Ghost Education (Part 4)

Posted by Mark on February 17, 2015 at 06:28 | Last modified: May 11, 2015 11:39The last sentence of Lane’s article told us the key to profit is to buy options traded in high volume with no discernible cause. Because this seems a bit weak, I want to scrub the cited Options Alpha article to make sure I have not missed anything.

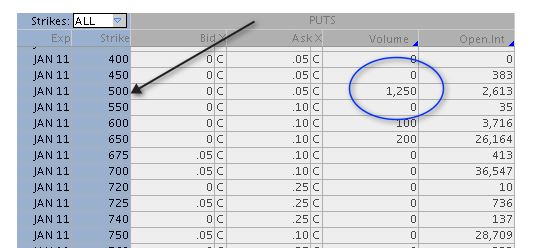

The Options Alpha article gives an example of high SPX option trading volume:

The article writes:

> CLEARLY, this is a classic example of hedging buy [sic]

> a large institutional trader and/or hedge fund.

This is an unverifiable claim and there is nothing “clear” about it. Yes, this could be a deliberate attempt to hedge, which is #2 of three main reasons the article gives for high option trading volume. This could also be #3: an example of “an idiot getting loose in the market” and speculating on a big drop by purchasing cheap OTM options. This could also be #1: upcoming news. We see predictions almost every day in the financial media warning of a catastrophic market crash just over the horizon. Maybe someone read one of these news articles and thought there was reason to buy this option.

To muddle the waters further, I will suggest this could have been a trading error! Any seasoned trader will talk about “Laurel and Hardy” trading mistakes. Maybe the trader(s) intended to buy 1000 strike puts and selected the 500 strike instead. Maybe the trader intended to buy 125 contracts instead of 1250. Purchase of 1250 contracts at a nickel each would only have cost $6,250 plus commissions. That could be but a pittance for an institutional trader, but it could be a retail trader as well (yet another detail that isn’t clear like the article suggests).

The article continues:

> Once you find out who is buying these options then only

> can you decide how YOU would like to make money off THEM.

No, we can never find out who is “buying” these options. Does this mean we can never do anything in terms of making money “off THEM?”

I will continue next time.

Categories: optionScam.com | Comments (1) | Permalink