> The reason confirmation bias can be so deadly to a human is because… we tend to look only

> for information that supports our pre-held beliefs… not only could we be biased about the

> information we do get a hold of, we may completely sidestep vital information in the first

> place, just because we are subconsciously ignoring everything that doesn’t fit in with our

> beliefs.

For the most part, traders maintain hope that a “Holy Grail” exists. Once we get wind of a potential contender, we become captivated. We confirm evidence in support and discard, overlook, or refuse to scrutinize evidence to the contrary. Confirmation bias must be one of the biggest culprits of flawed system development methodology. If left undetected then traders will fall victim (i.e. lose money) to the “scam” perpetrated by another or, even worse, inadvertently by themselves.

Categories: Accountability, optionScam.com, System Development | Comments (0) | Permalink