Does My RIA Need Live-Trading Experience? (Part 4)

Posted by Mark on July 17, 2014 at 06:09 | Last modified: January 28, 2015 08:48Today I continue the stream-of-consciousness sidebar that I began in the last post.

In Part 1 I pretty much decided that live-trading experience is not, in general, a necessary criterion for a competent investment adviser (IA).

Coming to mind in support of this realization was my work as a pharmacist. I did not make the medications. Machines in remote locations make the tablets, the suspensions, the creams and ointments, etc. All I know is what medications are best for different conditions. If you bring me a diagnosis (from the MD) then I can recommend the proper medication. This seems quite analogous to an IA [representative–that’s a legal term] completing a personal interview/assessment in order to recommend funds or financial products suitable for client investment. Those products are traded in remote locations (e.g. New York, Chicago) often by machines (computers): just like the manufacturing of medications.

This rationale, in addition to the “agnostic” reason given in Part 1, supports my belief that in general an IA need not have live-trading experience to be competent.

What I think matters more is an investment style that can best suit client needs. A short option premium strategy can generate a higher average return, a lower variability in returns, a lower maximum drawdown, etc., but few IAs have this sort of offering. If you believe this approach is best then the confusion becomes clearer. The confusion arises because live-trading experience is necessary to execute this sort of strategy and this causes two separate arguments–what investment strategy is best and whether life-trading experience is advantageous–to run together into one discussion.

Categories: Uncategorized | Comments (0) | PermalinkDoes My RIA Need Live-Trading Experience? (Part 3)

Posted by Mark on July 14, 2014 at 05:55 | Last modified: January 28, 2015 07:04Today will serve as the “stream of consciousness” part of the program.

Part 11 inspired me to compose the following e-mail as an attempt to solicit feedback on the title subject:

> I’d like to know your opinion about whether live-trading

> experience is something a good financial adviser should have.

>

> Personally, I think the financial industry as a whole is very

> deceptive. Most financial advisers are salespeople. They have

> the marketing pitch, they have the “supporting data,” and they

> have the skill to sell clients on different funds or corporate

> products. Many television commercials stress the importance of

> “personal relationships” between advisers and their clients.

>

> I think the disconnect arises because clients believe their

> advisers are the ones who make them money. In fact, without live-

> trading experience the advisers are limited in knowledge about the

> mechanics by which money is made. I think much of this knowledge

> is based in details about execution, how products are traded,

> working the bid/ask, slippage, different types of orders, etc.

>

> The big question I wonder about is: DOES THIS MATTER?

>

> I want to say there must be some edge to having an adviser

> who actually does the trading or has live-trading experience.

> Is that the case or is it just as well that all the traders for

> one firm be located in a central office in New York or Chicago

> where they focus on nothing but getting the best execution and

> trades for all the adviser firm’s [anonymous, to the traders]

> clients nationwide?

>

> I’ve read a handful of articles over the years that talk about

> important criteria to identify when searching for a competent

> financial adviser. I have never seen “live-trading

> experience” listed as one of these criteria.

>

> And yet… I’m hard-pressed to believe the average investor

> wouldn’t benefit more from hiring an adviser who does the

> trading him/herself rather than hiring the typical adviser

> who does nothing more than sales.

I’ll conclude this sidebar in the next post.

Categories: Uncategorized | Comments (1) | PermalinkHappy New Year!

Posted by Mark on December 30, 2013 at 08:38 | Last modified: January 24, 2014 08:40I want to take a moment to wish you all a healthy, safe, and Happy New Year.

I hope you have enjoyed a nice holiday season to date and may all your dreams come true in 2014!

Categories: Uncategorized | Comments (0) | PermalinkUndressing Negative Gamma Risk

Posted by Mark on April 27, 2012 at 13:42 | Last modified: April 27, 2012 13:46It’s rumored that fear and greed are the two emotions that drive markets. As an options trader I would argue that psychic pain, otherwise known as negative gamma risk, should be listed as the third.

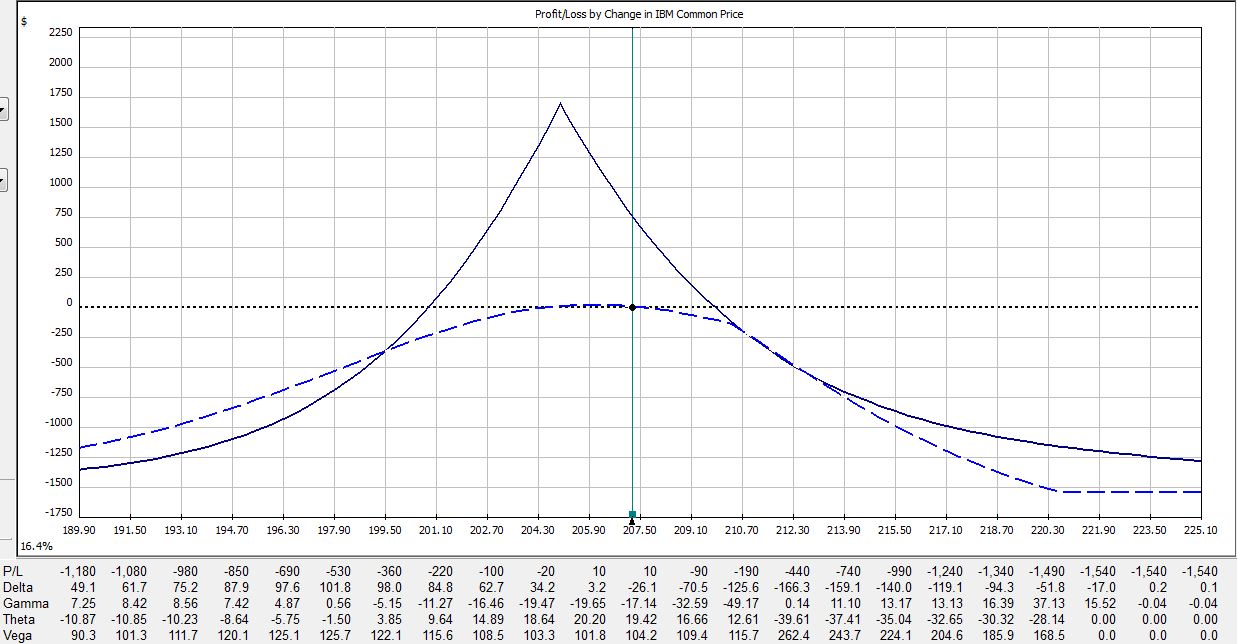

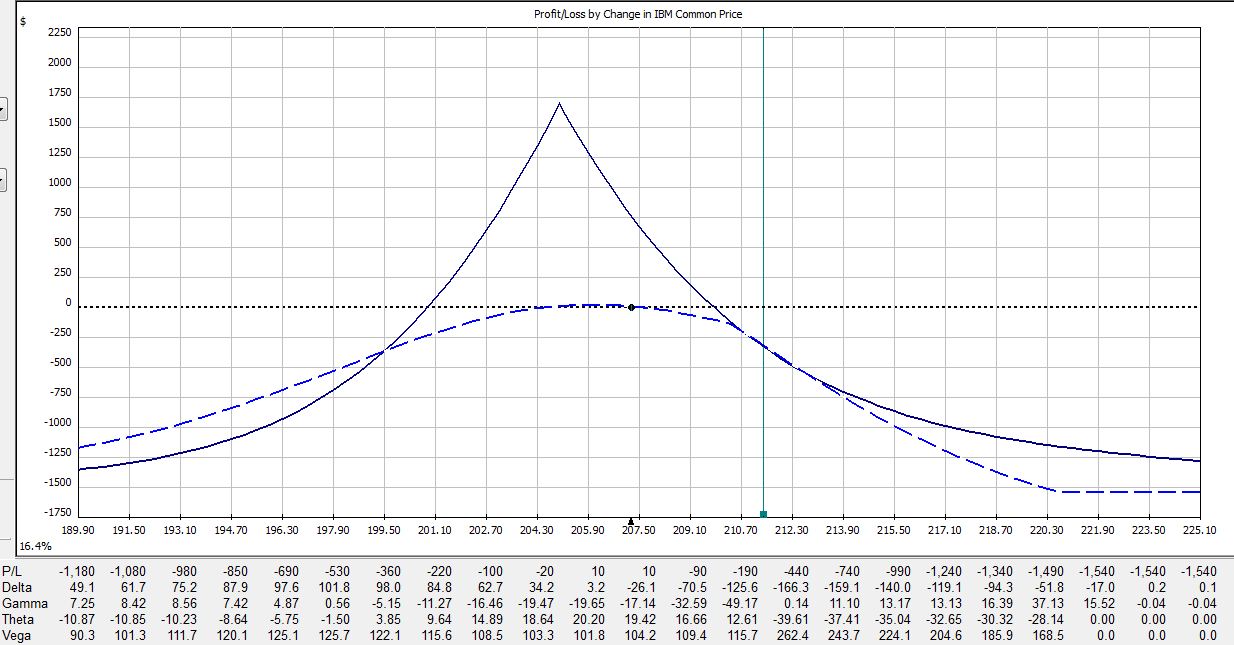

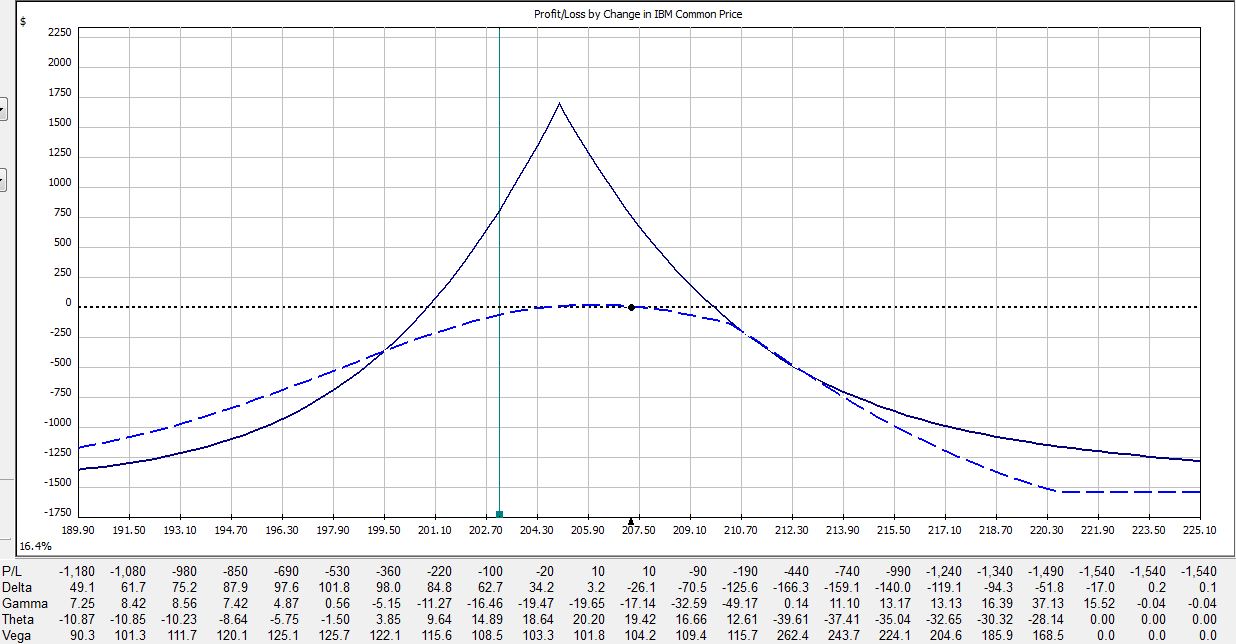

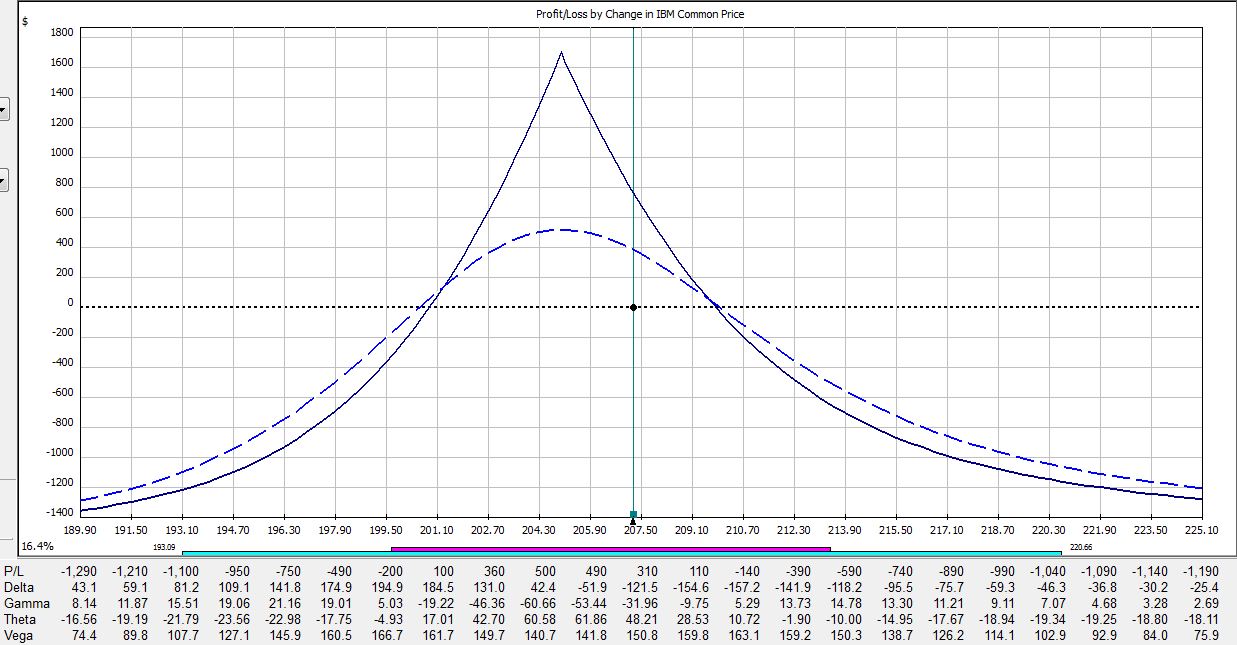

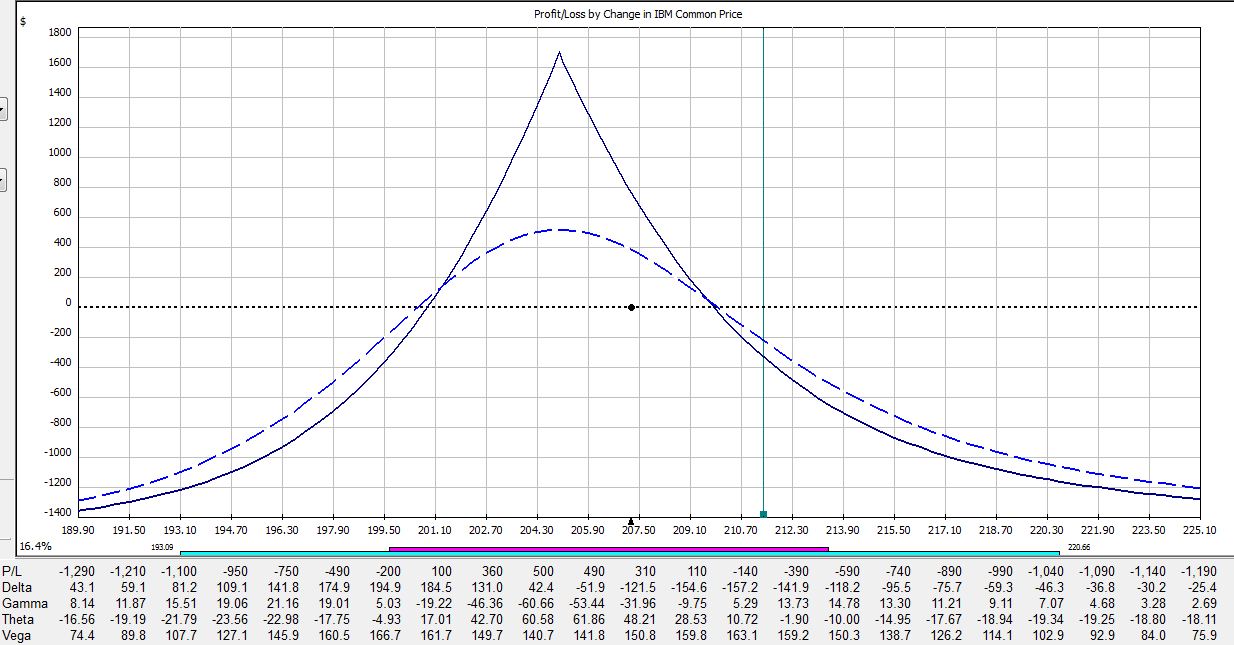

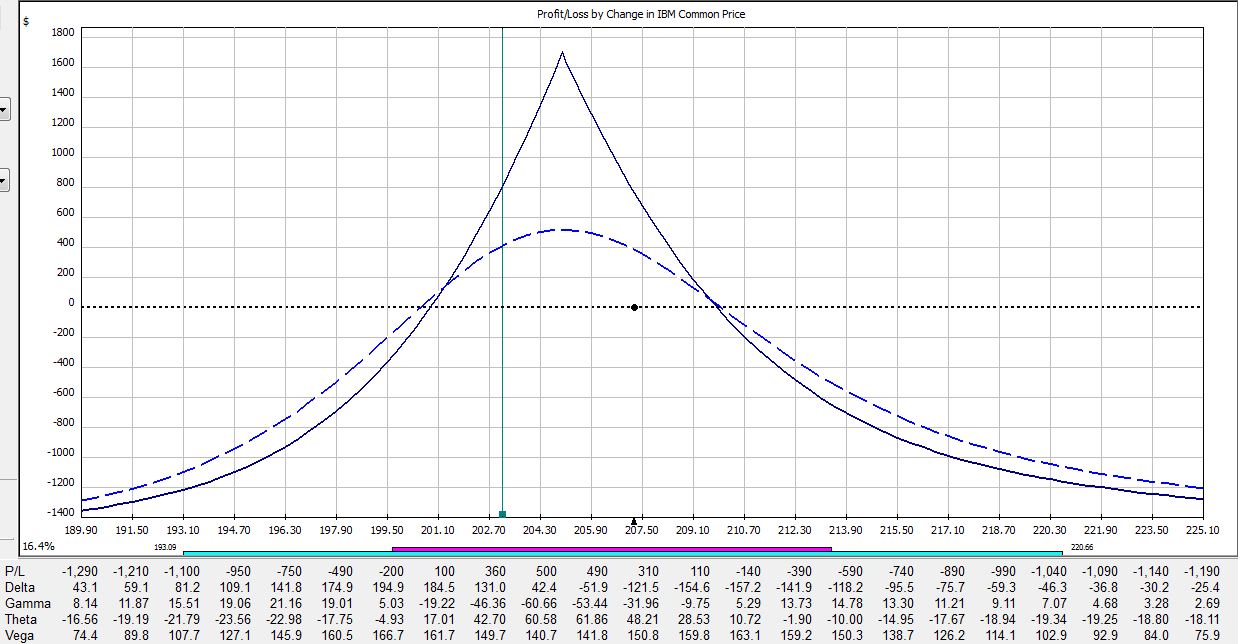

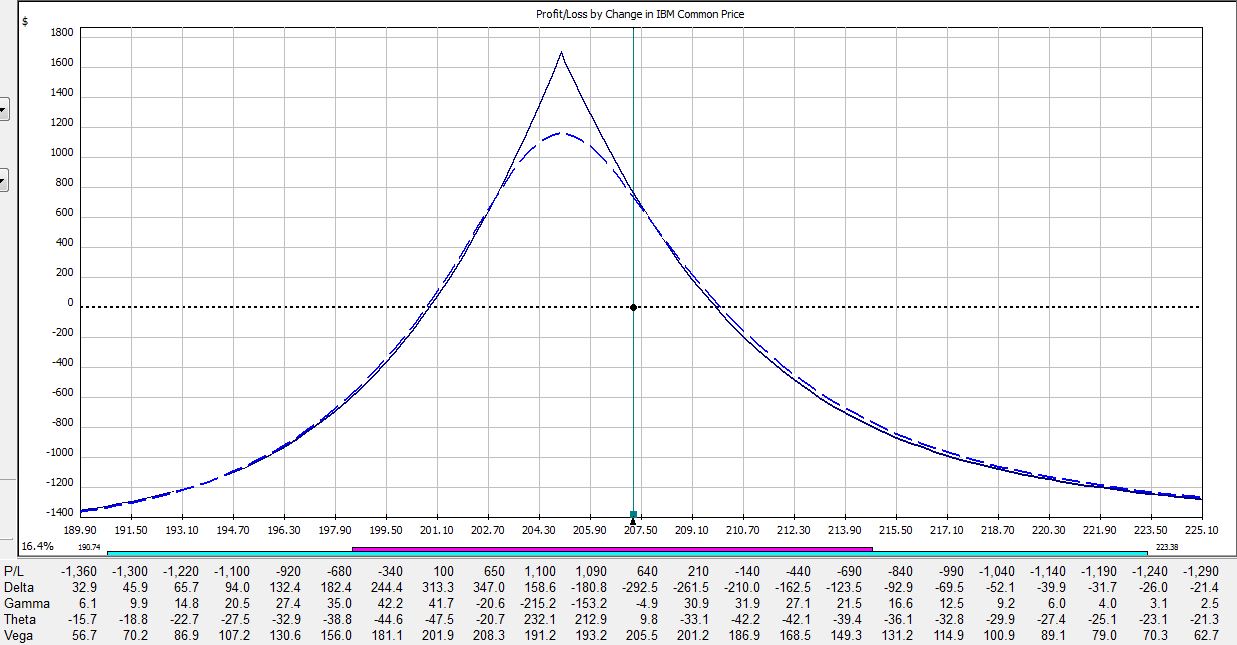

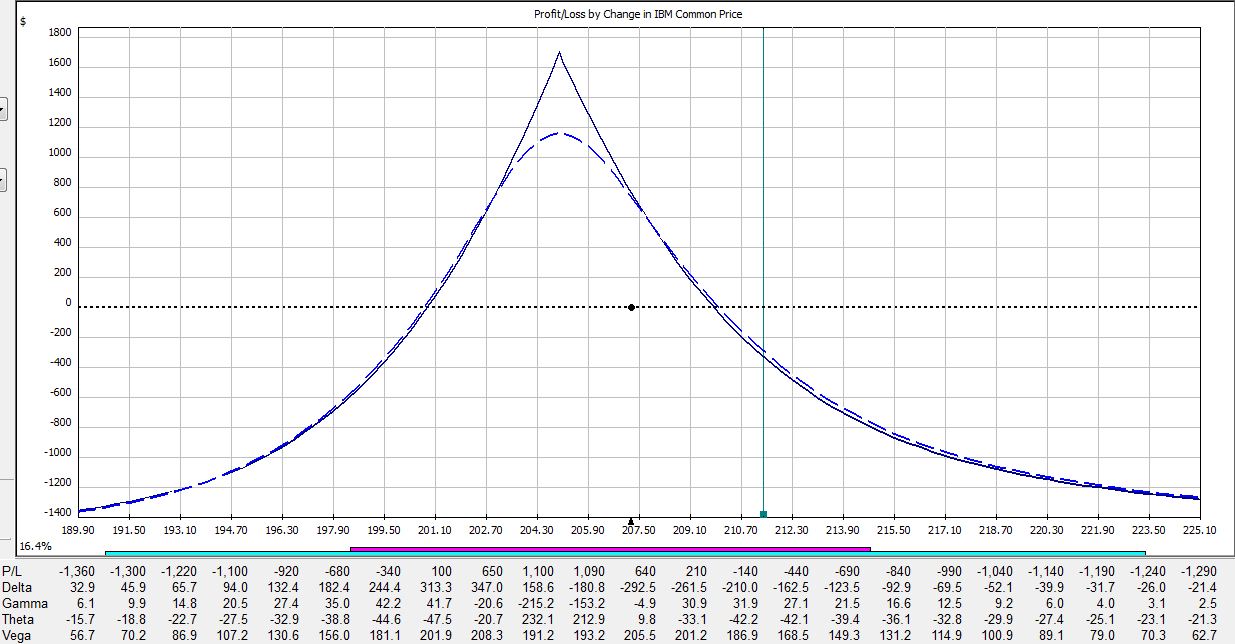

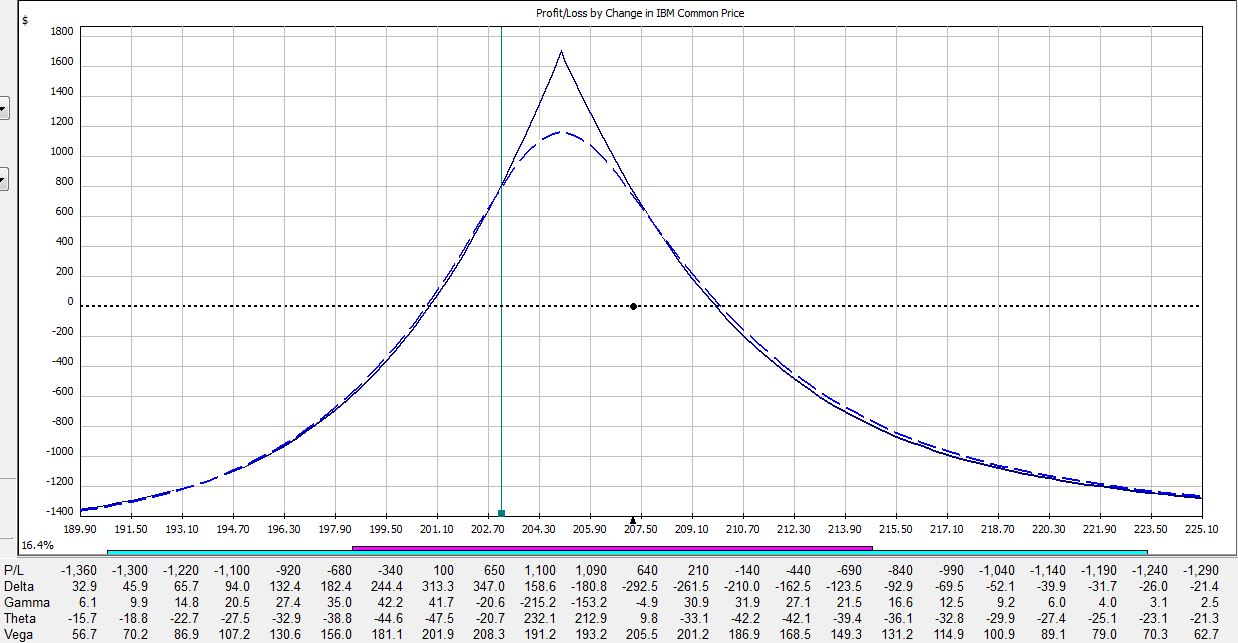

All pictures are risk graphs of a May/Jun 205 IBM call calendar trade (10 contracts) placed today (4/27/12), which is 22 days to May expiration. The P/L is the intersection of the green, vertical line and the blue dotted line.

At trade inception, we have this:

If IBM were to move up 2% today then the trade would be down $309:

If IBM were to move down 2% today then the trade would be down $50:

If IBM were to remain unchanged then in 15 days the trade would be up $353:

If IBM were to move up 2% then in 15 days the trade would be down $225:

If IBM were to move down 2% then in 15 days the trade would be up $400:

If IBM were to remain unchanged then in 21 days on the Friday before option expiration, the trade would be up $720:

If IBM were to move up 2% then in 21 days the trade would be down $275:

If IBM were to move down 2% then in 21 days the trade would be up $790:

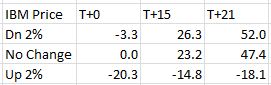

Here is a summary of these changes in percentage return on investment:

The table says at trade inception, a 2% move in the stock could result in a 20% loss. In just over two weeks, that 2% move in the stock could result in a 38% loss. On the day before option expiration, that 2% move in the stock could result in a 65% loss!

Psychic pain is seeing routine moves in the underlying suddenly have huge effects on the P/L. At some point, many traders would opt to close the trade so as not to worry about this negative gamma risk. Negative gamma risk can keep you up at night.

Graphically, gamma represents how tightly curved the P/L curve is. As option expiration approaches, gamma becomes huge. While many option trades are capable of “home run” sized returns, it’s truly a shot in the dark because normal moves in the underlying may cost you huge chunks of profit.

Tags: trader education | Categories: Option Trading, Uncategorized | Comments (1) | Permalink