Options are Better than Stock (Part 2)

Posted by Mark on September 8, 2016 at 05:06 | Last modified: July 26, 2016 11:16As discussed in Part 1, I have taken a defensive posture on the stock versus options debate in the past. As seen in recent articles by Perry Kaufman and Craig Israelsen, today I am going to implement a more anecdotal approach. When studied this way, options very much seem like a better trading and investment vehicle than stock.

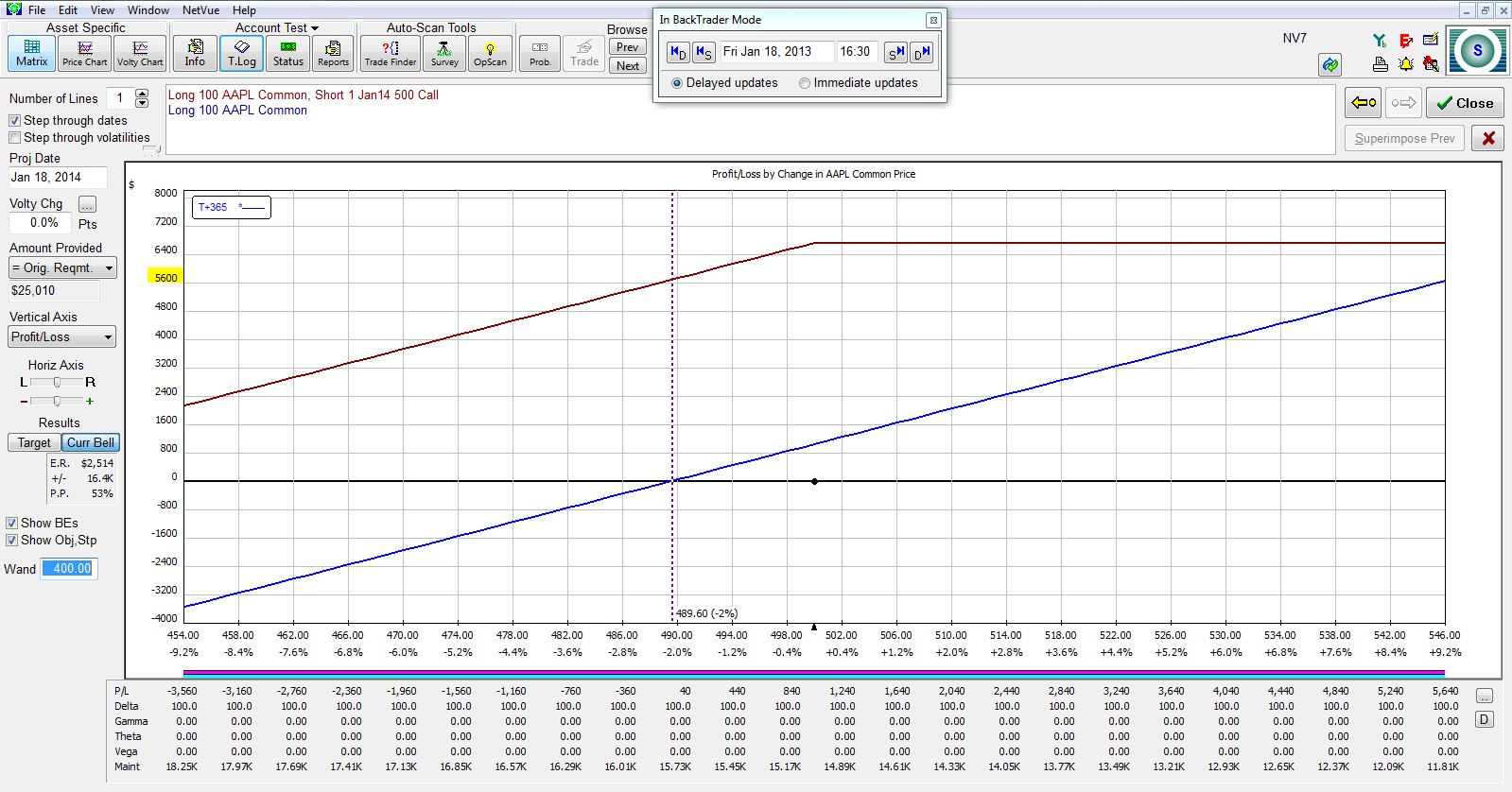

First, let’s revisit my comparison of long shares versus a covered call (CC) position from a 2013 blog post. The following graph plots the PnL of AAPL stock (blue line) and a CC position (purple line) 365 days after trade inception when the option expires. Stock dividends ($1,040) are included:

The vertical, dotted line shows breakeven for the stock position after 365 days if the stock price falls. At this zero profit level, the CC shows a profit of $5,600, which is the profit from selling the call at trade inception. The CC also outperforms farther to the downside and to the upside through an underlying price increase of over 10%.

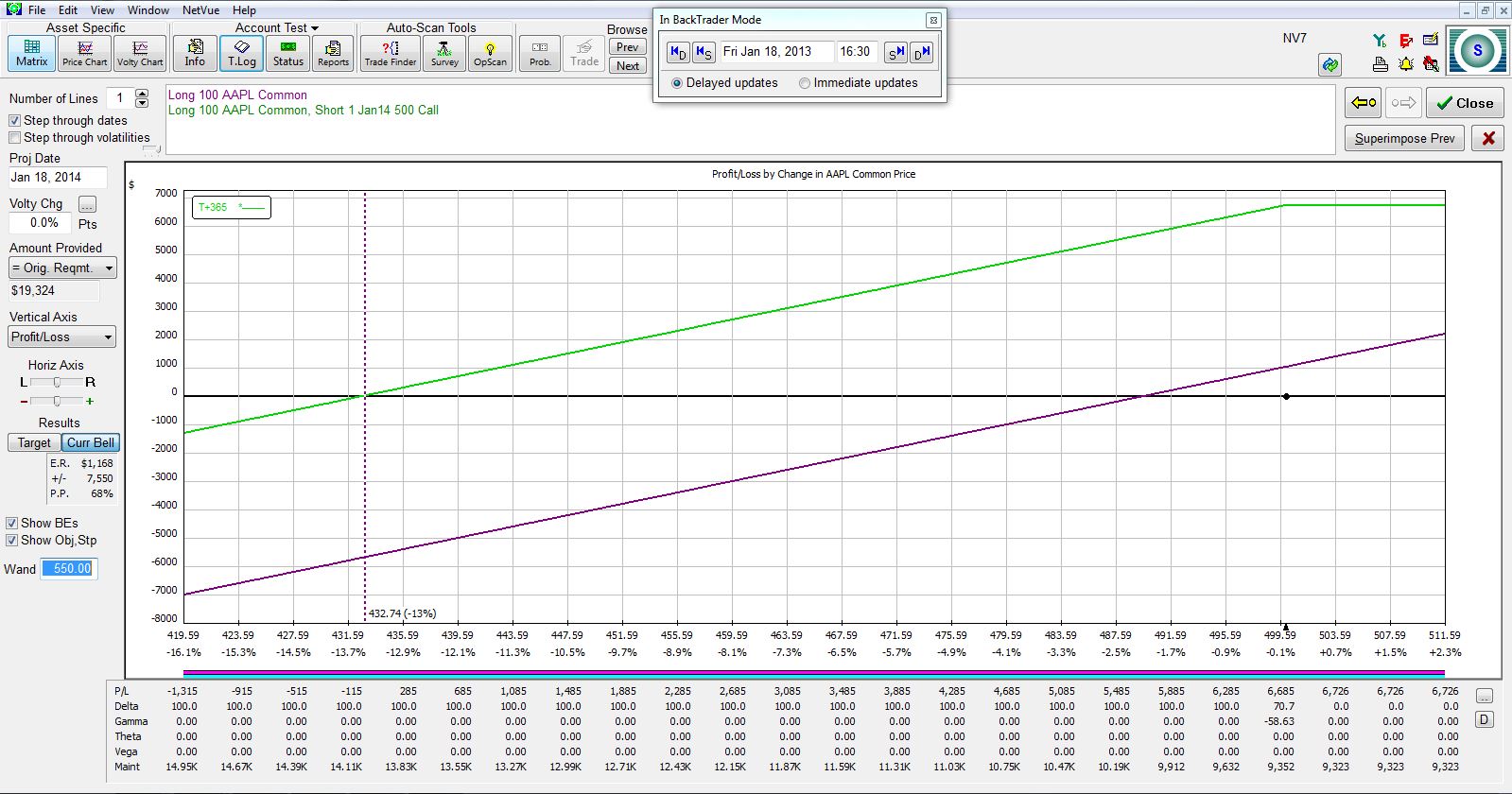

Second, I refer to the common interpretation of risk as potential maximum loss. To compare these positions when the market falls, we can shift the graph to the right:

The CC outperforms by the $5,600 mentioned above and this difference persists to a stock price of zero because the CC owner collects that non-refundable premium at trade inception.

Third, although a CC includes long stock, derivatives theory dictates that a CC is synthetically equivalent to a naked put. I illustrated this with graphs shown here. This is not anecdotal: this is universal.

Taken together, the first three points above argue for option superiority over long stock when the latter trades up a little, sideways, or down.

My fourth piece of evidence is anecdotal study of risk as volatility of returns. I cited studies here and here suggesting that returns are similar between stock and option positions with volatility 33% lower using the latter. Furthermore, my preliminary backtesting has shown lower maximum drawdowns for the naked put positions relative to long stock.

I will continue discussion in the next post.

Comments (2)

[…] I have shown the naked put position to outperform long stock if the underlying trades down, sideways, or up “a little.” In the previous example, AAPL stock could trade up over 10% in one year and still lose to the naked put. I also argued for higher consistency of returns with naked puts over long stock. This means lower standard deviation of returns and lower volatility of returns. In this case, it also meant lower maximum drawdown for the option position. […]

[…] previously demonstrated option outperformance when the stock moves lower, sideways, or moderately higher. I also made a strong case that options provide more consistent […]