Trading System #1–SPY VIX (Part 1)

Posted by Mark on September 28, 2012 at 05:31 | Last modified: October 1, 2012 05:35With the “motion to dismiss” now denied, the next step is to lay the groundwork for developing this strategy into a trading system.

As a review, the trading strategy is based on two claims. First, five days after the CBOE Volatility Index (VIX) closes 5% or more below its 10-day simple moving average (SMA), the S&P 500 index (SPX) has lost money on average. Second, when the VIX closes 5% or more above its 10-SMA, SPX has outperformed the average week better than 2-1 over the next five trading days.

The current system in development offers three variables to be backtested: x-bar stop y% extended from its z-SMA. In this case, we have used x=5 (five-day trades), y=5, and z=10 (VIX closing 5% above/below its 10-SMA). What we want to see in backtesting is solid results with these values. We also want to see solid results when we slightly change these values, though.

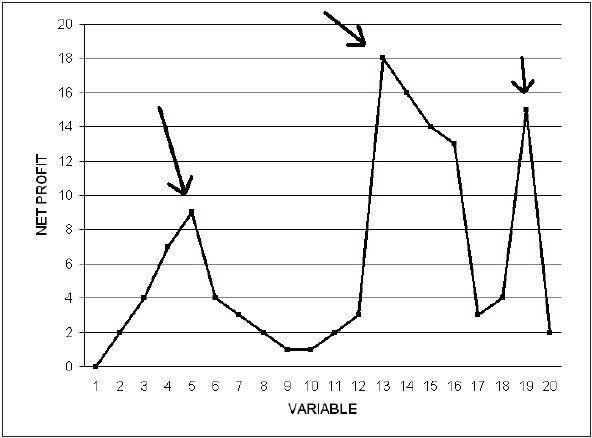

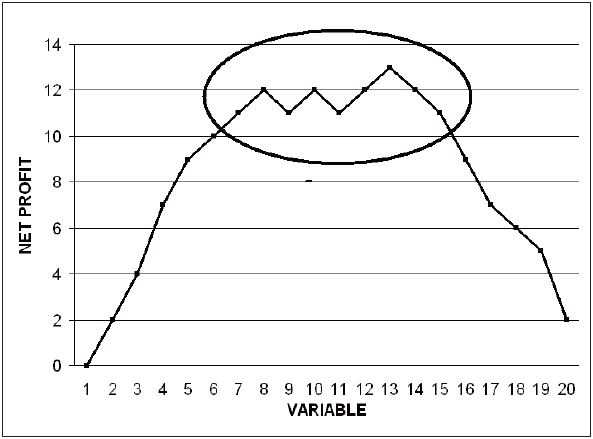

The process of “evolutionary operation” looks to keep one variable constant while changing another to see its effect on system performance. Graphically speaking, we want to plot some measure of performance (e.g. net profit) vs. the one variable being changed:

This does not have the appearance of a robust system because slight changes in the variable drastically affect net profit. Whether a moving average is four periods vs. five or 14 periods vs. 15 should not matter. If one value appears magically improved in the midst of mediocre results then those backtested profits are likely a matter of luck rather than the system taking advantage of consistent opportunity (and subsequent future profits).

This is what we hope to see. All values from 6-15 produced solid profit for this trading system. Rather than the spikes in the previous graph we see a plateau region in this one. This should be a necessary (but not sufficient) condition for a system we might trade in the future with real capital.

These graphs were adapted from Tomasini and Jaekle (2009).

In my next post I will continue this discussion in terms of optimization.

Comments (2)

[…] http://www.optionfanatic.com/2012/09/28/trading-system-1-spy-vix-part-1/ (9/28/12), I introduced the concept of evolutionary operation and began to talk about the different […]

[…] in http://www.optionfanatic.com/2012/09/28/trading-system-1-spy-vix-part-1/, I described the SPY VIX trading system as having three variables. The system trades when VIX is […]