Trading System #1–Initial Assessment (Part 4)

Posted by Mark on September 24, 2012 at 06:20 | Last modified: September 19, 2012 06:12Today I will continue to compare the SPY daily long strategy with vs. without an overbought VIX filter by discussing Sharpe Ratio (SR).

The Sharpe Ratio (SR) is one of the most commonly referenced measures of risk/return. It is calculated as the difference between the average return and the risk-free rate divided by the standard deviation of all returns.

The numerator of the SR describes “excess return.” The better the average return of the system the greater this number will be. The sign of SR will be determined by the numerator and any potentially profitable system must have a positive SR.

The denominator rewards systems that have higher consistency of returns. Typically when a system performs well, positive returns are consistent (e.g. closing at set profit targets). When the market goes awry for a system, feel lucky if you get taken out at your stop-loss point. In many cases with violent market moves, a gap may jump far beyond a stop-loss point before the trade closes. For this reason, more poorly performing systems have a larger variability of returns and therefore larger denominator.

A primer on how to calculate SR with Microsoft Excel is seen here: http://investexcel.net/214/calculating-the-sharpe-ratio-with-excel/ .

The SR has been highly criticized in financial circles and should therefore be taken with a grain of salt. For one thing, rewarding consistency of returns (e.g. 2% per month rather than 12% one month and 0% the other 11 months) means short option premium strategies often get high SRs. Short option strategies have catastrophic risk, however, that many other trading strategies do not (think Long Term Capital Management in 1998). What is also debatable is that the SR penalizes variability of returns whether that variability is profit or loss. A strategy that returned 2% in 11 months and 12% in one month would reflect similarly in the denominator as one that returned 2% in 11 months and -8% in one month.

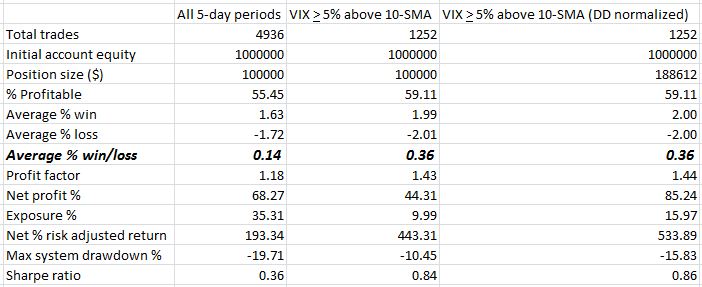

In the current study, buying SPY when VIX is “overbought” results in a much better SR of 0.84 vs. 0.36. As is often the case with other system statistics, SR is often negatively correlated with exposure. This means in order to get the desired net profit out of your portfolio, a single highly profitable system won’t be enough. The goal should be to find multiple systems with large PFs or large SRs to work together.

Categories: Backtesting | Comments (0) | PermalinkTrading System #1–Initial Assessment (Part 3)

Posted by Mark on September 21, 2012 at 05:54 | Last modified: September 21, 2012 06:51In my last post http://www.optionfanatic.com/2012/09/20/trading-system-1-initial-assessment-part-2/ (9/20/12), I focused on the concept of drawdown (DD) in the current backtest. Today I want to analyze Profit Factor (PF).

In my opinion, PF may be the most critical system statistic to study. PF is defined as:

# winning trades average gain

————————- x ———————-

# losing trades average loss

Stated differently, PF is how many dollars are gained per dollar lost.

A profitable system will have a PF > 1. If PF < 1 then the system loses money. An outstanding system prospect will have a PF > 2.

PF should be studied in conjunction with exposure. In many instances, PF and exposure are inversely proportional. A system may have an outstanding PF but trade only once per month. That will likely not give you sufficient profit to trade unless you trade the system really large. This would be too risky with regard to the possibility of Ruin.

Table 1 (http://www.optionfanatic.com/2012/09/19/trading-system-1-initial-assessment-part-1/) shows that the average 5-day SPY trade generated a PF of 1.18 vs. 1.43 for all 5-day SPY trades commencing on a VIX close at least 5% above its 10-SMA. This suggests the latter is a more profitable system, but as discussed in my last blog post, exposure is smaller. As I also discussed, max DD is smaller, which may enable us to trade larger. Column 3 shows the larger position size also generates the higher PF along with a higher net profit %.

I hope you are gaining an appreciation for the complexity of system development. Many statistics must be analyzed together and in reference to each other. Even when that is done, different conclusions can be made depending on what is most important to the individual trader.

Categories: Backtesting | Comments (0) | PermalinkTrading System #1–Initial Assessment (Part 2)

Posted by Mark on September 20, 2012 at 05:55 | Last modified: September 21, 2012 06:48In http://www.optionfanatic.com/2012/09/19/trading-system-1-initial-assessment-part-1/ (9/19/12), I presented a table of statistics from the initial backtest of premises for this trading system. Today I will discuss max system drawdown %.

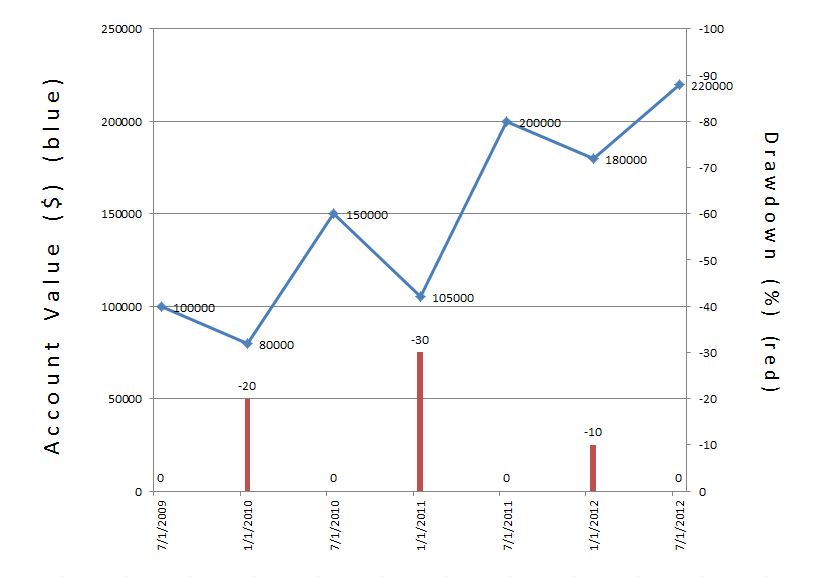

Drawdown (DD) is how much the account has lost from its all-time high. Take a look at the sample equity curve shown below:

The max DD % is -30% on 1/2/11 since the account value had fallen from $150K to $105K.

When assessing a system, it’s important to study DD because this can determine the probability of being able to trade a system consistently over the long-term. Typically, the larger the DD, the greater the Risk of Ruin, the greater the potential profit (think exponential equity curves rather than linear), and the greater the chance you will sell out at the worst time due to fear, sleepless nights, and severe anxiety when losses become largest.

Table 1 from the 9/19/12 blog post shows that when trading every 5-day period, the max DD % was -19.71% vs. -10.45% when buying the S&P 500 only when VIX is at least 5% above its 10-SMA.

This difference, a factor of 1.88, is significant because it can be used to position size the trade. If you are comfortable with a 20% DD then you could trade the “overbought” VIX with nearly twice the position size. Column #3 from Table 1 shows system statistics using a position size of $100K * 1.88 = $188K. Note that the net % risk adjusted return increases from 443.81% to 533.89% primarily from the Exposure increase from 9.99% to 15.97%. Most other system statistics remain the same.

These results are what we should expect given my statement three paragraphs above. Position size increased by 88%. Net profit increased by 92%. The bonus is that although I adjusted position size expecting a proportional in max DD, the latter only increased by 51%. We might be able to trade this system even larger and still remain within our comfort zone.

More on position sizing at a [much] later date.

Categories: Backtesting | Comments (1) | PermalinkTrading System #1–Initial Assessment (Part 1)

Posted by Mark on September 19, 2012 at 08:37 | Last modified: September 21, 2012 06:45In my post http://www.optionfanatic.com/2012/09/14/trading-system-1-backtesting-assumptions/ (9/14/12), I discussed my assumptions for this backtest. I will now proceed with an initial assessment of the claims used to define this strategy.

This part of the system development process is my “Motion to Dismiss.” Think of me as a Defense attorney asking the judge to throw out the entire case because “it’s absurd, Your Honor.” I found these claims on the internet and the internet is often an unreliable source of information. Before I waste time developing a trading system, I want to see if the claims even have merit.

First, let’s take a look at the average 5-day return for SPY vs. 5-day return when VIX is “overbought”:

Table 1

Please ignore the third [“DD normalized”] column for the time being.

Let’s begin the analysis with total trades, net profit %, and exposure %. Realize that the “overbought” VIX condition is more restrictive than “average 5-day return,” which includes one trade beginning every single day. It’s not surprising to therefore see “all 5-day periods” having nearly four times as many trades as the other column. Exposure % measures what percentage of the account is invested during what percentage of time. Position size is fixed here at $100K but where “all 5-day periods” has open trades every day, the other column only trades when the VIX is “overbought.” At first glance, “all 5-day periods” looks impressive with a net profit % of 68.27% vs. 44.31% but don’t overlook the decreased exposure.

“Net % risk adjusted return” equates the two trades by dividing net profit % by exposure %. The result is a hypothetical simulation of both trades being completely in the market at all times. By this measure, buying only when VIX is overbought performs better than buying in general by a factor greater than two.

From a portfolio perspective, focus on the word “hypothetical” two sentences above. Net % risk adjusted return is not a realistic number. Being out of the market much of the time is the nature of the trade. It will therefore generate less profit for you. In order to realize a good profit on of your total portfolio you would need to combine this trading system with other systems to put more of your money at work more of the time.

Categories: Backtesting | Comments (3) | PermalinkTrading System #1–Backtesting Assumptions

Posted by Mark on September 14, 2012 at 05:51 | Last modified: September 21, 2012 06:42In my last http://www.optionfanatic.com/2012/09/13/trading-system-1-introduction/ (9/13/12), I provided the rationale for a system I aim to develop. The first step is to determine whether the SPX loses money (on average) when VIX has closed 5% or more below its 10-SMA and whether it gains at least twice as much when VIX has closed at least 5% above its 10-SMA.

Before proceeding with the backtest itself, let’s consider the assumptions. I assumed no slippage but an $8.00 commission charge for every trade. I assumed a starting equity of $1M and placed each trade with $100K. My maximum number of open positions was set to 5. The account equity must be large enough to avoid trade limitation and consequent distortion of results (do you understand why?). Since I’m evaluating 5-day returns and placing a trade every day, I need to allow for five concomitant trades. With a position size of $100K, the account needs to be at least $500K in size. To handle drawdowns and still allow for all trades, I arbitrarily doubled that to $1M. I could have used $10M.

Similarly, if looking at percent returns then you don’t want commissions to be a factor in the backtesting results. For this reason the initial backtest does not usually include commissions. In this case, a 1% profit per trade is $1,000. I included the commissions of $16 (round trip) because that amounts to 1.6% of the profit, which I consider negligible.

Backtesting dates are from 1/29/1993 to 8/30/2012. The former date corresponds to the first month VIX data were available.

I will continue in my next post with a brief discussion about statistical interpretation.

Categories: Backtesting | Comments (2) | PermalinkTrading System #1–Introduction

Posted by Mark on September 13, 2012 at 04:42 | Last modified: September 13, 2012 07:27The first trading system I am looking to develop is based on some material I found on the internet. The claim is that in the five days after the CBOE Volatility Index (VIX) closes 5% or more below its 10-day simple moving average (SMA), the S&P 500 index (SPX) has lost money on average. Furthermore, when the VIX closes 5% or more above its 10-SMA, SPX has outperformed the average week better than 2-1 over the next five trading days.

Can I verify these results?

The first part should be easier to backtest. I will buy at the close when VIX closes 5% or more above its 10-SMA. I will exit five days later. As a benchmark, I want to compare these results to the average 5-day period.

What seems a bit tricky about this backtest is that I will need to allow for multiple signals to be in effect at once. In other words, if VIX closes 5% above its 10-SMA today, tomorrow, and the day after, then I will need to allow for three open trades. In practice, this would be simple enough: position size to allow for a maximum of five open trades at the same time. If your account size is $100K then don’t allocate more than $20K per trade. Most backtesting software that I’ve seen will not allow for multiple trades on the same ticker triggered at different times to be open concomitantly.

Thankfully, AmiBroker does not fall prey to this restriction. AmiBroker is the market analysis software that I have struggled to learn over the past 18 months. Let’s see if I can get some answers to this first question by tomorrow.

Categories: Backtesting | Comments (1) | Permalink