Time Spread Backtesting 2022 Q1 (Part 6)

Posted by Mark on August 4, 2022 at 06:39 | Last modified: May 2, 2022 10:31Before continuing the manual backtesting of 2022 Q1 time spreads by entering a new trade every Monday (or Tuesday), I want to discuss alternatives to avoid scary-looking graphs (see last post) and cumbersome deadlines.

Scary-looking risk graphs can be mitigated by early adjustment. TD = 3 in the lower graph of Part 5. Perhaps I plan to adjust when TD falls to 3 or less. I used this sort of methodology when backtesting time spreads through the COVID-19 crash. Another alternative, as mentioned in Part 3, is to adjust when above (below) the upper (lower) strike price. To keep adjustment frequency reasonable in this case, I should maintain a minimum distance between the two spreads.

In staying with the ROI%-based adjustment approach, something I can do to limit adjustment frequency is to adjust once rather than twice between trade inception and max loss. The base strategy looks to adjust at -7% and again at -14%. I could adjust only once at -10% and subsequently exit at max loss, profit target, or time stop.

I’ve noticed two types of time spread deadlines that can make for uncomfortable judgment calls. The first is proximity to max loss. When at an adjustment point, if a small market move can still force max loss then I question doing the adjustment at all. For example, why adjust down 17% if max loss lurks -3% away? Even -14% can be questionable because if down just under that one day, I can be down -17% the next, which puts me in the same contentious predicament.

A second awkward deadline I may face is the time stop. Base strategy calls for an exit no later than 21 DTE. Adjustments require time to recoup the transaction fees. At what point does adjustment no longer make sense because soon after the trade will be ending anyway? Rather than adjust at, say, 23 DTE, I could close a bit early in favor of a farther-out spread. Such a condition was not included in the base strategy guidelines but may be worth studying.*

Let’s continue with the backtesting.

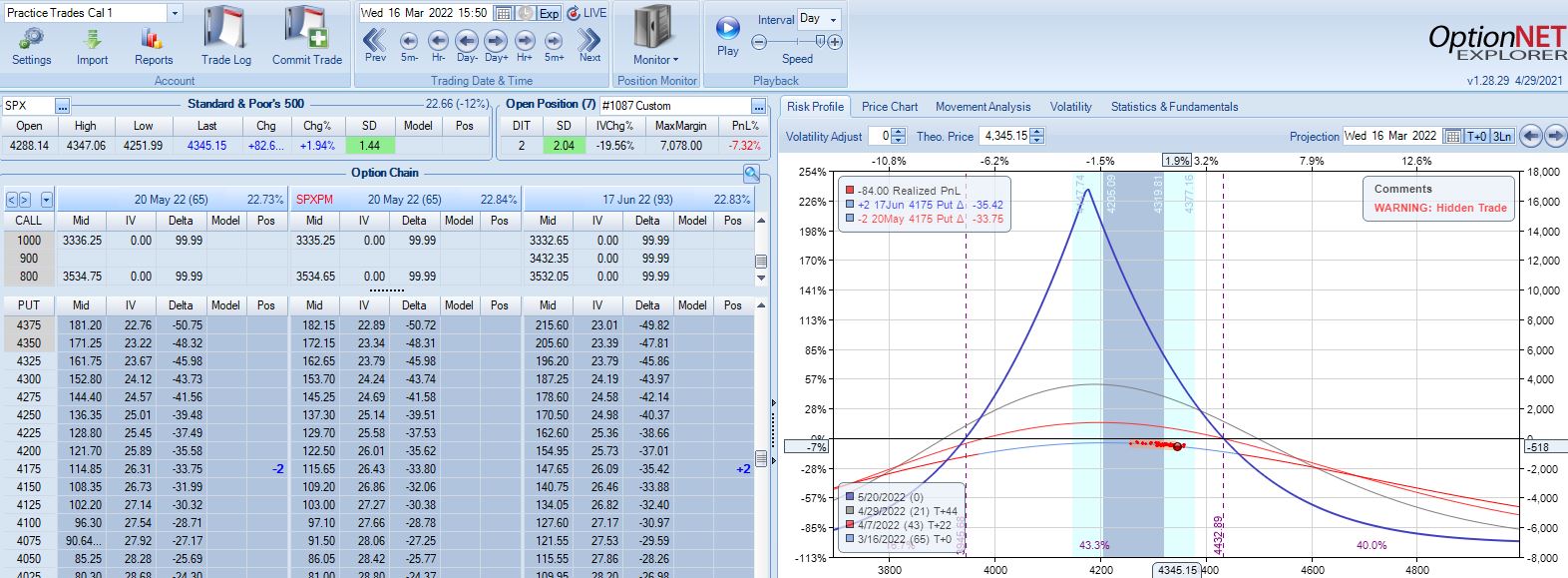

Moving forward through 2022 Q3 with SPX at 4168, trade #12 begins on 3/14/22 at the 4175 strike for $7,078: TD 46, IV 28.2%, horizontal skew 0.3%, NPV 270, and theta 50.

First adjustment point is hit two days later with trade down 7%:

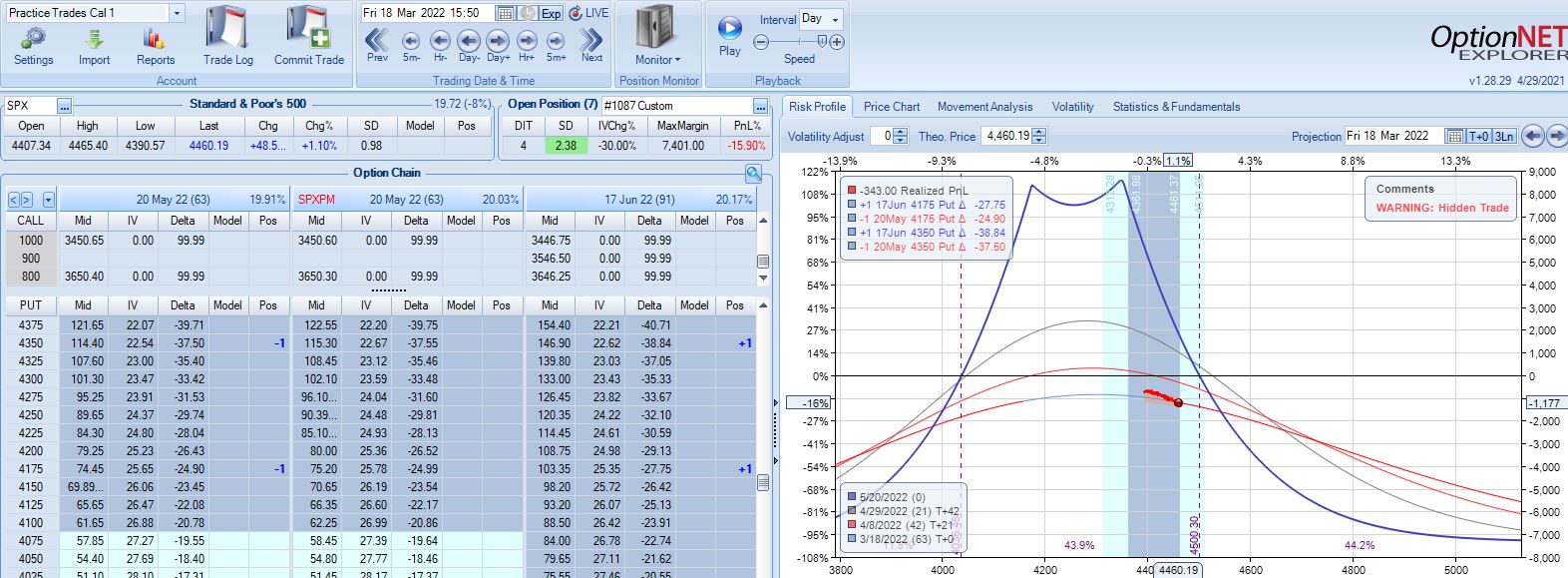

Second adjustment point is hit two days after that. SPX is up 2.38 SD in four days with trade down 16%:

I will continue next time.

*—Aside from varying the drop-dead adjustment DTE, I am also interested to see what happens if

the position is always rolled out at adjustment points whenever the front month is under 60 DTE.