Covered Calls and Cash Secured Puts (Part 1)

Posted by Mark on October 15, 2013 at 06:24 | Last modified: January 8, 2014 07:28In an effort to break my analysis paralysis and develop an additional stream of income, today I begin a blog series on covered calls (CC) and cash secured puts (CSP). I will begin today by defining the trades.

According to www.investopedia.com, a covered call is defined as:

> An options strategy whereby an investor holds a long position

> in an asset and writes (sells) call options on that same asset in

> an attempt to generate increased income from the asset.

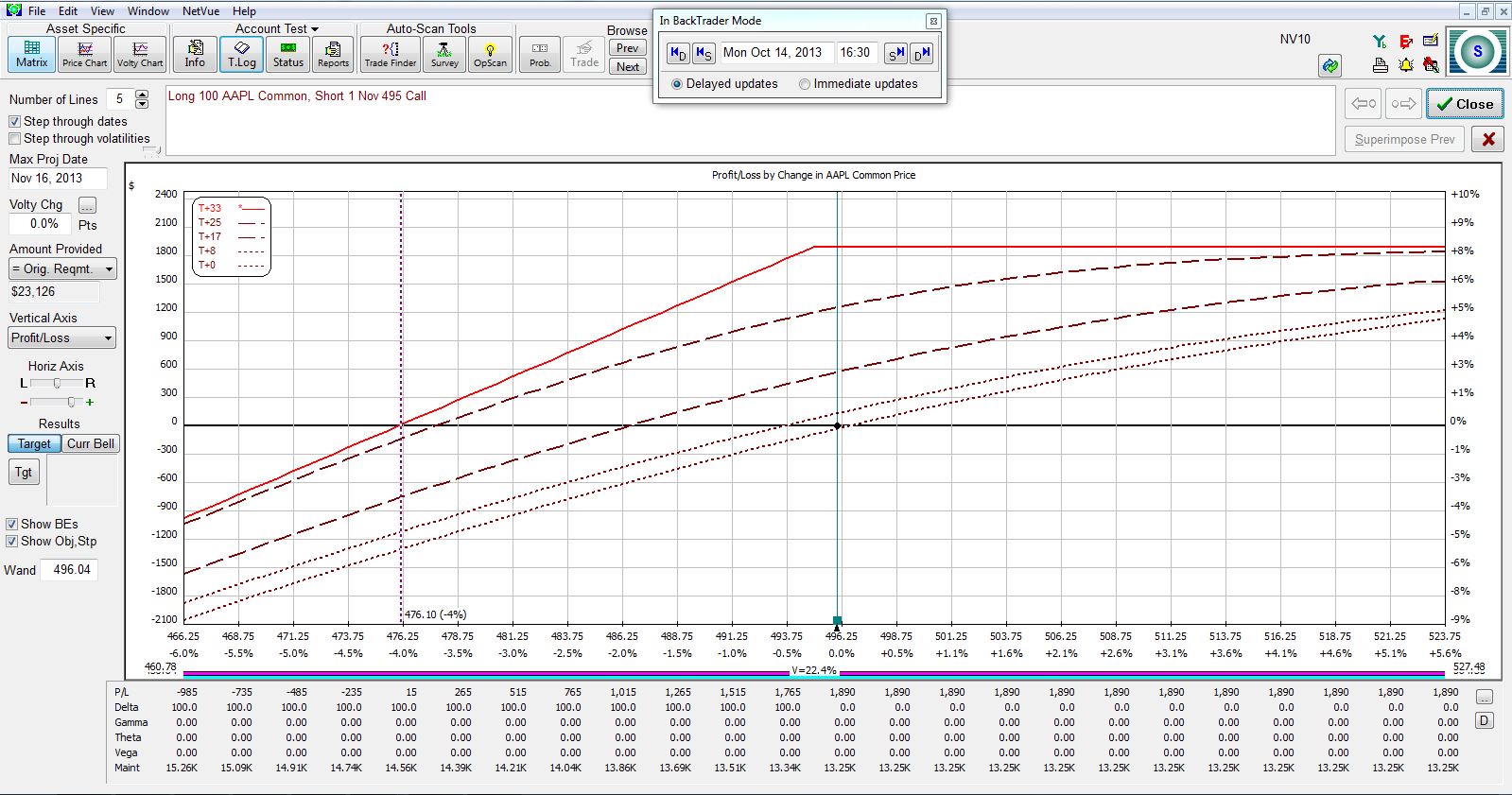

With Apple (AAPL) stock closing yesterday at 496.04, an example of this trade would be to purchase 100 shares of AAPL and sell a November (33 days to expiration) 495 put:

According to www.cboe.com:

> An investor who employs a cash-secured put writes a put contract,

> and at the same time deposits in his brokerage account the full

> cash amount for a possible purchase of underlying shares. The

> purpose of depositing this cash is to ensure that it’s available

> should the investor be assigned on the short put position and

> be obligated to purchase shares at the put’s strike price.

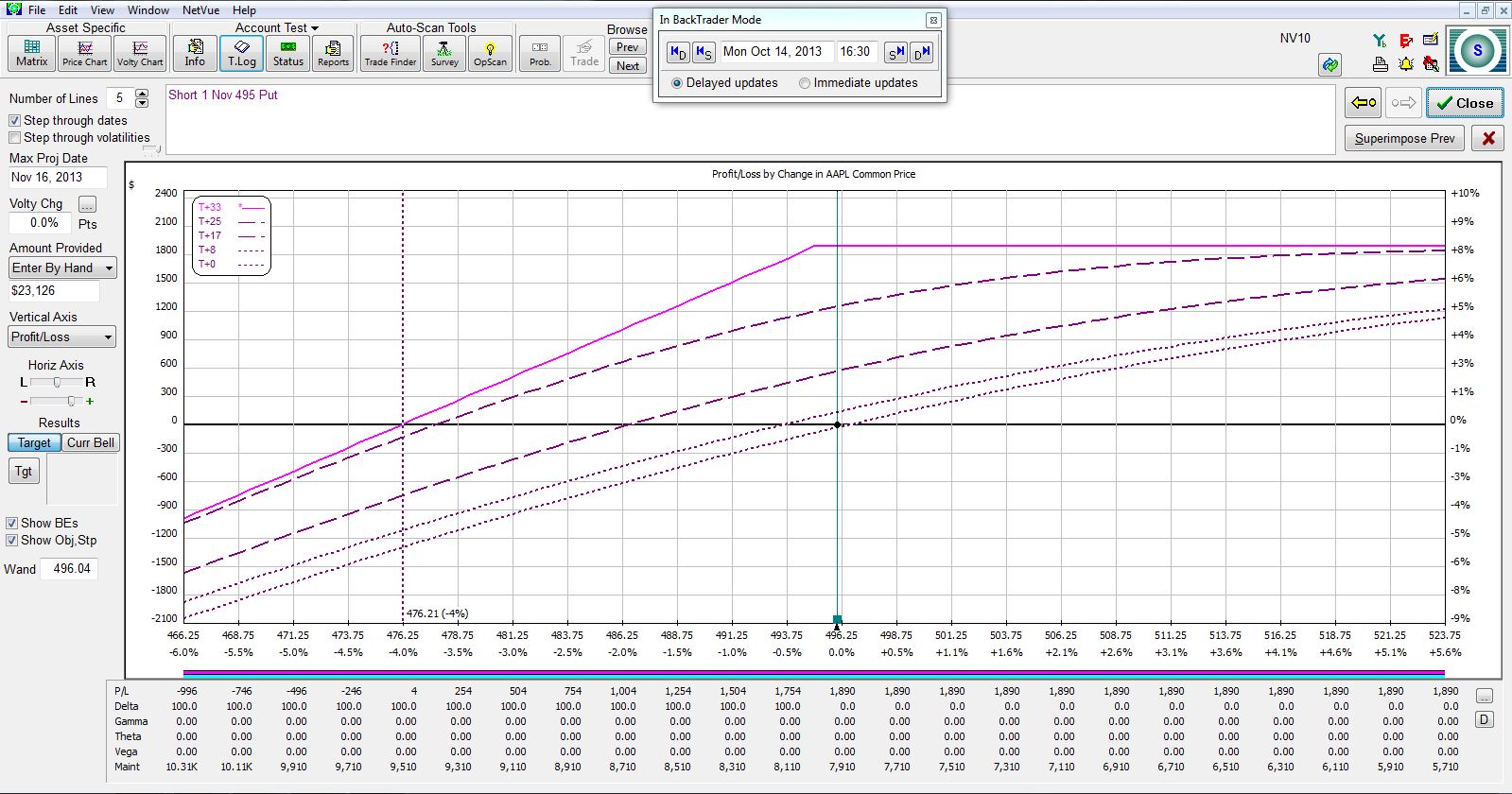

With Apple (AAPL) stock closing yesterday at 496.04, an example of this trade would be to sell one November (33) 495 put:

Notice that the two risk graphs are virtually identical. While the two may differ by a few bucks depending on the particular moment in time for the marketplace, if the same strike is selected to sell the call or put for the CC or CSP, respectively, then the trades are identical. These are known as synthetic positions.

While the trades are synthetically equivalent, the CC initially requires two brokerage commissions (buying stock and selling option) whereas the CSP initially requires one (selling option).

I will take a temporary detour with my next post and detail the “cash secured” nature of [naked] put selling.

Categories: Option Trading | Comments (3) | Permalink