Backtester Logic (Part 11)

Posted by Mark on October 10, 2022 at 06:45 | Last modified: June 22, 2022 08:35Moving on through the roadmap presented at the end of Part 9, let’s press forward with trade_status.

trade_status operates as a column in btstats to indicate trade progress and as a control flag to direct program flow.

You may have noticed the former by looking closely at the dataframe code snippet from Part 10. In the results file, this describes each line as ‘INCEPTION’, ‘IN_TRADE’, ‘WINNER’, or ‘LOSER’ (also noted in key).

As a control flag, trade_status is best understood with regard to the four branches of program flow (i.e. control_flag). The variable gets initiated as ‘INCEPTION’. This persists until the end of the find_short branch when it gets assigned ‘IN_TRADE’. At this point, the program no longer has to follow entry guidlines but rather match existing options (see third paragraph of Part 2). Once the whole spread has been updated at the end of update_short, the program can evaluate exit criteria to determine if trade_status needs to be assigned ‘WINNER’ or ‘LOSER’. In either of those cases, the trade is over and:

- Variable reset can occur.

- ‘INCEPTION’ gets assigned to trade_status.

- find_long gets assigned to control_flag.

- wait_until_next_day is set to True.

One variable not reset is current_date. This is needed in L65 (see Part 2) along with wait_until_next_day. For completeness, I should probably reset current_date as part of that else block (L68) and assign it once again as part of find_short or in the find_long branch with trade_date in L75.

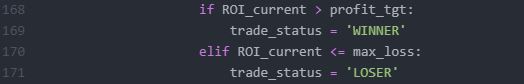

With regard to exit logic, I have the following after variables are calculated and/or assigned in update_short:

The only exit criteria now programmed are those for max loss and profit target, but this must be expanded. At the very least, I need to exit at a predetermined/customizable DTE or when the short option expires. This may be done by expanding the if-elif block. If the time stop is hit and trade is up (down) money then it’s a ‘WINNER’ (‘LOSER’).

I will also add logic to track overall performance. I can store PnL and DIT for winning and losing trades in separate lists and run calculations. Just above this, I can check for MAE/MFE and store those in lists for later plotting or processing. I can also use btstats. Ultimately, I’d like to calculate statistics as discussed in this blog mini-series. I will take one step at a time.

I conclude with a quick note about data encoding. Following the code snippet shown in Part 1, I have:

That imports each option quote into a list—any aspect of which can then be accessed or manipulated by proper slicing.

That ends my review of the logic behind a rudimentary, automated backtester. My next steps are to modify the program as discussed, make sure everything works, continue with further development, and to start with the backtesting itself.

As always, stay tuned to this channel for future progress reports!

Categories: Python | Comments (0) | Permalink