Backtesting Issues in ONE (Part 1)

Posted by Mark on May 21, 2021 at 07:16 | Last modified: June 20, 2021 08:51I recently subscribed to OptionNET Explorer (ONE). ONE is option analytics software that has been around for many years. I have started my ONE backtesting journey with ITM puts and have run into questions about data integrity.

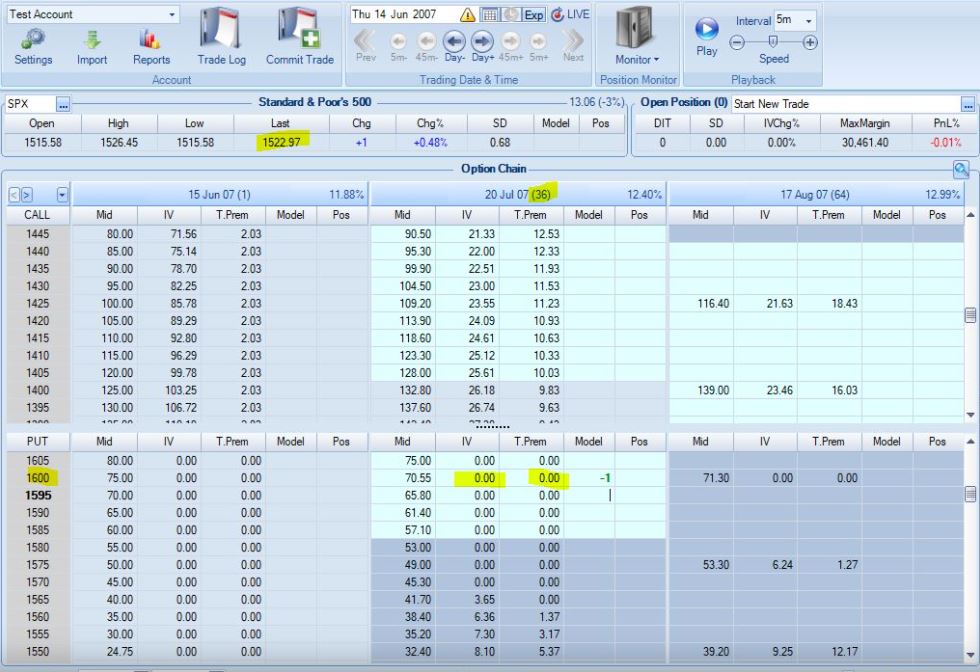

I started backtesting in 2007. Look at the following screenshot:

The underlying is at 1522.97. I highlighted the 1600 strike, which is roughly 1% ITM/week compounded geometrically. Zero extrinsic value (T.Prem column) is displayed. In fact, a range of strikes show zero extrinsic value down to the 1565 strike. With five weeks to expiration, this doesn’t feel right to me even being DITM.

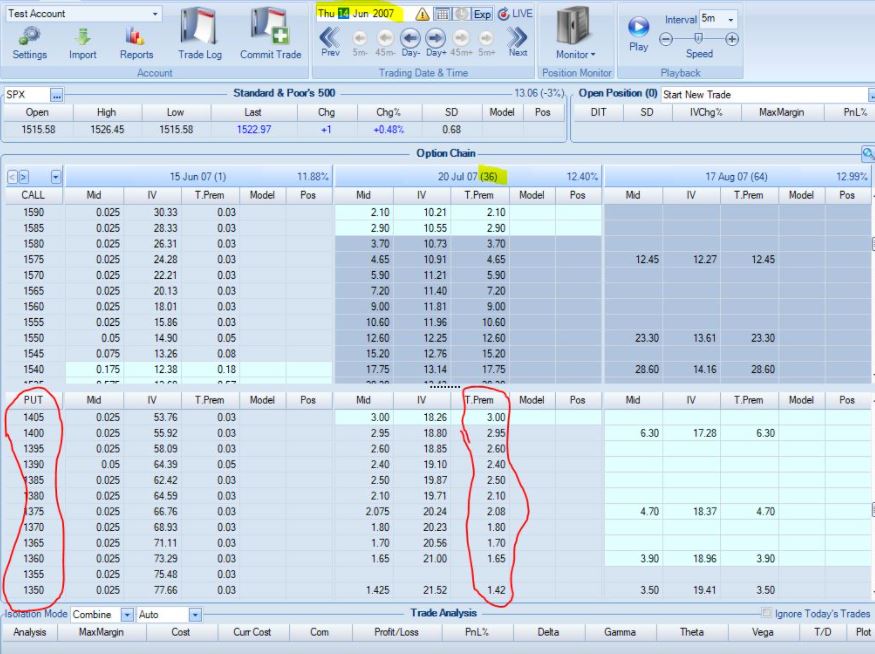

Look at the OTM portion of the option chain:

These puts have extrinsic value well into the third standard deviation. Vertical volatility skew would dictate OTM puts to have a higher implied volatility (more extrinsic value) than calls OTM by the same amount (referred to as moneyness). I believe this also pertains to ITM vs. OTM puts. Assuming this to be true (especially so if not), I still question what we’re seeing here. The option chain shows DOTM puts with extrinsic value well beyond the second standard deviation compared to ITM puts with zero extrinsic value less than a full standard deviation out.

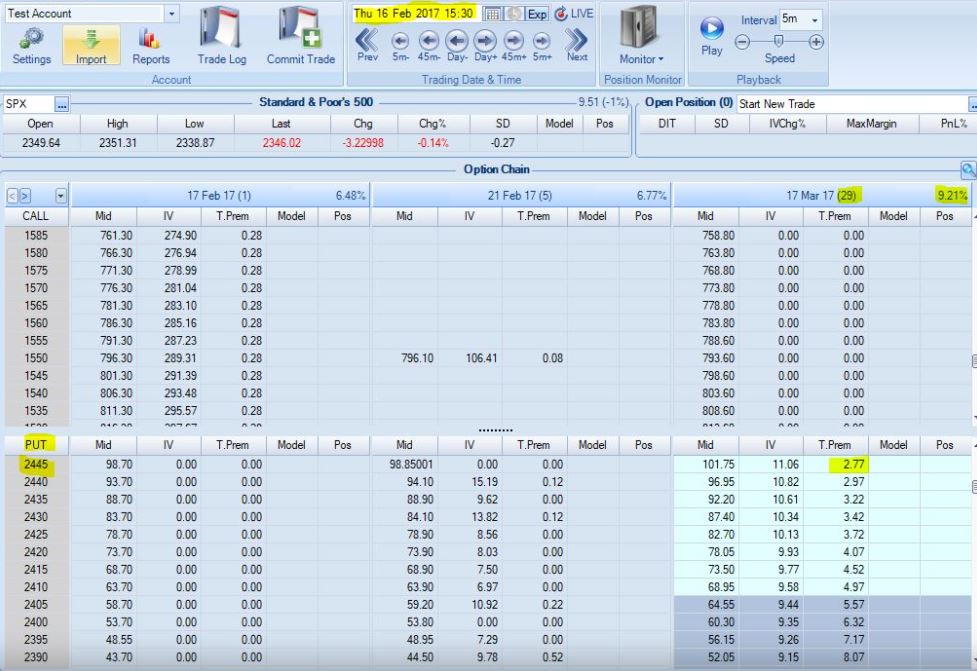

The following screenshot feels about right to me:

Extrinsic value should be greatest ATM and proportionally decline with moneyness. Whether the relationship is like an inverse V or a bell curve, what we see here seems much more reasonable. We shouldn’t see all zeroes.

I used to use OptionVue and I would sometimes have similar issues with their data. It didn’t seem to be every day, certainly, but before 2008-2009 or so, it was somewhat prevalent.

I will continue next time.

* — One standard deviation equals underlying price * implied volatility (decimal) * SQRT ( DTE / 365)