Undressing Negative Gamma Risk

Posted by Mark on April 27, 2012 at 13:42 | Last modified: April 27, 2012 13:46It’s rumored that fear and greed are the two emotions that drive markets. As an options trader I would argue that psychic pain, otherwise known as negative gamma risk, should be listed as the third.

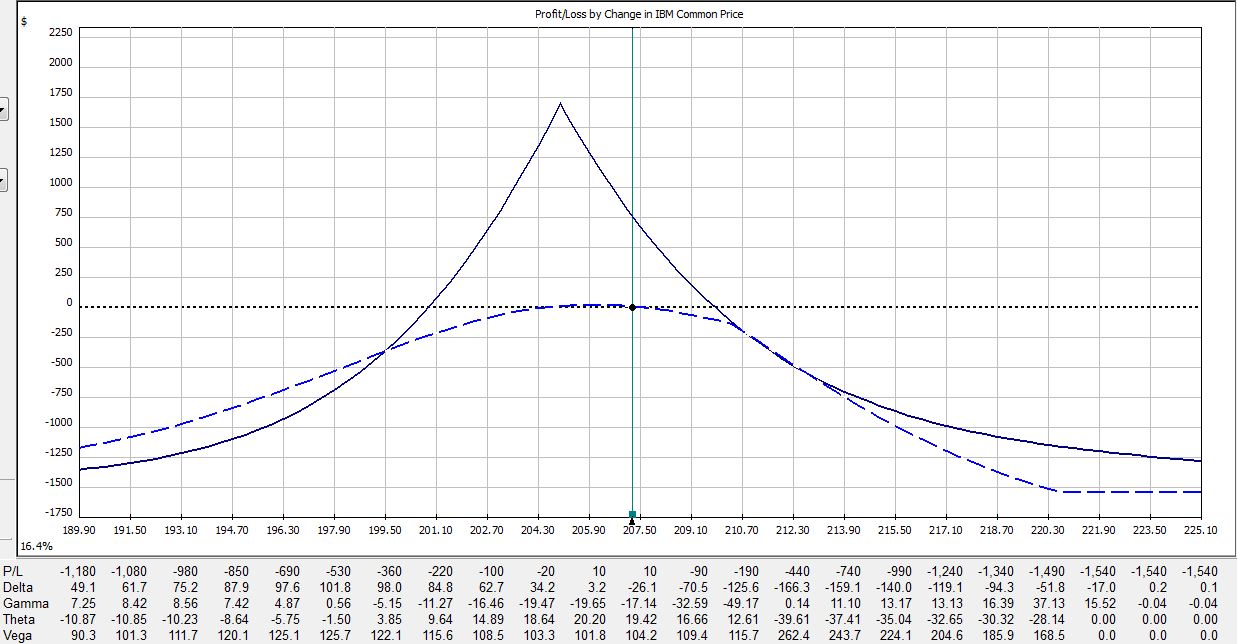

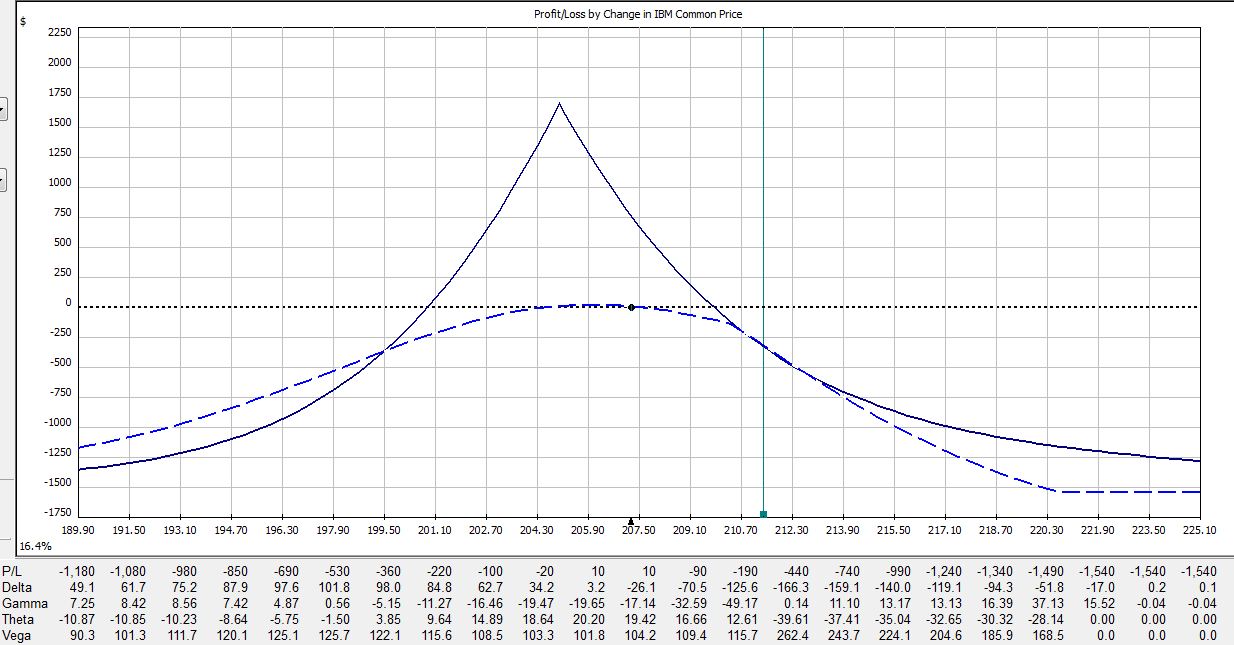

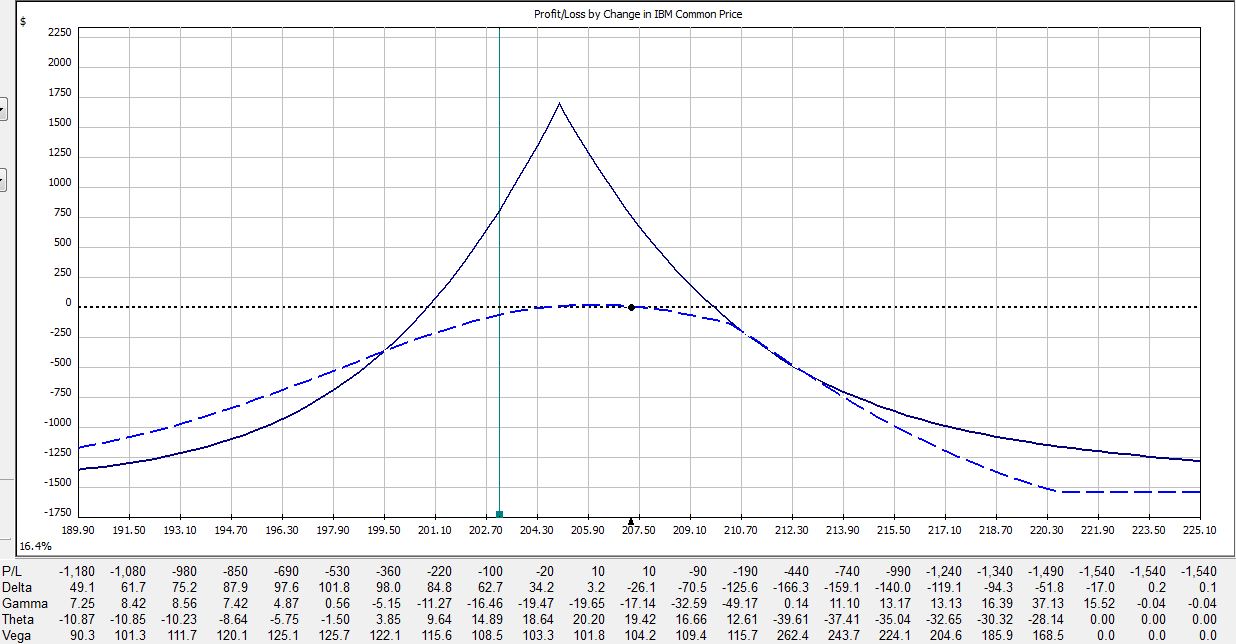

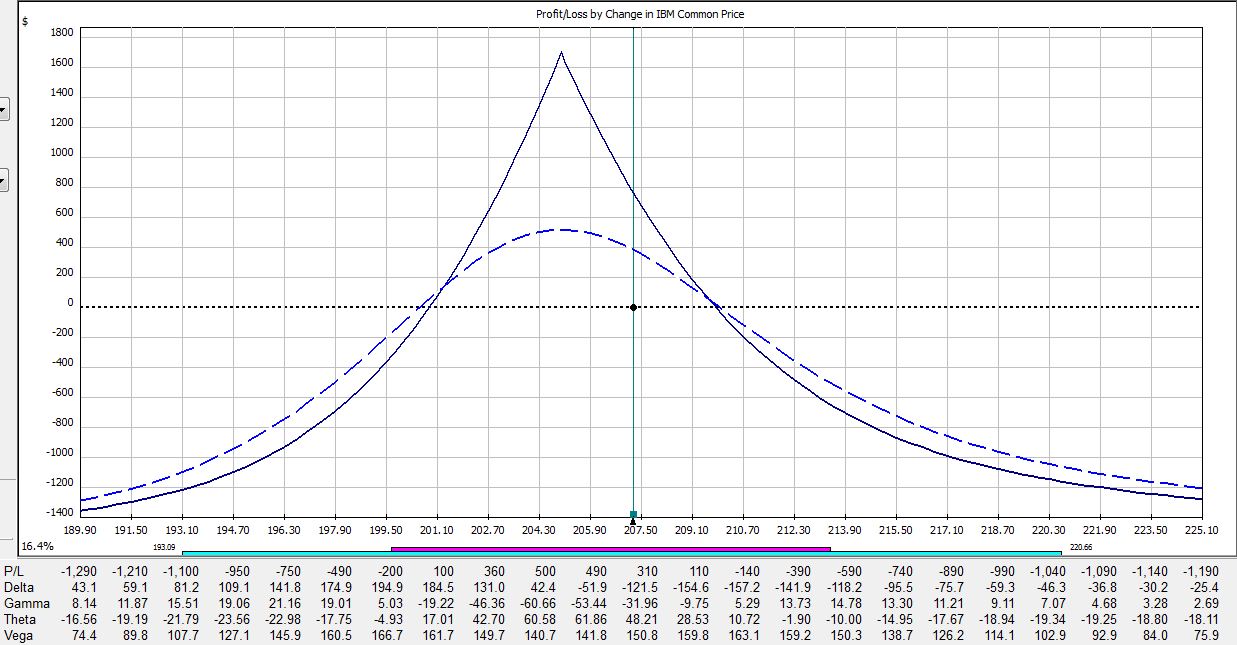

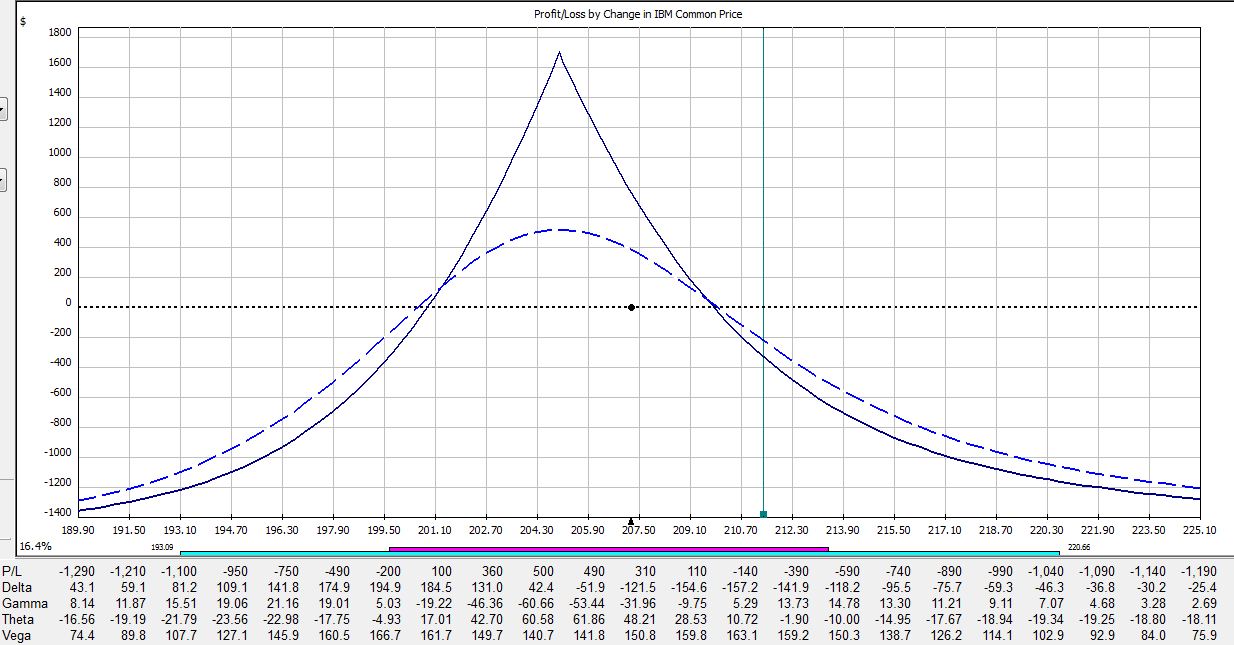

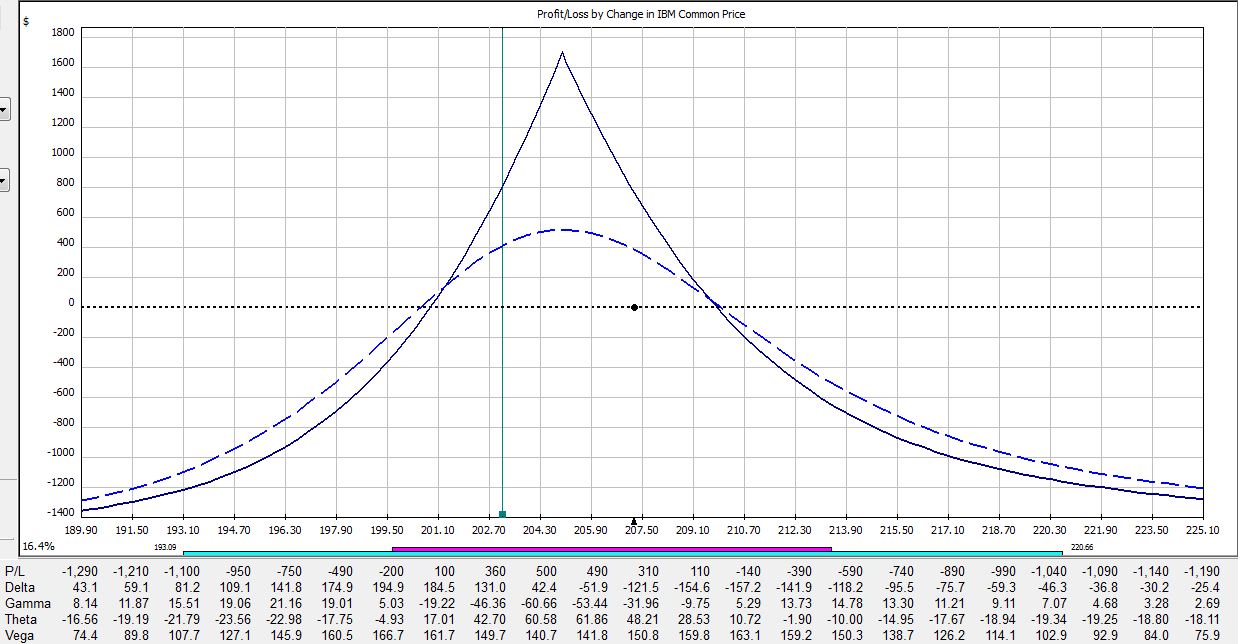

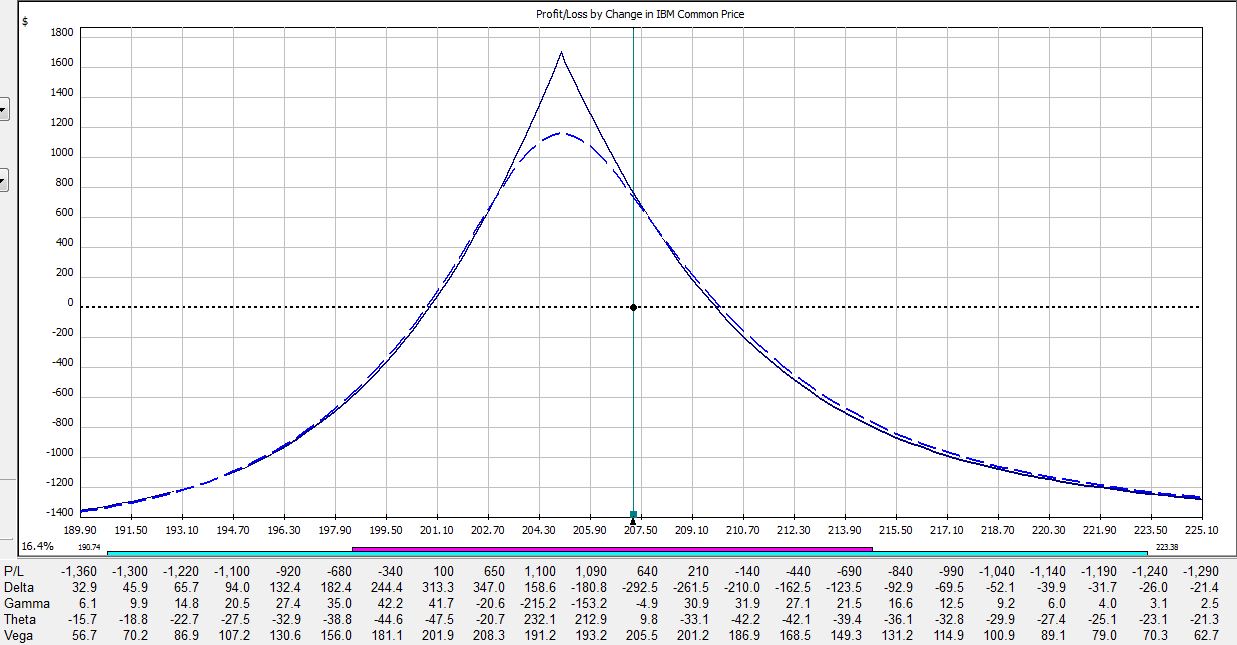

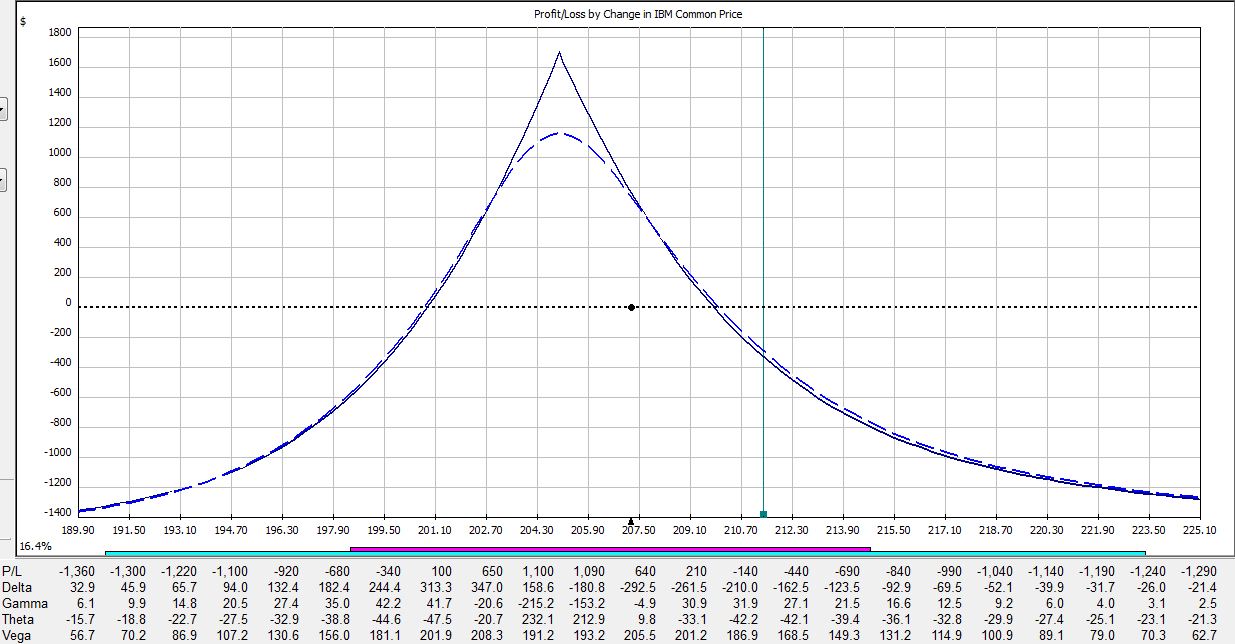

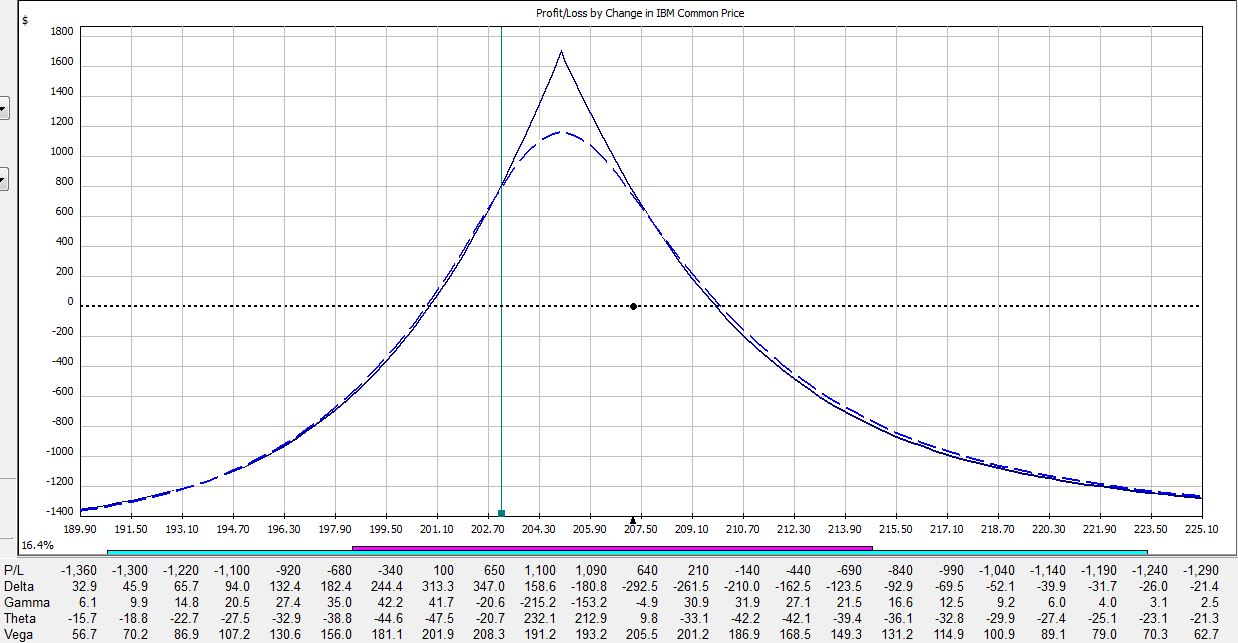

All pictures are risk graphs of a May/Jun 205 IBM call calendar trade (10 contracts) placed today (4/27/12), which is 22 days to May expiration. The P/L is the intersection of the green, vertical line and the blue dotted line.

At trade inception, we have this:

If IBM were to move up 2% today then the trade would be down $309:

If IBM were to move down 2% today then the trade would be down $50:

If IBM were to remain unchanged then in 15 days the trade would be up $353:

If IBM were to move up 2% then in 15 days the trade would be down $225:

If IBM were to move down 2% then in 15 days the trade would be up $400:

If IBM were to remain unchanged then in 21 days on the Friday before option expiration, the trade would be up $720:

If IBM were to move up 2% then in 21 days the trade would be down $275:

If IBM were to move down 2% then in 21 days the trade would be up $790:

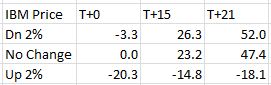

Here is a summary of these changes in percentage return on investment:

The table says at trade inception, a 2% move in the stock could result in a 20% loss. In just over two weeks, that 2% move in the stock could result in a 38% loss. On the day before option expiration, that 2% move in the stock could result in a 65% loss!

Psychic pain is seeing routine moves in the underlying suddenly have huge effects on the P/L. At some point, many traders would opt to close the trade so as not to worry about this negative gamma risk. Negative gamma risk can keep you up at night.

Graphically, gamma represents how tightly curved the P/L curve is. As option expiration approaches, gamma becomes huge. While many option trades are capable of “home run” sized returns, it’s truly a shot in the dark because normal moves in the underlying may cost you huge chunks of profit.

Tags: trader education | Categories: Option Trading, Uncategorized | Comments (1) | Permalink