Naked Call Backtest (Part 2)

Posted by Mark on October 25, 2021 at 07:30 | Last modified: July 6, 2021 11:03I left off analyzing naked calls with respect to portfolio margin (PM) and maximum drawdown (MDD).

The strategy could be implemented based on maximum drawdown (MDD), but margin is another clear limitation. Even one contract could require up to $3.3M in PM for ~$108K profit. This paltry 0.34% total return gets even smaller as the index continues to climb. Not worth it!

One thing I could do to decrease PM would be to sell the vertical spread instead of naked call. Going 200 points wide would risk up to $20K/contract. Ten contracts would be up to $200K in PM, but I certainly could not increase 64-fold from there.

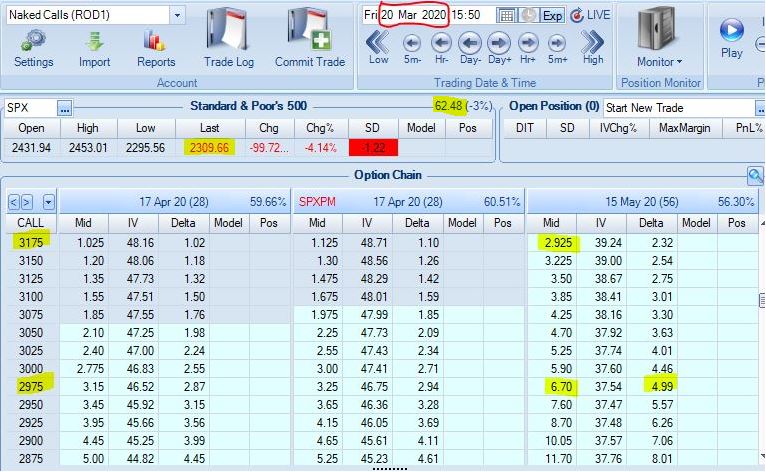

The spread concept brings with it some other interesting revelations. The backtest starts in high IV:

Observations:

- 200 points wide, which is $20K/contract risk

- Net credit ~$3.75 (~$4.40 going one strike NTM)

- Well into second standard deviation (SD) OTM

- Short delta ~5 (~5.6)

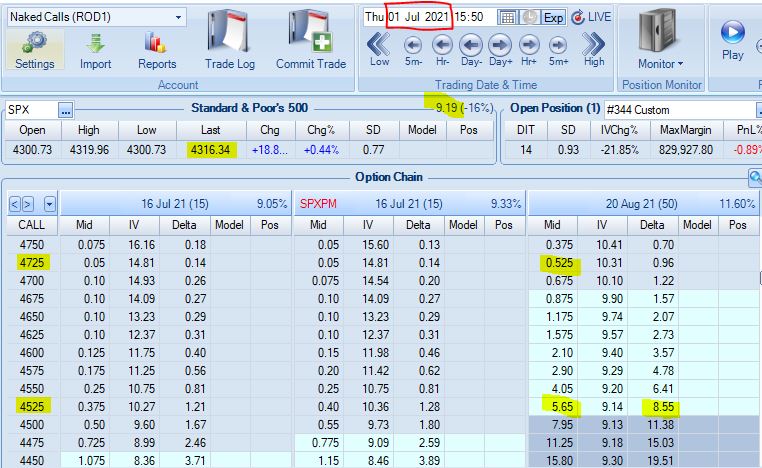

The backtest ends in low IV:

Observations:

- 200 points wide, which is $20K/contract risk

- Net credit just over $5.00 ($7.25 going one strike NTM)

- Just barely into second SD OTM (last strike in first SD OTM)

- Short delta ~8.6 (~11.4)

High IV is lower risk in terms of delta, but generates less credit because the long option is relatively expensive compared to the short. Low IV collects more credit but does so at a relatively higher delta, which is more risky.*

These examples illustrate two major differences: IV and index price. With regard to the latter, selling a fixed dollar amount is relatively NTM (higher delta) for index at lower value compared to relatively OTM (higher delta) for index at higher value.

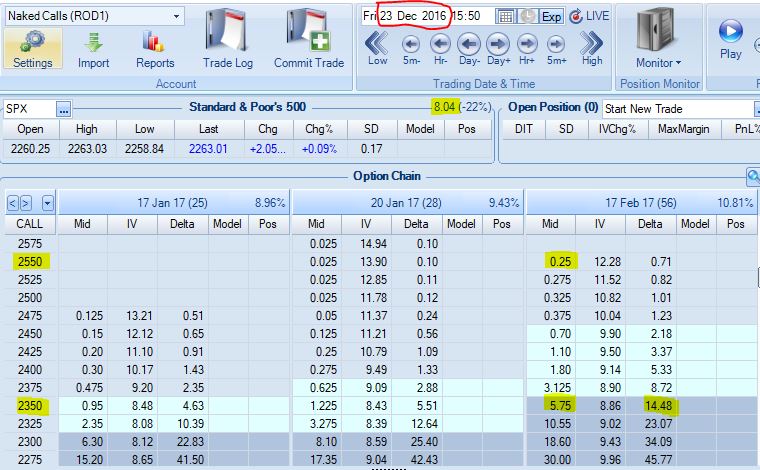

To see what SPX around 2300 would look like in low IV, we can go back to 12/23/16:

Observations:

- 200 points wide, which is $20K/contract risk

- Net credit $5.50 (~$2.90 going one strike OTM)

- Last strike within first SD OTM (just into second SD)

- Short delta 14.5 (8.7)

The first two examples suggest higher IV may hurt credit, but now we see that lower IV also results in lower credit if sold at a comparable delta value.

Also note that I can cut risk 50% by purchasing the long leg 100 points NTM for only $0.45 more.

I will continue next time.

* — I have discussed two different kinds of risk here. Spread width defines risk as the maximum

loss for any given trade. Delta represents risk by approximating probability of expiring OTM

(full profit) as opposed to ITM (likelihood of loss).