Not Exactly a Cash Replacement Strategy (Part 1)

Posted by Mark on May 7, 2021 at 06:53 | Last modified: April 19, 2021 17:18Today I will talk about the first component to a hedged approach to option trading.

A cash replacement is relatively safe. Cash is savings accounts, money market accounts, certificates of deposit, FDIC insured, etc. Cash suffers from inflation risk: it will be devalued over time if the interest rate (currently near zero) is less than the rate of inflation, which is generally not the case (see below). A cash replacement will not be government insured, but it should have comparable risk in terms of how much it may lose in any given year.

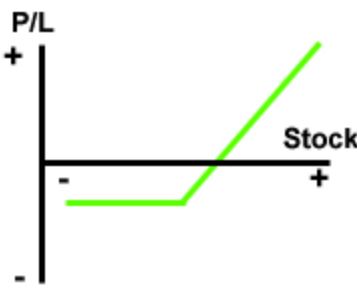

The first component in the proposed hedged portfolio approach is a married put. This is a long-term ATM put and 100 shares of underlying stock. The maximum potential loss is the total cost of the put. If the market is lower at expiration, then the loss incurred by the shares is offset by intrinsic value of the long put. If the market is higher at expiration, then the cost of the put subtracts from gains in the shares. The risk graph is shown below:

Before I can assess a potential cash replacement, I need to understand the historical annualized return on cash. According to Portfolio Visualizer, using Vanguard Short-Term Treasury Fund Investor Shares (VFISX) as a proxy for cash reveals an average CAGR of 3.75% (1.48% after inflation) from Jan 1992 through Mar 2021. The range is -0.57% to 12.11% with a standard deviation of 1.91%.*

Next, I need to run a backtest to get a comparable performance distribution for the married put. The shares will benefit from the annual dividend to discount the put cost, which is ~2% in recent decades.

Always implied when we see benchmark returns is that 100% of the account is invested. Few people really do that. The long-time rule of thumb, which I am not advocating, has been to invest in equities a percentage equal to “100 minus your age.” In a pinch, a “conservative” asset allocation often preached is 60% stocks + 40% bonds. Either way, whatever the equities return in any given period must be diluted accordingly to calculate total portfolio return.

If I believe the married put to be sufficiently safe, then I can use it as a repository for cash in the account and avoid deleveraging the portfolio as just described. Committing 100% of my investible assets to an approach like this would immediately give me a 4% (or more) advantage per 10% CAGR according to the traditional approaches mentioned above. That’s a huge head start.

While I will be interested to see the overall return of the married put, in theory the total cost seems more reasonable in periods of low volatility than high. In the latter portion of 2017 with SPY around $247, a 2-year ATM put could be purchased for about $20. The dividend yield was about 2% so the annual cost of this insurance was about 2.1% (rounding up).

Would I risk putting my remaining assets in a vehicle that could lose no more than 2.1%? Inflation has averaged 1.2% over the last 12 months, which means cash has returned roughly -1.0%. Losing 1% is not much better than losing 2.1%, perhaps, although with implied volatility currently higher maybe the potential loss is also higher—either way, if my answer is ultimately yes then this could adequately serve the purpose of cash replacement.

I will continue next time.

* — As an aside, correlation to US equities is -0.19.