Enamored with Day Trading? (Part 2)

Posted by Mark on March 5, 2020 at 10:32 | Last modified: May 4, 2020 12:11Today I will finish up the last post by getting into some actual data about day traders.

Chague et al. tracked 19,646 day traders from 2013 through 2015. This study received lots of buzz in Brazil. In addition to being extremely popular, day trading is also very controversial there.

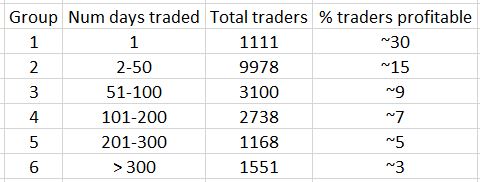

The results boiled down as follows:

These data suggest day trading and casino roulette share similar odds of winning. The more people day trade, the better the chance they have to lose everything.

Chague et al. explain the results run contrary to self-selection. In self-selection, individuals with better performance generally persist in an activity. This is common in activities that exhibit “learning by doing.” Michael Mauboussin, in The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing (2012), agrees: practice does not make perfect when the outcome is due to luck rather than skill.

Trading educators want us to believe something altogether different. I often see [day] trading advertised as a craft to be developed over time. I won’t be overnight sensation. It takes hard work. The more I practice, the more classes I take, the more mentoring sessions, the more I spend on this education, the more I will succeed. In the current study, empirical data along with statistical regression analysis showed performance to be deficient with those trading longer faring even worse.

Despite the poor averages, perhaps those who end up in the green are a smashing success. Looking at the 47 out of 1,551 day traders who were profitable after 300 days:

- Only 17 earned more than the Brazilian minimum wage (16 USD/day)

- Only eight earned more than an newbie Brazilian bank teller (54 USD/day)

- One earned 310 USD/day

For all the stress and strain of day trading, the chance of making a respectable $78,000/year was 0.06% and the chance of making more than an entry-level bank teller wage ($13,608) was 0.5%. No windfall profits were to be found with tiny profits few and far between. The average daily result was a loss of $49.

Even to realize the entry-level bank teller wage, one had to endure a large variability of returns. For the eight mentioned above, the daily profit ranged from $632 to $3308. In other words, that $54 average profit/day was usually between -$578 to +$686 per day for the most consistent and -$3254 to +$3362/day for the most volatile. Sleepless nights, anyone?

If the outlook isn’t bleak enough already, Chague et al. explain why their study is likely to overestimate actual performance. First, income taxes and other relevant expenses (e.g. trading platform cost, courses) were not included. Second, only days where total contracts bought equaled total contracts sold were included. They cite a study by Juhani Linnainmaa (University of California at Berkeley, 2005) that says retail day traders are reluctant to close losers (called the “disposition effect”). Days with unequal numbers of contracts bought versus sold were likely losers, therefore. By not including these in this study the abysmal reported day trading performance is, itself, artificially inflated.

Chague et al. conclude “it is virtually impossible for an individual to day trade for a living, contrary to what the brokerage specialists and course providers often claim.”

This is certainly something to think about!